God damn this system sucks. It’s literally designed to screw people over. I’d confidently guess that dealing with shit like this has caused people to get violent or breakdown in some form. It’s infuriating. I’m sorry you and your parents have this battle to fight.

It’s a Rube Goldberg device. I found a site called insurance-forums where agents post edge cases that no one knows the answers to. They also bitch about not getting full commissions for guaranteed issue (which is always in the favor of the beneficiary). Imagine being a senior and trying to figure this out on your own. I’ve already spent another hour on the phone today and am expecting to get back on a conference call this evening.

Variance: The insurance-forums bros abbreviate Mutual of Omaha stylistically as MOFO.

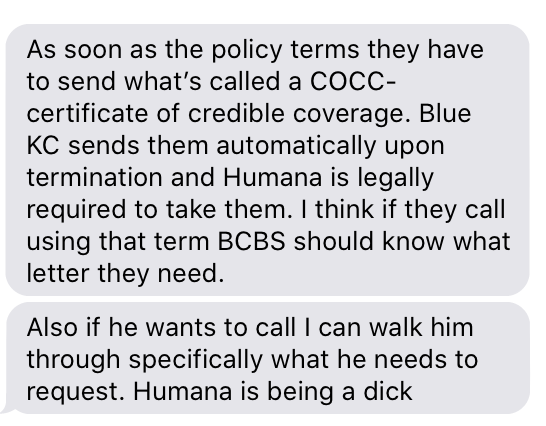

Here’s what my friend says.

Thought I’d let y’all know my bigoted therapist employee who won’t treat transgender folks also had a very lax approach to COVID, feeling telehealth would give her anxiety disorder clients an easy way to indulge avoidant tendencies. Or something.

Anyway, she’s showing symptoms of COVID now though hasn’t been and likely never will be tested. Thoughts and prayers obv.

We sent them the COCC and they said it’s not good enough. They want a COCC redraft stating that the coverage loss is involuntary because my mom has aged into Medicare. The retiree benefits manager said they don’t write letters like that because she is electing to leave the plan which is JLaw_ok.gif. They elected to leave because they both gained access to healthcare that doesn’t require paying an extra $10k/yr to rent-seeking scammers. The hostage is electing to run away from the terrorist. I elected to take the tax deductions I became eligible for instead of just paying more instead. Like, the implicit assumption here is that taking an action in your own financial interest that you are legally entitled to take is an unpalatable exercise of free will worthy of punishment.

Anyway, I’ve downloaded every single form from the different Medigap providers and it looks like UHC might do it with the standard COCC and “voluntary” cancellation of benefits. Gonna upload all of this shit and find out.

I’m sincerely sorry. That’s just awful.

If any of you aren’t irate enough from everything going on and need more rage fuel, check out this thread where insurance agents give their thoughts on single payer:

Without reading, do they say anything different than the one Pol agent?

It’s like a CPlanet thread but from the motherfuckers who are actually ripping you off and gloating about the sweet commissions.

So the answer is no.

It’s like that wv guy on 22. All very sad. I want health insurance agents to be unemployed. They can sell mattresses.

I got through two pages. Sickening.

I guess to be an effective salesman you need to buy into the propaganda to some extent. But like, outside of a few exceptions it is always jarring to me when people in an industry have a positive opinion of that industry’s bullshit.

You have to compare with that amount growing outside vs inside the account. Also these types of scenarios assume the individual has sufficient money to easily fill all tax-protected space, pay all bills, and still have ample savings to invest left over.

Think of it the other way around. Imagine an account where every time you spent money on health care, you could put an equal amount (pre-tax) in a tax sheltered account that will grow tax free and can be withdrawn tax free (for medical expenses, which you know you’re going to have eventually). If you had enough money, you would exercise that option with every medical bill.

