You first

I’ve lived in a non-coastal state my entire life.

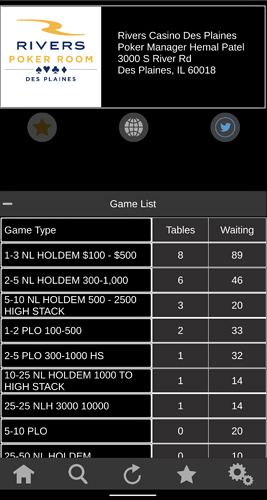

I need access to big enough NLHE games, so I’m pretty limited.

Holy shit. Those run regularly?

Edit: Oh, wait, that’s right outside Chicago. No way the housing market there is cheap right?

New poker room, so no idea how long it will last, but there seems to be some action.

I hear the straddle can be up to 5bb UTG or OTB, so the 2/5 can play pretty big. I expect to make a trip out there within the next month to check things out.

it’s not that bad

Lumber production is higher now than pre-covid, yet prices are still more than double. I don’t see how you can blame that on supply chain.

It’s not weird for people who work in markets every day. In trucking for instance fuel has nearly no impact on short term rates.

Gotta understand the assumptions behind headline economic “axioms” like prices are directly tied to costs. Why are they tied…. because increased costs affects quantity that can be supplied at any given price/demand level, duh.

So in housing markets where supply cannot increased because it’s already all built out then feel free to tax all you want.

In areas where you can build more then be careful with taxes….

This one finally sold for 80% of the highest zestimate that I saw for it in the last ~month.

Even though I have no intention of selling my house, I got the same feeling you get when you get coolered and lose a huge pot.

Brag: Still moving into a new house at some point and I can afford that

Beat: PG&E fucked up the power connection to the sub, causing a delay

Variance: Interest rates down now that I locked in my rate (but maybe the delay will get me out of the lock period)

I had a locked in rate on a refinance a few years ago and rates dropped. I reached out to the originator and while they wouldn’t lower the rate, they did give me a credit against loan closing fees, etc. that weren’t insignificant.

Thanks for the advice. I’ll try that if it’s an issue.

my issue is that they know they’re the only one who’s been willing to work with my employer benefit that is technically a second loan on the house. Don’t know how much leverage I have here.

Have mortgage rates actually dropped? Locked in 4.375% on a 30 year on April 20 and lowest rate I see on bankrate.com now is 4.50%.

Relatedly, is the consensus play to decline Owner’s Title Insurance?

I wouldn’t be surprised if your lender required it.

Am required to buy title insurance to protect the lender, have to pay double if I want to protect myself as well!

Question is should I decline to pay double to cover myself?

Really looking forward to Riverman’s response to this - it sounds absolutely ludicrous.

Title insurance is (as far as I know - I’m not a lawyer) to address issues where the title is unclear or erroneous and you end up owning a different-in-some-way property from what is described in the contract. I can’t imagine a world where you have this particular issue, where the lender’s title insurance can cure that issue, but where you would somehow still be harmed.

But again, I am not a lawyer, so maybe I’m just not imaginative enough to think of all of your possible risk!