I might get ruined by the rigged health care system first, but if a huge recession wipes out this spray-tan McPresident and his worthless, shit-eating Boomer supporters, it might actually all be worth it to me just on schadenfreude value alone. Also will be the perfect time to troll them with DOW JOOOOOOOOONES scoreboard talk to point out how people are buying up their misery and death at liquidation sale prices.

So you not believing that profit margins were increased by reducing investment in the business doesn’t actually matter… because I can see it clearly by pulling up the 10k of almost any major non tech public company. They’ve absolutely taken a hatchet to reinvestment in new capex as well as R&D… to hit their ever increasing wall street expectations. Eventually they either reinvest or stop being viable and that would compress margins quite a lot.

The inability to raise prices that you bring up is another interesting part of this. In highly competitive markets (and most non tech companies are in these markets) it’s very hard to raise prices without losing a lot of market share. Cost increases become very hard to pass on to consumers. Last year for instance was very hard for anyone who did a lot of transportation because transportation costs went way up. There are almost infinite examples of goods and services that large firms buy that could see increased prices over today. It’s very dubious to assume that they could pass on these costs. Costs are historically very low right now in real terms… so regression to the mean in all sorts of ways is not just possible but almost a lock.

Profit margins have been steadily creeping up for a long time now. If you think that trend is sustainable that’s fine I guess, but at these prices you had better be right. If you’re wrong you’re going to lose a lot of money. A lot more than you stand to gain with implied yields at 5% or less.

No lol. Capitalism isn’t the problem. It’s doing a fantastic job of achieving the goals we’ve given it… GDP is at record high’s and we’ve been so efficient with capital that we have way too much of it. We need to change the metrics and capitalism will do what it does best and hit those metrics hard.

GDP and capital efficiency have to stop being our policy makers end goal. Markets and letting people make economic choices for themselves are not to blame for our corporations and government being single mindedly focused on metrics that have almost no meaning to the median household.

This, by the way, is why I like Yang. He gets that shitty metrics make shitty results.

I like Warren because she’s targeting systematic corruption, which I think is a root cause of a LOT of the problems in the US today. I like Yang because he’s targeting shitty metrics which are another root cause of the problems in the US today. I strongly suspect that both candidates would address both once in office so for me both options are fine.

Do you think that, in practice, changing the metrics and goals of capitalism is going to be that different than implementing the “socialism” that bernie and the left support?

This is gonna sound bad but i wont shed a single tear if some major recession fucks over the entire boomer generation and they get wiped out. I just fear it’ll trigger some backlash that the younger generation will have to cough up even more cash to pay for.

We’re already being robbed blind, once millennials get old enough to realize it, these people will be wasting away in care facilities and absolutely no one will be around to feel sympathetic or to help them. They brought it on themselves and I will laugh.

My grandparents were amazing people, the silent generation. Parents were boomers. Throughout my life I am always amazed at how such a great generation managed to bring about such a fantastically shitty one.

By the way it’s not just boomers, older gen Xers have a bit of a deplorable streak in them too.

My father was born in 1917 and my mother in 1933. My Dad admitted the need he had to fight against the racism and misogyny that was ingrained in him growing up. That it took conscious effort to look inside of himself to make the changes necessary to overcome what he had learned in his youth.

They both taught me that everyone was equal, regardless of race or religion and for that I will forever be grateful.

My grandparents were amazing people, the silent generation. Parents were boomers. Throughout my life I am always amazed at how such a great generation managed to bring about such a fantastically shitty one.

I mean the PTSD from two horrific wars probably didn’t help make them the best parents.

The same as Bernie? No. The same as Yang/Warren? Why yes that’s what they are both advocating for. Capitalism very definitely needs reform.

You’re not going to get any argument from me obviously.

Millennials, myself included, will dutifully pay for their broke parents to age and die in comfort. It is absolute bullshit, but we’re not going to let them collectively die in the streets.

I will. They threw my ass out on the street when I was 19 with only $800 to my name making 7 bucks an hour, because they were too irresponsible and stupid to keep up with an extremely small mortgage payment. Gave me a week’s notice out of selfishness. Never really looked back.

I was close with my father but my mom, I don’t even know where she is. If I found out she was on the street I’d probably go spit on her. Not everyone has great parents.

Medicare for All*

*except Boomers fuck those people

Morpheus Voice

What if I told you we weren’t borrowing enough money?

https://twitter.com/JHWeissmann/status/1161848272765575171

FWIW I’m on board with this idea. Issue a couple of trillion dollars worth of bonds to build a couple hundred nuclear panner plants, boom no more coal and could probably even eliminate most natural gas plants.

