There‘s a possibility that the agent has some buttons to push to re-rate your car insurance to $38/month less (unrelated to the term life policy), but is using this as an opportunity to get a term life sale. I’ve seen this tactic in other markets.

So, assuming I can’t get cheaper elsewhere, I should take this deal if I qualify?

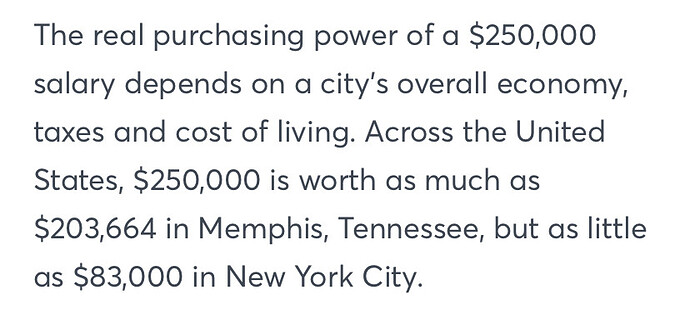

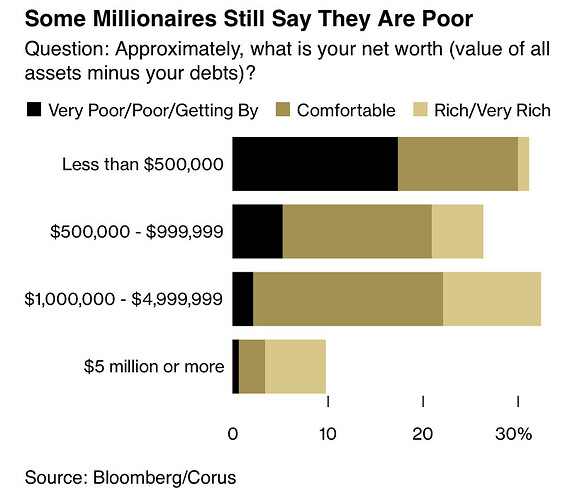

Of those making more than $175,000 a year, or roughly the top 10% of tax filers, one-quarter said they were either “very poor,” “poor,” or “getting by but things are tight.” Even a share of those making more than $500,000 and $1,000,000 said the same.

A half a mill in 20’s like a billion where I’m from

Can anyone recommend a good high-yield savings account?

I found one called Wealth Front that seems good, but I really don’t know shit. The APY is 4.8%

I’ve been a valued Chase customer since 2014. They recently sent a mailer for a checking and savings account bonus for $900 if I setup both and met some basic requirements like a recurring ACH deposit, minimum balance after 90 days, etc.

Well OK, I’m doing better financially than my past but not well enough that I can ignore a free $900 for an emergency fund that’s just sitting around anyway (yes, I know it’s taxed). I open the checking account and fund it with $1501 since the checking account service fee is waived if your average daily balance is above $1500. I then try to fund the savings account with $5k from the exact same bank account and I get a phone call from the Chase security department. While on this call, they said something along the lines of “we can send you a text message to confirm. what is your phone number?” Like, YOU CALLED ME. You have my phone number, there is absolutely no reason for me to give you a phone number. I told them I wouldn’t give them my phone number over the phone because what they are asking doesn’t make sense to me from a security standpoint. Anyway, they quickly ended the call since their process couldn’t take them further without authenticating via SMS text to a number that I would have to give them.

Maybe I’m just paranoid, but alarm bells just started shooting off in my head. Maybe I’m being difficult (HIGHLY LIKELY), but if they make me call someone to sort this out, I will close every account I have with them. They apparently think that someone who has paid every bill on-time from the exact same bank account for nearly a decade is a security risk.

If you have one nearby you could just walk into a branch and try to set it up there. I did that to get a similar bonus a couple years ago and it’s probably a little easier in that scenario

Wealthfront is pretty good. It’s a newer bank and has a more updated UI than a lot of other banks. You’re also able to setup investment accounts there. It was easy to setup other banks for transfers and can confirm 4.8%. They are typically pretty quick to adjust that rate up or down depending on the overnight rate, compared other common internet banks like Ally which is still at 4.25%.

I can give provide an invite link and we would both earn an extra 0.5% (so total 5.3%) for the first 3 months if you’re interested.

+1 on Wealthfront. I have used them for retirement investing for over 5-6 years and started a savings account recently as we save for a barn

You’re probably right and I’m just being difficult. I really don’t understand why I need to interact with anyone to do this simple task. If I had charged $5k on the Chase Freedom card, they certainly wouldn’t be ringing me to make sure things are legit when I pay them.

No, trust your gut here.

I bet there is a number to call the fraud department directly

Most likely not a scammer if they called you right away and maybe they needed you to verify it but I would just call directly and see if you get a different answer

Thanks for info. I’ll shoot you a PM if we go that way.

These days it’s hard to beat a money market account at a discount brokerage (Vanguard, Fidelity, Schwab), but that might not be what you’re looking for

I had this exact thing happen with Chase and their hysa product and it was indeed a scam.

Fidelity cash management account or a money market fund? The cash management account appears to basically just be a savings account and it’s insured, the money market fund is higher yield but I suppose there is more risk there right?

I’ve been lazy about setting up a high yield account for cash reserves but I’m looking to finally do it.

I was talking about the money market account. True money market accounts are FDIC insured, but there are also money market mutual fund accounts that have different regulations. Either option should be very low risk, but I would check with your brokerage if it’s important to you to know if your account is insured.

ETA: from your description it sounds like you’re looking at a money market mutual fund.

More than a year later and the WSJ is reporting that people are still getting scammed by this:

Fucillo isn’t alone. When the Federal Reserve started raising interest rates in 2022, many customers of the McLean, Va., bank assumed their rates would go up. Instead, Capital One is paying them far below the 4.35% it advertises on its main savings account.

The issue dates back to a little-noticed change Capital One made in the era of low rates. In 2019, the lender introduced a new savings account called 360 Performance Savings. Existing customers were kept in older accounts that had a similar name, 360 Savings, which the bank previously advertised as having “a great rate” but has since closed to new customers. When the Fed started its rate increases, Capital One only raised rates on 360 Performance Savings accounts.

Customers around the country who have the older accounts are complaining about the discrepancy to the Consumer Financial Protection Bureau, according to a Wall Street Journal review that found two dozen complaints detailing experiences similar to Fucillo’s in the agency’s database. Those with the old accounts say they were never told about the existence of a new account that pays more. Some asked the bank for back interest but say they were denied.