I’m surprised this took 3 days

This is not a valid inference.

Probably already one out there, this guy just has a lot of followers from making beginner javascript courses.

Imagine Twitter is worth $100 billion and Elon is going to put it all on red. You’ll pay 60 cents on the dollar for an $8 billion loan, because it returns 0 half the time and $8 billion plus interest the rest of the time.

The loan price is telling you more about risk of catastrophic failure (very high!) than enterprise value.

Wouldn’t it be cool if I sent out a tweet to my followers like “I’m going to snapdragon stadium to watch the Aztecs play football today” and the word going is a link to Uber, snapdragon is a link whatever that company is, stadium is a link to tailgating gear, Aztecs is a link to sdsu shirts, play is a link to your local flag football league, football is a link to ncaas website; and today is a link to the weather and you could purchase everything in twitter.

This is a fair point. With a normal business I suppose there would be something to say about the liquidation value of the collateral but twitter basically has no collateral.

He is definitely having some break from reality, perhaps drug induced.

We don’t need engineers! We need delivery drivers!

That’s a lot of buying, so of course I’m in. Hopefully just hovering over those links will pop-up like a 1/8th page ad clearly showing the gizmo I’m about to purchase.

https://twitter.com/evacide/status/1590834682320818176

https://twitter.com/mrbenwexler/status/1590834006421311489

This is a trademark law professor. Twitter probably dealing with 100 legal letters ATM. This is a significant reason they instituted verification.

This issue is obvious to any lawyer who took an IP law class. The fact that this stuff is happening tells me Elon is about as interested in basic legal advice as Trump.

Wait until he deals with privacy laws in 100 different countries during his one day a week job as CEO.

https://twitter.com/design_law/status/1590872084208844800?t=w8c9dPdRIQN_Q7u2lVP2hA&s=19

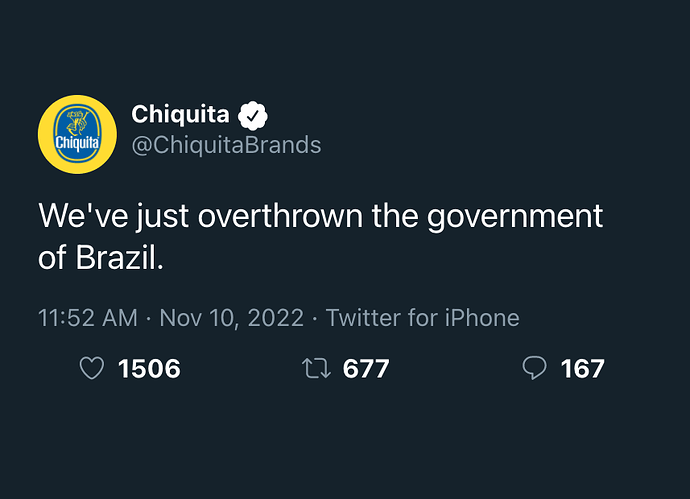

This is an all-time meltdown.

It is a little more complicated than saying the enterprise value is $8 billion, but it speaks to how fucked this capital structure is from the jump. Tenneco, another hung deal from the same time period in a tough space with an aggressive equity sponsor, is on offer in the low to mid 80s.

This does speak to the bath the banks are going to take on this because I’d speculate based on past situations that the first piece the banks can get off may be a special first out tranche within the secured tranche. So if the bid on that is 60, the loss on the rest of the $13 billion going to be even higher.

If he had any sense at all he’d just sell the company and eat the loss.

I don’t understand the “finance LBOs” business model. Do they really make enough on the deals that work to offset the Twitter and Citrix disasters? If so, how?

I think they committed before it became a complete clown show, and felt like they couldn’t say no because Tesla investment banking business is so lucrative?

Pretty sure JP Morgan realized this asshole was a lying POS a long time ago - good for them!

LBOs kind of have a reputation for being a handout for the pre-deal shareholders who get a sweet price for their shares, and then the company is fucked after. Not THIS fucked, but thats what a billionaire walking-talking Dunning-Kruegar exhibition can achieve.