Nuclear has too many fear-mongers to ever take off in a big way. The fact it’s actually THE answer to all of our energy + pollution problems is irrelevant to people, they just start screeching about Fukushima or other disasters.

San Onofre was a perfectly fine nuclear plant that was shut down out of a pure fear reaction to Fukushima. It needed some expensive repairs but it was the 2nd most power generating station in California, which has tremendous energy needs especially in the summer. It was reasoned that cheap shale natural gas would provide a better and cleaner energy alternative (lol fracking).

Just pure stupid. This planet is doomed.

It seems doomed… but it’s amazing how fast capitalism will make nuclear popular when the carbon taxes land. Seriously imagine how nuclear would do with a concerted marketing effort run by people who truly understand the dark art of marketing.

It seems doomed… but it’s amazing how fast capitalism will make nuclear popular when the carbon taxes land. Seriously imagine how nuclear would do with a concerted marketing effort run by people who truly understand the dark art of marketing.

And the marketers don’t even have to lie! Although they will have some work to do to reverse powerful and well-made anti-nuclear propaganda like the HBO Chernobyl miniseries.

They can quickly recast that miniseries as what it is… a story about powerful people putting their own personal interests ahead of the good of the public. Also Chernobyl was along time ago and they can talk up the (truthfully significant) safety improvements that have been made to nuclear power since.

So you not believing that profit margins were increased by reducing investment in the business doesn’t actually matter… because I can see it clearly by pulling up the 10k of almost any major non tech public company. They’ve absolutely taken a hatchet to reinvestment in new capex as well as R&D… to hit their ever increasing wall street expectations. Eventually they either reinvest or stop being viable and that would compress margins quite a lot.

Profit margins have been steadily creeping up for a long time now. If you think that trend is sustainable that’s fine I guess, but at these prices you had better be right. If you’re wrong you’re going to lose a lot of money. A lot more than you stand to gain with implied yields at 5% or less.

This might turn out to be a long post, but the point is simple: I think you’re wrong about the underlying data, and I think you’re coming to bad conclusions based on that data.

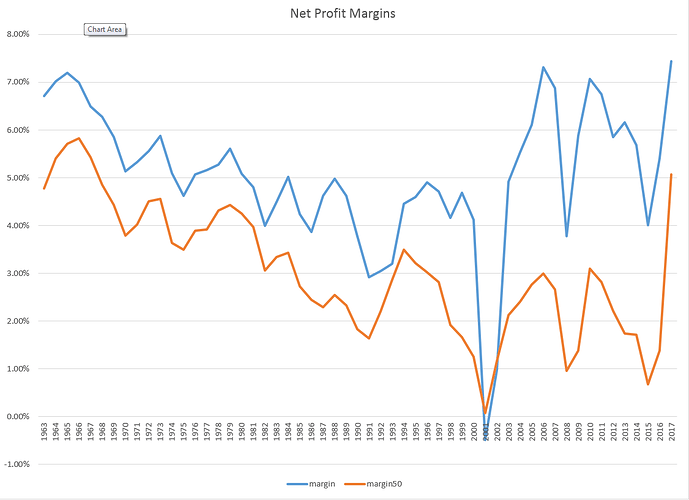

I don’t know what firms you’re looking at, but I’ve got Compustat data with the universe of US firms filing public financial statements. So here’s what that data looks like along a few dimensions over the last 50 years or so, presenting both the median firm measure and the aggregate US measure. (In all cases, the median result is the variable name ending with 50.) First, profit margins, defined as income before extraordinary items divided by sales:

I guess you could look at the 2003-2017 data compared to the 1983-2000 data and say that there’s been an increase. But there’s a lot of variability in this measure and I don’t see how you can look at this graph and come to the conclusion that there’s an obvious recent trend towards higher profit margins, and that the current levels of margins are unsustainable.

(It’s also important to remember changes in accounting rules that distort profit margin comparisons, particularly a shift from gross revenue accounting to net revenue accounting, but that’s not worth going into at this point. Edit: I made a follow-up post to illustrate how this works and why it’s important.)

