Dont understand how anyone pays 6%, except for maybe ultra luxury listings needing international buyers or super budget stuff where its not worth it otherwise. In Canada (Ontario,) max commission is 5% but I’d be shocked if the average person paid more than 4.5% unless they needed their house to be emptied/stored and re-staged. Anyone who pays 6%, or even 5% isnt interviewing multiple agents.

The average is definitely ~5.5%, all you have to do is go to zillow and it is shown in the listing.

Just closed the sale of my house two days ago. 14k to realtors, 3.5 months to close (NY avg is a bit over 60 days but there was a delay)… most stressful thing I’ve ever done.

I’m ecstatic to have this behind me but what a process. Turns out I’m not as patient waiting as i thought.

Risk management is surely part of it. It looks like the mortgages are still converted to bonds and sold, so it’s not like the originating bank owns all the mortgage debt that they write. Also their customer base is probably less susceptible to bank runs. I thought one of the issues for SVB is the VCs and other large depositors have something of a herd mentality and someone like Peter Thiel can start a bank run by calling a bunch of buddies and spreading FUD

In the US it seems that the higher end properties are more often sold for less than 6% commission. 6% of sale price is so massive that you will find agents willing to negotiate on that.

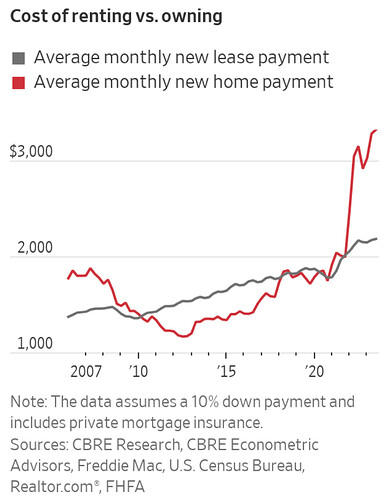

Big public companies that rent out single-family homes are beating the rest of the rental market this year, thanks to tenants who are paying large rent increases on the sorts of homes they increasingly can’t afford to buy.

Landlords Tricon Residential,Invitation Homes and AMH, which together own about 180,000 rental homes, each posted rent increases greater than 6% for the third quarter over the same period a year prior.

We love having our life necessities fully owned and controlled by faceless corporations with a fiduciary duty to maximise profit don’t we folks?

Jesus… put this in the shitty media thread.

They just discovered a new name for having roommates.

It’s simply too expensive to rent a one-bedroom place on your own for a lot of people. But being in a couple, splitting rent and bills between you, can make it slightly easier. I can’t help but feel like people like me are punished for being single.

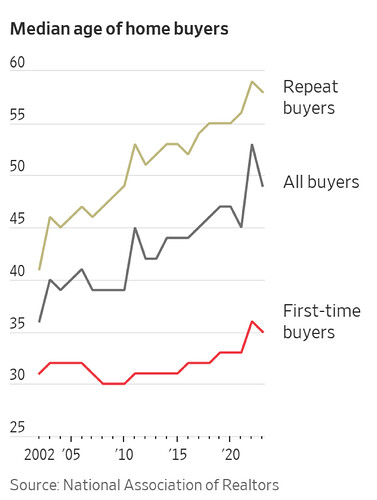

I’m in the same boat. It’s impossible to find housing on a single outcome right now. If I hear one more boomer who bought their first home for $27k comment on the lazy millenials I might snap.

What really tilts me is that I could have bought 3 years ago if I was in the financial position I’m in now. Homes that sold for $110k in 2020 are going for north of $300k now. $150k going for $400k+. Just insane increases across the board.

It’s nuts. When I bought my house in 2005, I quickly got a call from someone offering to buy it. Obviously I wasn’t about to sell a house that I intended to live in for decades (and I’m pretty sure they were just going to demolish it and build new), but it got me thinking about how much it would take to get me out of this place.

At the time, I thought $400k would do it. Now I couldn’t hang up fast enough on that offer. It’s not because I’m greedy - though Zillow has our house worth more than that - it’s that I wouldn’t be able to find anywhere to live with that money.

I’d probably need at least $600k at this point if I don’t want to finance any part of a purchase. In my area, new construction is $600k minimum, with most new houses going into the millions. My house is ok, but it’s almost 50 years old and I can’t imagine anyone paying $500k, $600k for it.

I’ve been getting lots of calls, texts, and letters lately from people (read: investors) wanting to buy my house, but I haven’t followed up. Part of me is curious, but I’m sure they’ll lowball me because they just want the land.

The commission is typically between 5% and 6%, which is usually tens of thousands of dollars out of the seller’s proceeds. But the seller also factored that cost into what they listed their home for, so indirectly, the buyer is paying the cost, too.

Aren’t they just selling for maximum price the buyer will pay?

The median priced home in 1950 was $7,354 (about $93,000 adjusted for inflation), according to the US Census, making a 6% commission $441 (about $5,500 in 2023). By 2000, the median home price was $119,600 (about $215,000 in 2023), allowing agents to split a fee of $7,176 (about $12,800 in 2023.) In October, the median home price was $391,800, according to the NAR, and the 6% commission paid by a typical seller was $23,500.

LOL

Imagine a realtor trying to negotiate a $25k commission with the buyers. The easy solution here is that the seller agent shows the homes like they do in other countries.

When you want to buy a home or get an “expert opinion”, you start paying for those services from a real estate agent. If you don’t, then you just go at it alone.

My brother and I are both currently looking for first time homes, and commiserating daily about how impossible it is. He sent me this screenshot the other day. I didnt verify its accuracy, and the article you posted has the number at 26%, but either way it’s just so gross and depressing.

25% is the number I have been seeing since covid started.