I don’t really disagree with you about Tesla and DoorDash being questionable investments at their current prices, but all stocks are valued on theoretical future profits. As they say, past performance is no guarantee of future results. It’s just easier to quantify, so it’s possible to build elaborate quantitative models around historical results with a straight face.

I feel like a crank because of my monomaniacal obsession here, but I am compelled to point out that this is a much bigger deal in ultra-low discount rate environments. If you’re discounting at 10% or 15%, it’s not unreasonable to assume that past performance is going to be basically like future performance during the periods you care about (the next 5-10 years), at least in most cases. But if you’re discount at 2%, you care about earnings 30 years out. If you look at the Dow 30 years ago, it had Eastman Kodak and Sears Roebuck and the American Can Company as components. Things change.

Just mechanically, low discount rates force investors to value earnings from far-future periods about which little is known. (In other words, the “discount rate” on the quality of information we have about what will be happening in 2050 is the same, and our data is poor, but the financial value of money in 2050 is now much higher.) If you want a bubble theory, you can speculate that the absence of concrete information is allowing people’s natural inclination towards speculative frenzy to take over, and that’s probably true to a large extent. But there’s not really an alternative. You can’t just assume that GM’s earnings are going to persist over a 30 year horizon when you know that there’s likely going to be a fundamental change in how cars are built during that period.

A Random Walk Down Wall Street is one of the books that I would recommend to anyone who is interested in investing or wants to learn more about personal finance.

One of the first things the book covers is two theories of stock valuation, which it calls the firm-foundation theory and the castles-in-the-air theory. The firm-foundation theory is the view that a stock’s price is determined by the current value of a future stream of profits, which is what Bob’s describing.

On the other hand, the castles-in-the-air theory says a stock is worth whatever someone is willing to pay for it (or might be willing to pay for it tomorrow). This is the logic of speculation and bubbles.

It’s helpful to keep in mind that both of these dynamics are determining the price of most stocks at any given point in time.

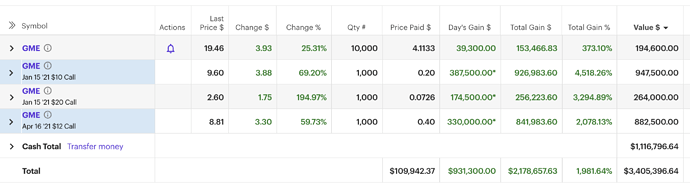

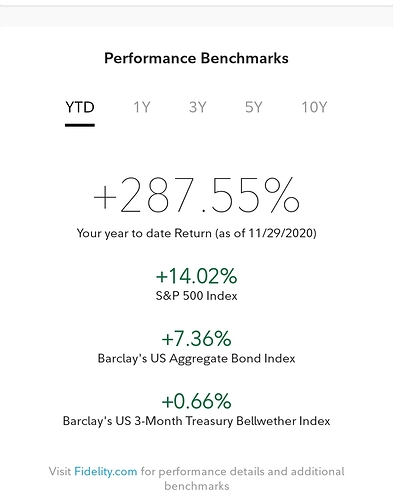

100% gamestop portfolio guy has a far bigger brain than the rest of us apparently goddamn

up 25% today

Where’s my fucking PS5 then???

I have again decided that purchasing additional shares of Berkshire Hathaway and shorting an equal number of shares of Apple is a risk-free arbitrage opportunity, and have acted accordingly.

Both sides of that arbitrage are currently underwater, but I am confident that the situation will soon be corrected.

I will be taking no questions at this time.

popped when this guy bought more shares apparently and this

Cohen called for a strategic review to help the company transition from a brick-and-mortar retailer to a technology company.

what could this possibly be

The gamestop electric car of course

Between this and GME there must be some newly minted millionaires in the WSB community. Shit is crazy

This recent article includes discussion of both Vanguard and State Street:

Bottom line, probably nothing to worry about. In theory probably pretty hard to screw up a target date fund. ![]()

I wouldn’t worry about it, an inevitable outcome of the proliferation of target date funds and passive funds and stuff like that will be a race to the bottom in fees and retirement plan sponsors will shuffle around between providers. I wouldn’t worry unless your option to be in passive or target date funds is taken away and they start sending you marketing materials about private markets opportunities and institutional grade hedge funds.

Yeah… QS makes no fucking sense. I was almost in pre-merger but it ran ridiculously high then fell to $11 before going 10bagger a month later.

So I broke my own rule with buying individual stonks and started messing around with SPACs in July and this happened…

This shit is nuts right now… it’s beyond bubble status and I’ve been piling profit back into some index funds waiting for the rug pull. I can’t imagine wtf will happen if all the degens actually get $2000 checks.

Insane. Also fuck you (to quote wsb)

Interesting interview with Michael Saylor, who discusses his rational for betting his company’s farm on Bitcoin. Has a unique (at least to me) perspective on why all assets are inflated and why bitcoin is a viable alternative.

Worth a listen if you’re at all interested in the subject.

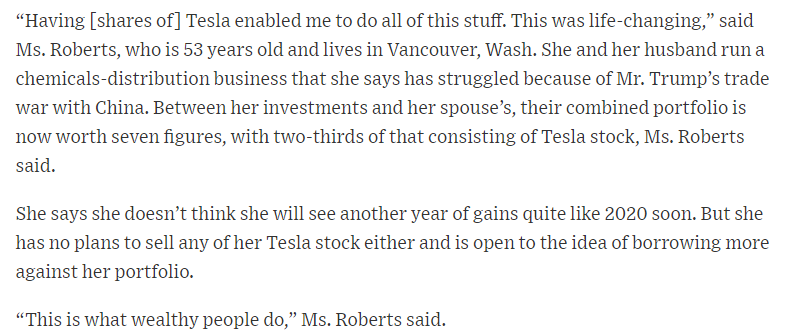

Seems sustainable

Well this always ends well.

If you read the article, some imbecile with a hyper concentrated, leveraged Tesla position says “this is what wealthy people do,” that’s gotta be a sign we’re close to the music stopping.

I just finished “Billion Dollar Loser” about WeWork and Adam Neumann. Boy oh boy, there are an enormous number of idiots working in finance who can be star-struck by a bullshit-spewing CEO. It’s frightening that people who should presumably know better are still falling for the “pay no attention to our GAAP numbers - our projected adjusted metrics look fantastic!” nonsense.

Overall, the story is super interesting but the book was a little thin, so I’m not sure I’d recommend it. I think you can probably get the general idea from the author’s magazine story here: