To be fair that is just a little necessary fraud and everyone should be overcharging their federal government to get theirs.

This thing seems horribly structured.

The government mandates that all the applications flow through banks. Meanwhile every large bank is coming off waves of massive fines, not to mention some huge negative consequences for going along with the government’s plans in the global financial crisis. There is going to be fraud galore, of course the banks are terrified of being pursued when the inevitable waste fraud and abuse stories circulate.

In addition to that, its so damn complicated the only people ready to take advantage of it are highly sophisticated organizations that in many cases are busier than ever (professional firms, primarily). Every law firm, PE firm, hedge fund, etc. has their application teed up, while mom and pop have no clue.

So if all applications need to flow through banks what is the purpose of the EIDL app on the SBA website? Or is the need to go through a bank just for PPP?

It is $600 on top. When you apply online, it will actually tell you your expected check with the additional monies as a separate category, then the total. I lived in multiple states so was given #freemarket choices which state I wanted to apply in depending on how much I’d get in one vs another.

I was almost baited by that one yesterday.

I got through to the end where it asks you for your routing and account number to ship the $10k no questions asked advance and I thought, “ehhhh this is too easy, this can’t be right” and stopped to wait for further guidance from the bank.

It sounded like you can only choose one, but then I see this on the PPP application:

If Applicant is refinancing an Economic Injury Disaster Loan (EIDL): Add the outstanding amount of an EIDL made between January 31, 2020 and April 3, 2020, less the amount of any “advance” under an EIDL COVID-19 loan, to Loan Request as indicated on the form.

Seems like people might’ve been able to double-dip and then refinance their EIDL at this new .5% interest rate? Sweet deal imo.

They changed the PPP rate to 1% FWIW.

I think they both go through an SBA lender at some point, but the EIDL is an up front grant that may or may not get turned into a future loan.

Of course I’m mostly guessing like everybody else because this whole thing is fucked eight ways to Sunday and the only thing you can likely count on is that the usual people who exploit and defraud corporate welfare will get everything and the people who really need help won’t get shit.

It seems like a common thing is going to be claiming a sole proprietorship to get the initial 10k grant then never going further in the process.

Why can’t everyone in the country do that?

https://covid19relief.sba.gov/#/

Go through the process yourself and give us a trip report from prison?

I would expect they’d compare what you entered with your tax returns from the past year or two.

Person A - schedule C filer, deducted expenses, etc. - Approved

Person B - all income from previous tax year was W2 - Denied

Person C - edge case, mixed income sources - Manual review

I mean, that’s how I would do it anyway.

I assume they will check the EIN or SSN(for sole proprietors) vs tax returns. Or they will ask for more documentation at some point during the application. I still don’t know anyone who has applied who has gotten approved, not approved, or contacted after applying.

Haha

No I’m just saying from what’s been posted it seems like the 10k is a grant and unless it prohibits sole proprietors who have only been in business this year, there will be plenty who will get that 10k then bail.

Hopefully there are some mechanisms to prevent that, but then I’m sure there will be ways around them for those inclined.

Chase said they’d email and tweet when they’re ready to take PPP applications. They didn’t.

But I checked their site and it was updated with this.

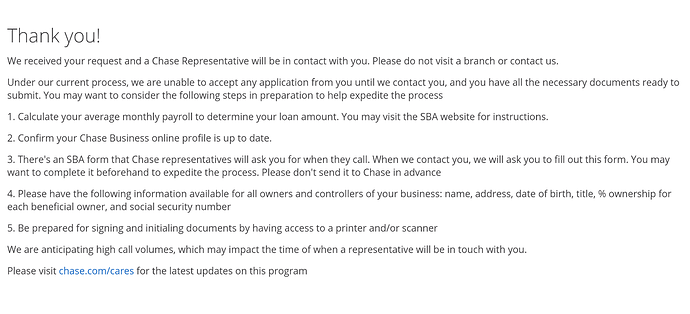

So I followed the steps to “apply”, filled in 5 pieces of information (business name, my name, my email, business EIN, phone number), and then got

So I’m feeling really great about this. No confirmation email from them that they have my info. Confirmation message with messed up grammar that basically promises that the process is going to change and that it’s going to take forever for someone to call me.

Jamie has everything under control.

These people have absolutely no interest in actually doing the job. If there isn’t an immediate stealing opportunity, they just make a speech / send a tweet and check the fuck out.

I’m obviously a homer, I work for a bank, but there is nothing in this for the banks. My institution is participating to serve existing customers and (I assume) not take a PR hit, but there is no money in this and huge potential downsides. Banks are subject to KYC (know your customer) regulations that require pretty extensive due diligence that can take a couple weeks, which have some pretty stiff penalties attached for non-compliance. It isn’t clear to me that this is being waived, and even if it is, banks are understandably worried about being scapegoated when the implementation of this thing gets FUBAR’d.

But Mr. Mnuchin said this was so great for the banks they should put their traders in the branches to process applications!

Being an existing customer should help with KYC right?

Who holds the bag when people do the fraud is very relevant. You can’t get hundreds of billions of dollars into people’s hands quickly and also be super careful and detailed about the process.

Do you have any ideas on how this can be structured in a better way or is there pretty much no good way to implement something this big this fast?

I don’t know if helping small businesses is something that would be better off being delegated to state governments to figure out the details.

I honestly don’t know. Off the top of my head, I think a better approach would have been just shipping every single american $4k a month indefinitely.

I don’t know how you deal with business obligations, though. If its subjective, that’s bad for obvious reasons in the Trump era. If its objective, many undeserving folks will get money. And the fraud will be off the charts no matter what.