One of the big differences between the very small percentage of Realtors who make 90% of the money and the hobbyists who split up the rest is how quickly they will get rid of tire kickers and market feelers.

Checks all the boxes!

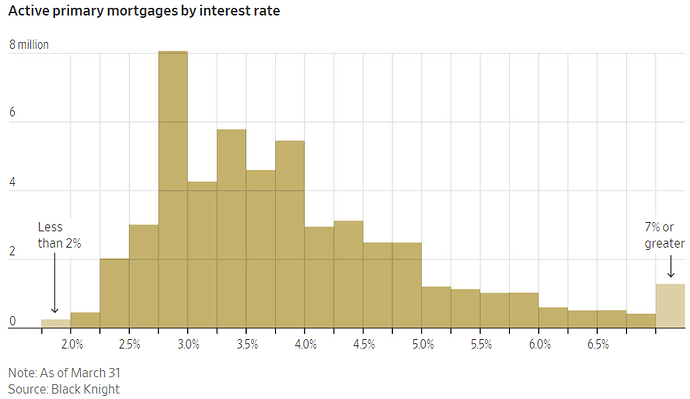

Even if I magically had to move across the country for whatever reason there is no way I’m selling a house with a sub-3% mortgage.

Yeah, I can’t imagine selling our 2.6% mortgage and buying somewhere new at 6-7%. I’m sure that prices at least partially reflect the rise in interest rates, but still couldn’t do it.

Yeah it’s rough out there. Meanwhile boomers who had fairly average income are sitting on two paid off houses. Must be nice!

Yeah, houses can only drop so much before they get snatched up by those willing to buy them outright. Nobody got the ARMs to worry about this time.

Renting older millennial here…

Playing with mortgage calculators online has been the most depressing thing about the entire internet the last 18 months.

I’m sure that prices at least partially reflect the rise in interest rates

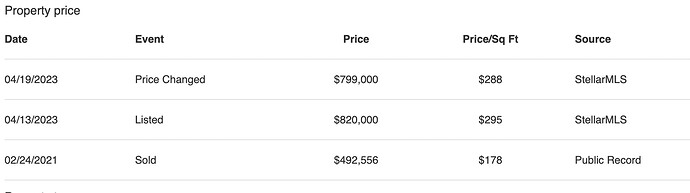

Nope. The gap between a mortgage payment for a house a few years ago and now is massive. Here is a house I was looking at on Realtor recently:

It was built in 2020, so it’s not like it is some renovation job.

Yea, another millennial here with the same experience. When interest rates went up the amount of house I could afford dropped like 40%, and I think prices have dropped, like… 5%

So, still renting and planning to rent for the foreseeable future.

Maybe they are, but why arent banks offering incentives to sell up and pay off early?

Mostly because banks don’t own mortgages, they instantly sell them to be repackaged as bonds. But on top of that, people aren’t (that) stupid.

My point is that having a 3% loan is valuable, and someone holds the down side.

Seems there are a bunch of missing trades that would make both parties better off.

I think the problem is the fed owns most of the MBS in the US, and since they have their own money printer they don’t really care if they are taking a loss on them

Moreover they sell them to REMICs, which have lots of restrictions on what they can do with their portfolio. Not 100% sure, but they probably can’t negotiate buyouts with borrowers that aren’t troubled.

her videos recreating orders and reenacting coffee shops earn her up to $9,000 per month, according to documents reviewed by CNBC Make It.

Eckroth is also a competitive barista and marketing strategist for coffee brand Onyx Labs, where she makes $45,000 per year. Last year, her total income was $141,000. But turning what you love into work can be dangerous.

Not sure where to post but this reframing irked me. None of it is untrue (and congrats to her, I will check out her posts, it sounds like something I’d like) … but the relevant skillset here is professional marketer, not barista.

ETA: I get that this is a whole genre, but why?

Because with wages stagnating and the world going to shit, everyone is looking for a shortcut to wealth. Articles like this go along with articles on lottery winners, crypto bubbles, and wallstreetbets-style stonking–each one selling the reader a brief thought of “that could be me!”

Rich Disney super fans out there living the dream

A Bernie-Sanders supporter, Ms. Scaramucci leans much further left than many residents of Golden Oak. She said she hopes that the DeSantis drama will burn out over time.

“I know that Disney legal is very, very thorough,” she said. “The mouse may be tiny, but it has big teeth.”

But Mr. Tupy said that, in his experience, politics doesn’t come up much when Golden Oak residents get together.

“Disney is more of a religion,” he said. “We worship the mouse.”

I’m curious whether a (new?) financial product could be constructed that basically allows mortgages to be assumed by a buyer through a separate legal agreement, and which carries with it the sort of transparency and protections that everyone would be looking for. Perhaps it’s impossible.