Ugh, yeah you’re right. All those predatory lender fucks are going to have an angle on this.

Not dischargeable in bankruptcy and social security can be garnished.

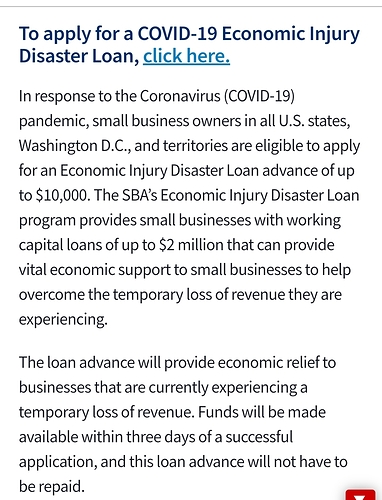

I don’t really understand the EIDL process. Fill out the form on the SBA site and then what? They give you $10,000? You go through a more formal loan process later? As someone who owns a small business with revenue in the 6 figures that I doubt would be eligible for typical SBA loans but has been hurt badly by all this is this just a free $10,000 for me? Or will I get nothing?

is predatory lending considered an essential business?

Very unclear, but my impression is the $10K is an advance on a more formal loan. So I think they give the initial application a once-over and if things look good so far they ship you $10K, then follow up to get more documentation for a more formal loan, of which the $10K would be a part. Not sure what happens to the $10K if you or they don’t proceed with the more formal loan, but I don’t think you just get to keep it.

Our banker also said that we should send them our application, but that final guidance from SBA is not available so they’re not processing any loans yet.

Oh nice, I didn’t see that.

I guess my bigger question is that it has been 3 business days since I applied and I haven’t gotten so much as an email from them. Also if I take the $10,000 and decide not to pursue additional funding then what happens?

Yeah I dunno. I did my application on the 30th and haven’t heard anything either.

I spoke with my accountant (pretty sharp/informed guy) about this topic today and everything seems to suggest the $10k EIDL advance is a straight grant. So if you get the $10k there is no need to repay it and no obligation to ask for further loan money.

Timing is less clear, but it’s supposed to take 3 business days from the day the application is approved to get the money. I saw somewhere the application may take a couple weeks to approve, but that timeframe seemed more like a guess to me.

Also of note is that, if you get the $10k EIDL grant, that amount is subtracted from what you can claim for forgiveness under PPP, if you also apply for that.

All of this is changing daily, so who knows what the gov will be saying about it tomorrow.

Some updated forms on there since earlier today.

One question I have is what is the difference between sole proprietorship and self employed?

Aren’t all self employed people considered a sole proprietorship?

You can be self-employed in a partnership.

Either way, the lender information PDF seems to very strongly imply what I suspected about whether or not self-employed/sole proprietors/ independent contractors/whatever with no employees can qualify:

What underwriting is required? You will need to verify that a borrower was in operation on February 15, 2020. You will need to verify that a borrower had employees for whom the borrower paid salaries and payroll taxes. You will need to verify the dollar amount of average monthly payroll costs. You will need to follow applicable Bank Secrecy Act requirements.

If it’s a secret, I’m in.

Comforting as usual

https://twitter.com/Hugh_Son/status/1245832960621842434?s=20

Chase’s PPP page is down. I’m speculating they’re updated in preparation for accepting applications soon.

Considering the application form keeps changing, I’d imagine not.

I accidentally fucked ours up by including employer-paid federal taxes on the initial calculations. I ran them through the tax attorney who caught it before we submitted to the bank. My gut says a lot of people are going to be asking for too much and the government is going to have a hell of a time getting their money back later.

It was just an updated message from the CEO.

Can anyone clarify on the expanded umemployent. Do you get your states unemployment + $600 or your states unemployment + x to equal your old wage up to $600.

Everything I’ve read indicates it’s a flat 600 on top