I asked about that when shopping. I was told the appraiser knows the offer and knows they have to meet it. That they never failed to appraise at the offer in this market, but they used to sometimes.

So mortgage companies have been basically writing blank checks for the last two years? This goes agains the narrative in the media that borrowing is very stringent.

I’d be curious to learn what the average down payment tends to be in this environment.

For those who are skittish about putting a lot less than 20% down, let me provide some perspective. Most people put down less than 20%. The median down payment was 13% in 2021, according to the latest figures from the National Association of Realtors

I’m going through this currently on the seller-side, and can offer a few bits of info.

Buyers are including an appraisal contingency on their offers, where they’re basically saying “we’ll cover any delta between appraisal price and sale price, up to $X” - 2 offers we received had this contingency where X was $25k. Both offers were 10% down, so they’re signaling that they have more cash if they need to leverage it, but are unwilling to include it as part of their offer down payment.

When we bought this place in 2019, the appraisal value came in LESS than the list price, which was ridiculous. Our accepted offer was only like $10k over list, and the damn appraiser said the house was worth $10k less than list. Based on the comps and other market data, the appraiser was in the wrong. But you can’t just go back to the appraiser and the bank and say, “do the appraisal again, we don’t agree”. This all went down after the Purchase & Sale agreement, so we were on the hook for the 5% cash we transferred at P&S if we walked away, OR we had to cover the $20k delta.

I have no idea how, but our mortgage broker pulled some strings in the background and got the bank to re-appraise the property with a different appraiser - this time the appraisal came in at our agreement price. The whole thing felt back room shady, but it was resolution for us.

In general, it IS a big problem for inexperienced buyers that want to come in and offer 20% over list price. The bank will never value the property at that number, and they’ll have to cover the difference or never, ever have their offer accepted unless they can cough up the $200k or whatever, which generally ain’t happening.

in my area it’s not loose lending, shit is all cash.

The system is working fine everybody, don’t worry, when the bubble pops it’ll be fine and unwind smoothly!

Institutions (and real estate investors) buying them in cash to turn them into rentals were buying around these prices with rates at 3%, I don’t see why they’d let them fall back to where normal buyers can beat them out since the rate hike doesn’t affect them (except maybe the institutions drawing down huge lines of credit then buying in cash). I’m concerned that it’s not going to end up being a bubble, but rather is the beginning of the process of potential homebuyers getting trapped as renters as the ownership class corners the market.

Yeah, a lot of this conversation reminds me of the IPO discussion we had around here a year or more ago. There’s likely some strategy in intentionally pricing a stock (listing a house) at a price that you know is lower than it will ultimately sell for, and there’s no reason to believe that the listing price is a good estimate of the house’s fair value.

See the post above by ChipsAhoy

I asked about that when shopping. I was told the appraiser knows the offer and knows they have to meet it. That they never failed to appraise at the offer in this market, but they used to sometimes.

I guess my point is situational. Depends on the market and depends on the accuracy of the list price relative to market value. In my recent experience, we received offers with escalation clauses and appraisal contingencies. This is just an anecdotal observation, but appraisal contingencies are a common part of offers here in the Boston area.

Now that the fun is mostly over for us, we get to turn our attention and stress to house hunting in Los Angeles.

I bought a townhouse in 2019 after my divorce. It’s in a gated community near University Center and Twain and was built in 1974. It was 145k, and was in a range where I could afford it by myself, and is super affordable with any roommate. I wasn’t really planning on it but picked up a roommate right before the pandemic, who promptly lost his job and was on unemployment the whole time. So after a year and a half of barely paying me rent, he moved out.

Now one of my gfs moved in and we have it pretty easy. Combined 170k income (she’s the bread winner) and HOA + Mortgage is ~1100 a month. This place probably has linoleum in the kitchen from 1974, and original windows so it needs some work. Still at 1500 sq ft with 3 bedrooms and 2.5 baths it’s got space to work with. Enough for us to have separate bedrooms, and an office room. An identical unit right next door recently sold for 230k. They did some basic remodeling and it’s now listed for sale on opendoor for 280k. The owner had bought it in 2009 for 30k. Zillow reports my place is worth 246k which seems like a joke but not knowing that a place sold for 230k right next door.

What makes it more of a joke is knowing that these places all need to be repainted. Most have wooden balcony’s that need to be replaced by the HOA as well. I don’t use the balcony attached to my master b/c it’s unsafe (I wouldn’t lean on a railing). Apparently the HOA was underfunded forever and is now catching up. I just can’t fathom having $100k equity after 2.5 years, but recognize that I am fortunate. A teacher friend of my makes 65K+ and is priced out of buying anything by herself and is stuck paying ever increasing rent. She could afford a mortgage like mine, but those don’t exist anymore in Las Vegas.

This is the end game for most millennials and Gen Z. Just wait until the regional markets start getting cornered, then the rent hikes will chew up about 100% of any wage increases.

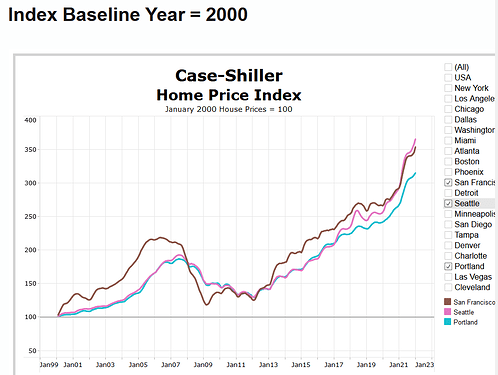

I think it’s hard to assess changes in value based on the average/median transaction, because compositional effects really influence those numbers - you’re kind of assuming that it’s the same distribution of houses that are selling in each period. The Case-Schiller indices give a more apples-to-apples measure of price changes. Here’s Portland, Seattle, and San Francisco:

The last 10 years have been bonkers, but it’s not quite as severe as some of the anecdotal stories suggest.

Also crazy is the fact that the average homebuyer in 2000 could have sold 13 years later and “only” doubled their money. Seems very quaint!

does anyone know why they don’t smooth out the walls? shouldn’t that be relatively simple?

The aesthetic is part of the selling feature. People who buy a 3d printed house right now want to advertise that fact.

This seems big for climate change, too. A concrete home should be fireproof, and stand up better to hurricanes or tornadoes.

You cannot call Tampa the “Bay Area”. GTFO with that shit.

Can confirm, Tampa housing is insane right now. Sucks bc I kinda like the place.

What’s the deal with house boats? Tampa area has so many waterways, lakes, canals, swampland it seems like houseboats would be a good idea. I’m sure there’s a bunch of laws about where you’re not allowed to stay, but with the current housing market, house boats are starting to look pretty appealing!