It isn’t a one thing situation, but decreased supply is a very real cause

Most of this stuff is bullshit imo. For example, Californian tech workers have moved into your state and they are driving up prices! Yet, somehow the price of real estate is still up 15% yoy in San Francisco despite every single tech company going remote.

San Francisco is a destination for reasons other than proximity to Uber HQ.

Institutional buyers own less than 1% of houses in the U.S. There is probably some marginal effect of interest rates where people stay in houses with great mortgages but rates only started going up like 2 months ago and the housing shortage has been upon us for years so that can’t be the explanation.

The solution is to build more housing, but that isn’t exactly easy since over half of homebuilders went bankrupt in 2009, the ones that remain are more conservative, materials and labor are very expensive, there is a severe lack of developable land where people actually want to live (and where the jobs are). Also NIMBY.

Our home went live Friday morning around 5am. The “Zestimate” was $358k. Our realtor’s comps put it at $346k. We listed it at $400k and within 16hrs had 3 offers for $405k cash, $410 FHA, and $425k VA. Went with the cash offer.

I thought the Zestimate and comp analysis were low based on the features of our house, lot size, and mountain views.

More stories here: Tales from this insane real estate market [Home sales] - Bogleheads.org

What is the benefit of leaving $20k on the table and not accepting the VA?

Dunno. Someone asked the same question in the thread and didn’t get an answer.

I assuming no risk of the buyer backing out and not having to wait a month plus.

Sucks though because all cash = flipper. In my neighborhood there’s no option to buy a cheaper fixer upper unless you have all cash.

Cash is in your hand, VA loans typically take 40-50 days to close.

Did not know this till I googled, but in addition to delay, the seller has to pay some of the fees normally paid by the buyer:

"When you buy a house, there are always going to be fees you have to pay at closing. When you use a traditional mortgage, you’re responsible for all buyer-related fees. The same isn’t true when you use a VA loan.

The loan program prohibits buyers from paying certain fees at closing. Typically, this will include the loan underwriting fee and the closing fee. Those fees don’t go away. Instead, they become the seller’s responsibility."

How far in advance should I get pre approved before I want to make an offer? Internet gives me a wide range of up to a year. I also assume I should try to avoid buying a new car between now and then? Not sure how long my current car will last.

The 97% Conventional Loan also seems like the ideal situation for me. Budget will be around $500k - $650k but I’ll only have 3% down + 3% closing costs. Credit score is 800 and our only debt is $50k of student loans my wife has which will be forgiven in 3 more years (assuming we don’t get screwed on PLSF). My current lease ends in March of 2023 in which I’ll probably go month to month until we find a house we want. PMI seems drastically overrated on the “AVOID AT ALL COSTS” front. From what I gather it would come out to like $250 a month which seems negligible in order to not save 20%(LOL).

Any thoughts on any of this?

They are acting like all these little things have added up to create the huge increase in home prices.

-Millennials are now at the age where the average person buys a house and that is driving the market!

-Investors have now started buying up tons of single family homes to rent them out.

-There aren’t enough construction workers because of covid. Curiously enough, my company also can’t find software engineers. Certain occupations like school bus drivers might have been effected by covid, but for these others, I think suggests that the economy is just super overheated.

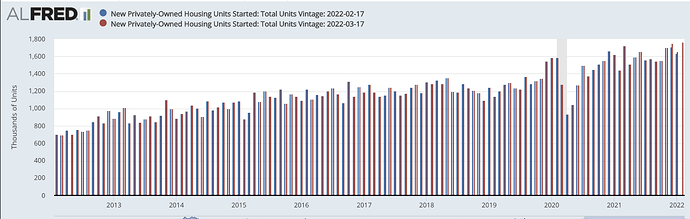

Here is a chart showing that housing starts only declined for a few months:

IMHO, the primary cause is low interest rates and then the secondary cause is FOMO. Homes are now at all time high when compared to median income.

Once pre-approved they provide you with a letter saying they will finance up to a certain purchase price with some other details. One of those details is an expiration date, which in my experience is about 90 days from the date you were pre-approved.

ETA: and fwiw, my experience is I just got pre-approved again after my previous one lapsed. Each time you get pre-approved there is a little drop to your credit score, but it bounces back pretty quickly (like the next month based on CreditKarma).

Lender will have an appraisal contingency whether it’s conventional, FHA, etc. If your agent tells you the house is worth 350k that’s also what the appraiser might come back with and then the buyer can no longer afford it at the agreed price over 400k.

I not sure I’m laughing as hard at this as I should be. I’m still laughing, but there is a grain of truth in there. If you’re young and not really settled down with kids, buying a home is often a terrible decision. The convenience of renting and not being locked into something is huge. I’ve seen plenty of people who are in this position who buy (because it is what they are supposed to want), regret it eventually, and then take a bath on the sale.

And if the market was 20-40% lower than it is now? Would they still feel that way? Is it possible the market IS 20-40% lower if scum sucking fucks like this arent buying up inventory at an insane pace and driving up the market to untenable levels?

I don’t know if they would, but they probably should.

Just like you can’t time the market, you shouldn’t be timing the real estate market for shortish-term gains. If there is a decent chance you might want to move in < 10 yrs (which I think describes most people without spouse and kids), then buying is generally the donk move.

Sure some people stupidly buy and the the real estate market goes way up and they are happy with the decision. They are being results oriented. They just got lucky.