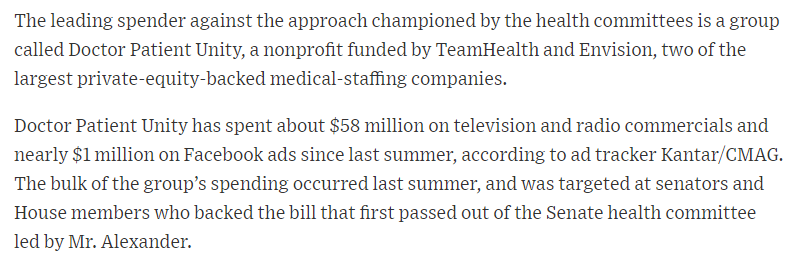

How relevant, I just came in here to post that my wife got a $2000 bill for an ER visit in July of 2017 from…Envision Physicians! Man those fuckers have a lot of gall. I know she had sort of a panic attack around that time during pregnancy, we went to the ER and were eventually seen by a doctor for probably 15 minutes who reassured her nothing was wrong (fwiw the doctor was fantastic, like the absolute perfect person for my wife to see at that moment in time). I told my wife that we’re not paying a three year old bill that apparently didn’t even go to our insurance, although I’m not sure how this ultimately plays out.

Yeah, it’s tough. Not that I never realized it, but the past year has really made it hit home how shitty our healthcare system is.

We got hit with a $3,000 ER bill for my 11-year old right at the end of 2019 (he’s fine, but probably did need the ER). We got on a 12-month payment plan. We also got a couple other bills that trickled in afterward for shit like x-rays.

Then my wife had a cancer scare a couple months ago. In the end, nothing was wrong, but all the tests created another bill of a few thousand bucks. This is all with insurance. So we’re paying that over 12 months, too.

She lost her job last week and therefore our insurance (we have it until the end of the month). That also hurts our ability to pay those big bills because part of the plan was an HSA that the employer contributed to.

We signed up for a bronze ACA plan yesterday to kick in on June 1. After government subsidy based on our income estimate for this year, it’s only $350-ish a month, but of course, the plan pretty much sucks ass.

She did have four interviews today, a couple of which were for jobs she thinks would actually be good. Fingers crossed.

Ultimately it comes down to how much you care about your credit score.

If you don’t care, just ignore the bill. Since a majority of USA#1 citizens now have some bullshit medical nonsense on their report and lenders are desperate to keep lending to them, the credit rating companies have severely reduced the negative effect of medical collections. But it will still hit your score in the short term.

If you do care, call and try to settle for a reduced amount. Get it in writing before you pay.

That sucks dlks, sorry to hear that. Did you try negotiating any of these down? Were you on a high-deductible plan or were those still the costs after insurance?

Nobody likes our medical billing system but it’s an especially sore spot for us because, after our first daughter passed in utero, we were surprised with a massive bill from the company that they sent her genetic work to which was supposed to be in-network. It probably wasn’t that big of a deal as we were told right away that they had a program to reduce the bill from the $5000 or whatever it was to $475 if insurance refused to pay; the issue was they kept sending us the bill over and over with late notices, which needlessly extended the pain of the loss for us over several months. I also got another surprise bill earlier this year from the company we did genetic testing with for our 2017 pregnancy. Fortunately, I still had the number of the company rep who we worked with and he told me not to worry and that it was already paid, but man this system is such a shit show and infinitely worse for those who have no way of navigating it.

Our current is rock solid, I doubt not paying would hurt enough to make a difference and we don’t intend to extend any other credit lines soon except for maybe another car when we need one. I’m sure we owe them some amount of money but $2000 it absurd and billing us for it three years down the road is also absurd. I suspect at this point they will take any amount of money and be done with it but I’d be happier to not deal with them at all.

YMMV but I would STRONGLY suggesting meeting (at least on the phone) with your wifes employer and check into COBRA status - I think you’re covered for at least 18 mos from time of job loss. The rules are very complex, and you would almost certainly need to pay some part of the cost, but you get to keep the insurance.

MM MD

We checked. She works in insurance, so she’s on top of all of it. COBRA coverage would be over $2K a month for our family.

And we went over the ACA options with someone at her ex-employer who specializes in it.