Central Banks never try to “catch up” for past misses. They just try to keep this year’s inflation in a target band.

The only way to get to -4% would require about 15% unemployment

As of April, 61% of consumers said they are now living paycheck to paycheck, according to a LendingClub report.

Even top earners are stretched thin, the report found. Of those earning $250,000 or more, 36% said they live paycheck to paycheck.

These numbers seems kind of meaningless unless the survey gave a clearer specification of “living paycheck to paycheck.”

I never understood this year. Does Paycheck to Paycheck count if you have a decent amount in retirement accounts? What about debt? How much is paycheck to paycheck.

Yeah, this is a meaningless designation. Mentally, I feel like I live paycheck to paycheck because every month when I get paid, there just isn’t that much left over after I take care of:

- outstanding credit card balances (that generally include at least some preposterously discretionary nonsense)

- mortgage (which obviously includes a principal component)

- car loan

- 403b contribution

- kids’ college savings

- after-tax savings ambiguously earmarked for things like a new roof or a vacation or whatever

I mean, it’s objectively silly for me to believe that I am anything close to paycheck-to-paycheck. And yet, I can’t shake that mental feeling.

Oh, I absolutely agree this is what it should mean. I just do not have a healthy view of my own finances, and I suspect there are other people who have a similarly biased view that might lead them to falsely believe they live paycheck to paycheck.

I know the feeling, on paper I seem to be doing OK, but after bills, spending, savings and charitable donations there is never anything left to add to my swimming pool full of hundred dollar bills.

The above list contains at least three buckets that are essentially savings, so it only feels like paycheck-to-paycheck because of how you earmark this literal pile of extra money. My guess is that even if your household received a windfall of an extra 10-20% per year this extra amount would quickly get divied up mentally and you would still feel like you were living check-to-check.

Yes, of course I would.

I don’t know how to make this any clearer: I am a doofus.

That kind of mindset is actually a pretty good way to accumulate money. I’ve heard it referred to as artificial scarcity, and sometimes seen it mention as an alternative to the more common advice of making a bottom-up budget. That’s basically my MO: set up mechanisms that automatically divert money into savings or investment accounts until what’s left over approximately covers my expenses.

Maybe you should get a few hunded dollars in singles and roll around naked on the bed with them for a taste of baller decadence.

“Forced scarcity” seems like a weird way to reframe basic good savings habits like some Big Insight. It’s been know for decades that people that auto deduct from their pay to save end up saving more. It’s not a trick, it’s basic common sense.

I do the same thing although I was a bit lazy on updating amounts for a while so my cash on hand was way higher than necessary. However I don’t trick myself mentally into feeling broke or living check to check because I know I could access these funds if I needed to or I could just stop saving and investing if something catastrophic happened.

Yeah I automate saving every month. If my checking account swells I’ll inevitably decide on some frivolous spending. Mentally my investment account doesn’t even exist as an asset, and it feels as much of an expense as my mortgage or car payment. Drives my wife absolutely nuts.

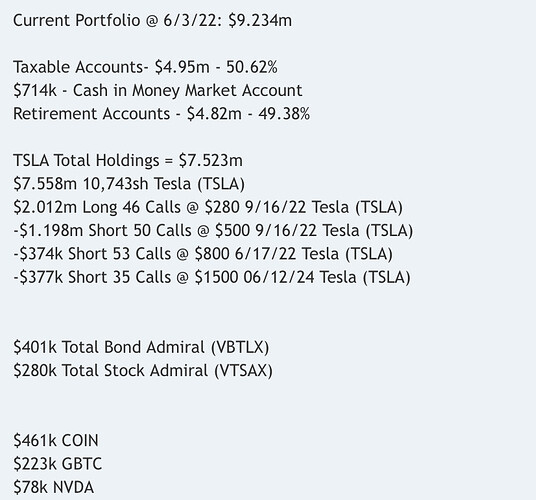

Hey guys, do you think this is a well balanced portfolio for a retiree?

https://www.bogleheads.org/forum/viewtopic.php?p=6709253#p6709253

When you’ve got $10M you can lose 90% of your portfolio and still be a millionaire.

My mother is getting her things set to retire. She just put her house up for sale. Pretty sure she’ll be spending the summer looking for a place to settle down south (where real 'murica is!).

Wouldn’t be surprised if I was spending my next Christmas in the center of Florida. Ick.

SUB’s gonna be swingin’ with the Villagers!

Because of my company’s payroll practices, two months per year I get 3 paychecks instead of 2. June 2022 is one such month.

I try to be unemotional about money but I can’t help but laugh at myself, these “bonus” paychecks absolutely trigger an irrational glee in me.

We have the same, but the third cheque is always a bit bigger than the other two because of the way they handle deductions.