Stocks and bonds generally move in opposite directions. I.e., on a day when stocks are up you’ll usually find that bonds are down.

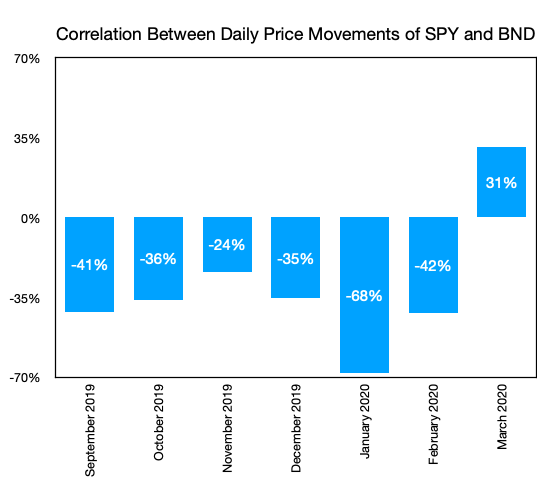

One thing I noticed during recent weeks is that this inverse correlation has been disrupted. I would check my phone and see that BND (a total bond market ETF) was moving in the same direction as the SP500. And this was happening a lot. I confirmed this by running some numbers and comparing to the previous 6 months. My stats is rusty but I think the general result is accurate.

Can anybody offer a theory about why, during the past few weeks of crisis and volatility, this would happen?