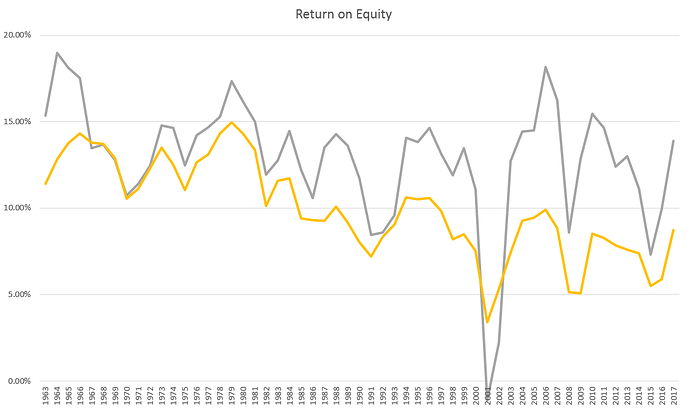

In my mind, the best measure of profitability, and the one most tied to long-term stock performance, is Return on Equity (ROE). Here’s what that looks like:

It seems clear to me that there’s a slight downward trend over time, and I don’t think there’s any reason to believe that these levels of profitability are unsustainable. A mid-teen ROE is a perfectly healthy, but not preposterous, return on investment.

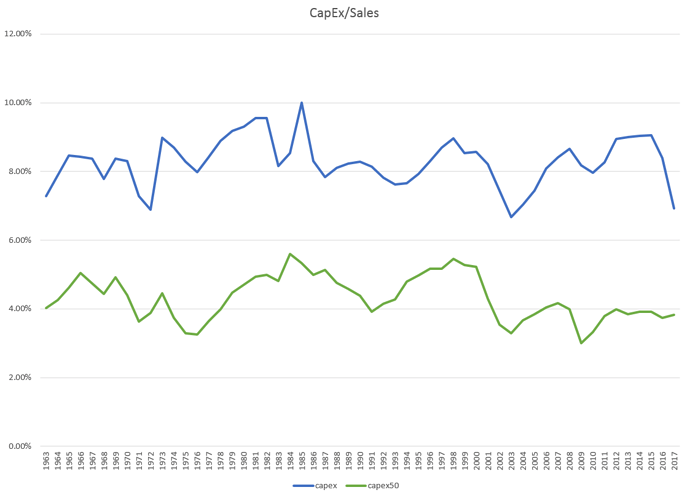

As to your claims about firms investments, I don’t see that in the data either. Looking at capital expenditures as a proportion of revenues:

Again, it’s hard to see any evidence of firms “slashing” their capex budgets in the aggregate. Of course some firms will be doing so, just like some firms will be engaging in much greater CapEx spending. But the aggregate picture here is definitely not one of overall decreases in CapEx.

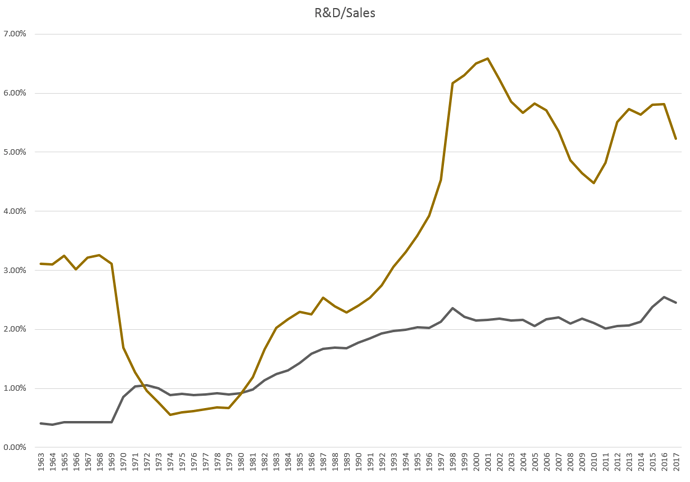

Finally, there’s absolutely no evidence of an aggregate decline in R&D spending:

I didn’t try to create a non-high tech sample, because I don’t think there’s a great way to do that just based on SIC-based industry classification. But again, the aggregate US population of firms is investing far more in R&D than they ever have.

So I look at all these performance measures and I’m just completely unclear where you come up with the conclusions that:

- profit margins are unsustainably high

- firms are slashing capex or R&D spending

My best guess is that equity returns in the next 10 years or so will be in the 4-7% range. On a nominal basis, that’s lower than the historical average. But given current discount rates, it’s still a perfectly reasonable equity premium.

Good post. I’ll be looking at it carefully as soon as I’m able. I appreciate that you know what you’re talking about and showed your work as much as you did.

Most of my perception is based on (anecdotal but for a rather large sample size) what I’ve been seeing happen around corporate culture during my time in the work force. I actually think there could be some really interesting insights to be gained by trying to figure out how your data and mine can both be correct. The overlap might be a really interesting filter on both perceptions.

Thanks, SC–good post