I don’t think we should get rid of the Fed, but they need to chill the fuck out with the zero percent interest rates. the government was paying unemployment out for more than most of the people who got laid off were making.

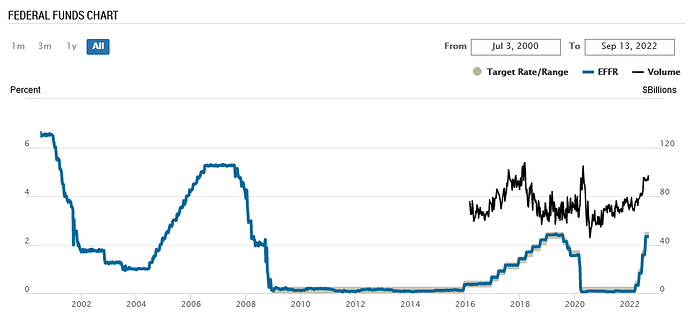

What do you mean when you say this? Here’s the federal funds rate over the last 20 years (ignore the squiggle that shows up towards the end - that’s just volume).

Are you saying they were wrong to have the rate so low in 2009-2016 or in 2020-2021? I think I’d disagree with that, especially for the 2009-2016 period when fiscal policy wasn’t doing enough to stimulate demand.

It seems like they are way too slow to adjust, we have had three huge asset bubbles now (tech/housing/covid) caused by low interest rates. we even had a labor shortage during covid and they still had zero percent interest rates.

personally, I would accept less overall growth for less variance.

You may have that opinion but the US Fed has generally been faster and more aggressive than the European Central bank and other peers. Due to their mandate they are not responding to asset prices but employment numbers and consumer inflation measures. At some point if there is still unemployment and low inflation their mandate is to reduce rates to generate growth unless it causes inflation.

As shown by spidercrab low rates worked for a long time and I think if US Fed had kept rates at like 1.5 or 2% from 2012 to 2016 while ECB was at 0 or even negative we’d have a stronger dollar relative to foreign currencies which would impact the cost of US labor and exports hurting our economy. As it happened 2009-COVID was one of the smoothest growth and business cycles in history.

Today, because the US Fed is being more aggressive raising rates than their international counterparts the US dollar has appreciated dramatically over the last year against the Yen, Euro, Pound, etc. This will have long term effects on US competitiveness, which is maybe OK in the short term due to high employment demand but could also be difficult to reverse.

In short, when inflation is due to supply shortages and not weakness in the currency their options are a lot more limited unless they want to risk causing other major distortions in trade.

Higher mortgage-interest rates have reduced home-buying demand, and homes are sitting on the market for longer. Home prices have slid from their springtime peaks in some markets, and some sellers are reluctant to lower their asking prices.

And with many prospective home buyers priced out of the market, rents for single-family homes have soared in recent years.

As prospective sellers shift from selling to renting, that is pulling supply out of the for-sale market, just as the number of homes for sale was starting to rise from near record lows. The tight supply of homes for sale is a big reason why prices continue to climb even as sales decline.

If nothing else less money for LOL realtors.

Obvious policy here is to set the first time homebuyers interest rate at 3% or half the current rate or whatever the fuck.

30 year mortgage now 6.5%

The apartment above me just went into contract. I’m dying to know what the price was, but I won’t find out until the deal closes, which will probably take a couple months.

Damn, that’s even higher than my original 30-year from 2005. At that time, I had an 80% loan at 5.5% and a 10% loan at 7%. Refinanced a number of years ago to a 15-year at 2.99% combined. Chopped 8 years off my mortgage and saved about $100,000, although naturally my monthly payment increased because of the shorter term. Will have it paid off in August 2027.

Well I’m never gonna own a house, now

Never gonna own a house, now

Never gonna own a house, now

Never gonna own a house, now!

At this point I’ll take 10% mortgage rates, fuck it. Crash the whole market and maybe in another year I can buy in cash if it crashes enough.

Except so far there’s not much of a crash. And we’re now at the point where if I wanted to rebuy the house I sold earlier this year, which I owned solo, and had my girlfriend move in and contribute her max budget, we wouldn’t be able to afford it.

feeling better about my 5.375 at least

Yeah if prices don’t drop then we’ll have to save up longer and buy something bigger. From what I’ve seen the houses over like $550K didn’t bubble as much.

the difference between now and two years ago is insanity.

your periodic reminder that the last time the fed raised rates to double digits it took almost 25 years before mortgage rates dipped below 6%. Over the past 50 years they have averaged around 8%

Double interest mortgage rates would come way before the Fed rate hit double digits though.