This is actually a very common problem but usually on a smaller scale. Its extremely hard to shift mindsets from saving to spending if you assign a moral imperative to saving all your life. If you think that “good” people (smart, responsible, etc.) are people that save and invest then how can you possibly change gears in retirement? Wouldn’t that make you a bad, stupid irresponsible person?

I raise you “retiring on Tesla stock - update: ain’t pretty”

https://www.bogleheads.org/forum/viewtopic.php?p=5808154#p5808154

Unfortunately the guy is still worth $7.5 million (but dropping by the day).

Lol that guy’s hilarious. Lol meritocracy.

Current portfolio: $8.5m

Target portfolio @ retirement: ~$9.7m

Gotta admit, I’m excited for the update in ~23 year when he only has $4M and is incapable of spending it due to crippling anxiety. I’m not rooting for him to do worse, just that is the trajectory I see him headed and it is fascinating.

Another tax planning question:

I’ve already maxed out my 401k for the year. I’m allowed to make another contribution to my IRA.

Do I need to have itemized deductions to get the IRA contribution tax advantages for this year?

The IRS categorizes the IRA deduction as an above-the-line deduction, meaning you can take it regardless of whether you itemize or claim the standard deduction.

Thanks, although I’m pretty sure we’re above the MAGI for people with 401k’s already so probably not something we can take advantage of.

“I have $7.4 million plus a paid off house. Can I retire?”

https://www.bogleheads.org/forum/viewtopic.php?f=1&t=391265&newpost=6983650

Yeah, but no emergency fund.

If you think about it, a year ago they had $10M, probably just having cold feet.

They are just over 50 and planning to live to almost 100, so it is actually pretty expensive to provide for almost a century of individual years of life.

Even so mathematically they can retire, but emotionally they probably can’t. If you have $7-$8 million and no debt but you’re still afraid of running out of money then you will never enjoy retirement. Every purchase will come saddled with guilt and worry and eventually remorse that you weren’t frugal enough. These people are probably better off “half retiring” in their 50s so they can always fall back on the Responsible Decision to keep working part time which will give them some justification to spend some money. I think if they just retire they will end up sitting in their house terrified to spend money, or even worse arguing about it until they get divorced.

That’s 1,480 trips to Disney World. My rule of thumb is you can’t retire until you have at least 1,500 trips to Disney World saved up. They’re close, but no cigar.

For people that haven’t moralized their savings and investing behavior in the the style of Bogleheads, the absolute best thing to do if you’re 50 and have $7 million is to plan a modest post 60 retirement and spend your 50s absolutely blowing through at least half of that money. That could involve “wasting” it on luxury trips and stuff but you could also do all kinds of other rewarding stuff and basically have the best decade of your life in your 50s while you’re still healthy. Instead of anxiously sitting on a pile of money so that you can just donate it all in your 70s and 80s, you could spend your 50s doing great vacations with your family, maybe helping a younger family member get out of school debt free or with a down payment on a home, you could sit on a couple of charity boards so that you don’t feel like you’re wasting your time, you could even teach a personal finance class at a local community college and help countless others have success as well. Pretty much the absolute last thing you want to do is grind out your last remaining healthiest years putting in hours for a corporation so that you can have a 99% chance of not running out of money in retirement and a 50% chance of having so much money that you have nothing to do with it except hand it over to a charity on your death bed. Congrats, you didn’t strengthen your family relationships and you never enjoyed life while you could, but hey at least you weren’t one of Those People that is Irresponsible With Money.

Does anyone have a bank they actually like? My credit union has finally irritated me badly enough that switching out of spite feels worth it.

I like Ally a lot for online savings, but still use a local CU for checking.

In Glorious Socialist Canada we mostly get to select from among members of a banking oligopoly. My bank and I basically live in a state of detente, they try to sell me products and I steadfastly refuse, but I use their online brokerage function to invest my money so they make a small amount of money off me there.

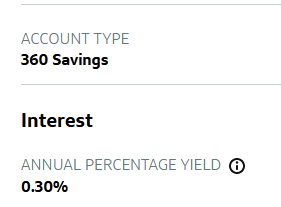

This is pretty irritating.

I had an ING online savings account that was acquired by CapitalOne. I didn’t pay too much attention to it - it was the place I stuck cash that I thought we might need over the next 12 months for large house expenses. But I did expect it to be earning interest as I would periodically see online ads for CapitalOne stating a competitive rate. Like right now:

So imagine my surprise when I just checked my account for the first time in a while and see this:

Apparently, they created a new type of savings account with this higher yield and DIDN’T CONVERT these existing accounts to that new type with the higher yield. So I’ve been earning <0.5% on this account for the entire year. I guess bad job on me for not keeping up with this, but it’s complete bullshit.

LOL what a scam. Never, ever doing anything with capital one based solely on this post.

That sucks. Very similar scenario here, where I think they inherited my ING account, and it’s one I rarely look at or think about. But I guess I caught it somehow a couple years ago, and converted to the Performance Savings. Still have an orphan $0.01 in the old “regular” Savings account somehow.