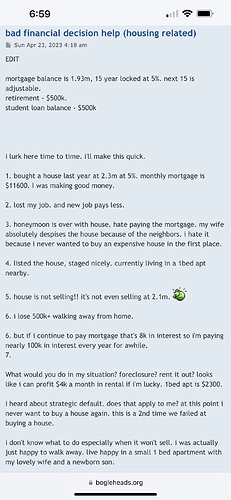

There has to be a ton of this happening in SF:

There is abaolutely no way a 15K/mo rental is fesable long term.

Money just amazing. Guy’s monthly mortgage payment is only slightly less than my annual. … we both feel the same about our houses tho. Funny.

A person’s relationship with money tends to drive satisfaction as much as their amount of money. If you have a healthy relationship with money then you need WAY less of it to feel satisfied.

… or dissatisfied, it seems.

(home ownership joke)

It seems like refusing to sell because the number it would go for hurts emotionally is just a form of irrational market timing / sunk cost fallacy. Unless you believe that depressed asset prices are caused by a temporary credit crunch type deal that you have the financial strength to weather.

California is a state where they can’t go after you for the mortgage deficiency so just sell and move on.

By the way, if you read on, he is a doctor in PNW, not a techie in Silicon Valley.

That guy’s whole profile - $500k retirement savings, $500k student debt, $2 million house with $1.9 million mortgage, is chaos. That combined with a wife that is angry about their $2 million house is

CA real estate kinda pricey

It appears I’m about a decade late to the party, but TIL that plans are allowed to rollover unused FSA amounts to the following year (up to a max of $570). And that mine does this.

I’ve never had a regular FSA but have often used limited-purpose FSA’s, but thought they were use-it-or-lose-it, and always stressed during enrollment about picking the “right” amount to contribute, worried about picking a number too high.

Well that stress doesn’t change that much. You’re still going to lose anything over the roll over, so you still have to make sure not to put in too much and also make sure to spend it down to the roll-over amount.

The cushion is nice, but I still did think about those things. That’s another advantage of the HDHP/HSA approach. You don’t need to think about this stuff. You do need to save a ton of receipts, though for optimal usage.

Home insurance is in crisis in Florida and I have little faith the the republican super majority will find any real solutions. Gotta hope no more big storms. I see all these condo listings for $250k and the HOA is $1200/month. Paying more in HOA than the value of the property over 30 years and who knows what the rate will be in 5 years.

Here’s what the governor is doing instead of addressing that

https://twitter.com/rondesantisfl/status/1657212176178855939?s=46&t=XGja5BtSraUljl_WWUrIUg

I guess this is the right thread for this?

I recently found out I’m supposed to have renters insurance on my apartment. I asked for a quote and was told approximately $10/month. I was told if I got term life insurance for around $19/month, the bundling would drop my car insurance by $38/month.

What’s the catch?

Possibly none. After shopping around for insurance this last month, we’ve learned that insurance pricing is really weird.

Of course, there could be one in your case. Be sure to read the fine print.

Maybe just that you were paying too much for car insurance? You might think about getting a car+renter’s quote from a couple other places as a sanity check.

Probably some combination of a) you are less likely to shop your insurance in the future once you become attached to the idea that it is all bundled, b) someone that buys life insurance may represent a better actuarial risk

Getting life insurance for me was super tricky because of having high blood pressure of all things. Also had to get a pretty big policy