Our place allows you to set contributions specifically on your bonus check to 0 while still allowing you to contribute and get the match on your same standard separate paycheck. So you may want to investigate if that’s an option for you.

Yeah I tried that last year. Not an option.

Reputable employers do a true up at the end of the year but lots of scummy companies intentionally screw people.

What was the policy that made front-loading not qualify for full match?

Interesting. I had never heard of that being a problem for people to watch out for. I am a bit surprised it is legal to set it up that way as there are so many regulations that an employer needs to follow when setting up a retirement plan. But if there is nothing illegal about it, I’m surprised more employers don’t do it. It clearly benefits the employer and hurts the employee.

Just read the linked article from JordanIB a few posts up, it explains everything you’re asking about.

Thanks. I missed that.

Do you guys count long term retirement savings when looking at what % of your current net worth you have in cash or no?

Example, wife and I have about $X in a short-medium term Vanguard Three Fund Portfolio. We have about $3X in cash and $3X accrued in 401k’s. We’re looking at buying a house in the next year and would probably need all of the cash and Vanguard $$ for a down payment, but not sure if we’re too heavy in cash at the moment.

I think I paid $1,500 or so back in 2012.

I’m currently putting my accumulating house down payment in a HYSA and will likely be keeping it there for ~2 years. Is this the right play?

Wonder if I could get my house named a historical building or something. Eligible for some funding to preserve it? …

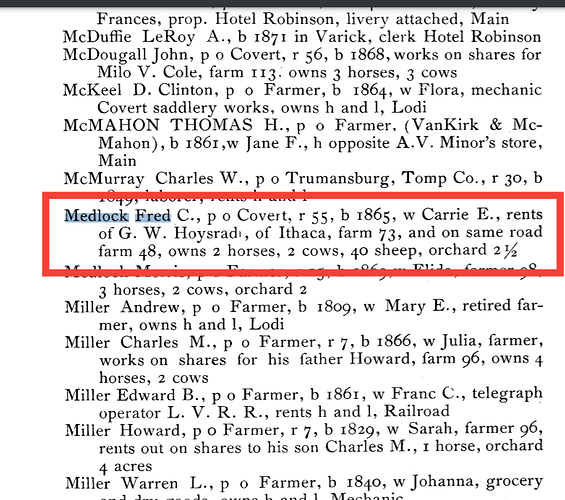

Hmm … Medlock Orchard & Farms? est. 18xx. This is the 1st farmer to own it, as near as I can tell.

It would frustrate the hell out of me to earn ~0.5% interest or whatever, but I think it’s the right move.

Depends on what the rate is, and how much money you’ve already accumulated.

If you know for sure you won’t need it for anything else and you don’t want to take on any risk, GICs are almost certainly better for the money you already have.

It’s painful. I’ve got around $25k in it right now and know I’m missing substantial gains on it. Seems too risky to do anything else though.

$25k at .25% (LOL)

If you haven’t, take a long look at the low/no down payment options. There’s a lot of things out there to get you in. For example: Down Payment Grants and Loan Assistance Programs for First-time Homebuyers

You might be good for a 800k house today, income permitting. Then after you buy, you keep saving while in the house to get a refi which eliminates the bad loan/pmi you had to take to get in the door.

If you do wait, I’d still gamble with the down payment. House prices could double while you are waiting, making buying impossible. Inflation could appear out of nowhere and wipe it out. I don’t see why the risk of the SP500 crashing is the only one to protect against.

You can get 0.65% on a nine month CD at Marcus right now

Can’t you get a (marginally) better rate on a CD?

Only argument against CD is if you’re not certain about the time frame and if a good deal comes up sooner you don’t want to have to cash in the CD before maturity and pay whatever associated penalty.

But if you’re really sure that it’s going to be at least one year, then you could do CDs for a year and then back to high yield savings after that.

We’re talking about pretty small amounts here, so it may not even be worth the hassle for you.

Yeah unless I suck at math then switching would generate me an extra $1k. The flexibility of having quick cash is way more important to me than the $1k.

This doesn’t seem right.