I’m sure some people will game the system. It’s easily game-able.

Yep, no doubt about it. They can easily manipulate their FTE’s by hiring right before June 30, or flat lying about that number (it is a self-reported number). The real issue for those laying a bunch of people off will be spending 75% of their loan funds - a loan amount that was figured using what amounts to 10 weeks of payroll expenses - on payroll expenses over the 8 week period.

Can’t owners just pay themselves?

Yep. They could also just start paying bonuses to the remaining employees to use up the 75%. That, combined with a 100% FTE ratio and they are golden.

I believe it can’t be used for salaries over $100K annualized, the same way those amounts couldn’t be counted in the initial application.

But again all of this will be super easy to fudge.

Washington unemployment finally came through. Still waiting on stimulus unemployment that is supposed to back date to march 29. Still no word on where the 2900 stimulus is for my family.

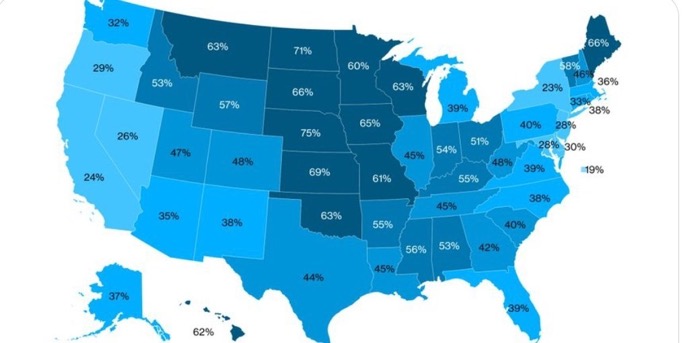

Nebraska with the highest % of approved loans

https://www.bloomberg.com/graphics/2020-sba-paycheck-protection-program/

Finally heard back from the CPA yesterday. He definitely got our application filed before the money ran out! No idea whether or not we will see any cheese but we haven’t til now and I assume we will not.

If you got an SBA number, you’re good. If not, you’re probably screwed.

I will ask about that. He did not volunteer that info which doesn’t inspire confidence, nor does the name of the financial institution: Fountainhead Capital

“Congratulations, your PPP loan has been approved! Please proceed to Galt’s Gulch to claim your manies.”

To me that inspires much more confidence than Chase, Wells Fargo, Capital One, PNC, etc etc etc. As pissed as I am at Chase, it doesn’t seem like they were the absolute worst of all the big banks. Capital One didn’t even begin accepting applications from their own customers until literally the night before money ran out lol.

And now here come the requests for additional information, including a copy of the BACK of the owner’s driver’s license which I sent already.

Buffet had to get loans for ALL his companies.

CNN has an article about why one may not have received a stimulus payment yet. None apply to me. The ONLY thing that should be delaying mine is that the IRS doesn’t have my bank info, but I’m getting the “Payment Status Not Available” message, so I’m not even getting the chance to enter it. I don’t mind waiting for a check - I just want to know what’s going on.

I actually filled out a form at the end of the article to tell them my situation. That would be funny if they quote me or call me to get more info.

Same boat. I am still getting “Payment status not available.” Filed my 2018 taxes and am entering info directly off my filed taxes. Not sure where the error is.

Got a link to the article?

Just search “irs payment status not available” and there are a bunch. If you’re in the same boat as me, none of the “reasons” apply.

Same.

Quick question for everybody that is getting the IRS “payment status not available” message even though none of the reasons given apply: Any of you have your credit frozen with Experian? Mine is frozen and I’m starting to find a few anecdotal references to people who have frozen their credit having these issues.