Your pony too slow. He’s already done that

So accurate.

I have very little sympathy for employees who get screwed in young startups who were banking on a big stock payout. You need to treat those shares like they’re worthless. negotiate for salary unless you’re at a large series C company and really believe in it. Hell, maybe they did. The idea seems terrible to me though.

Team zero sympathy. A minimal amount of due diligence makes it obvious the company has zero path to making money.

lol that Adam guy is a grifter genius. Makes guys like Hannity and Tucker look like small time chumps. Sad!

I liked this one better. There’s still a problem with

The marketplace stepped in. The mandatory disclosure that the SEC requires in the form of S-1. The autopsy here will reflect death by S-1. Then, media and academics read the S-1 and started applying this incredibly prescient competence called math. Essentially what happened is that the employees of We who didn’t get a chance to sell, SoftBank, and some other institutional investors have lost $47 billion. Had this consensual hallucination gone on for 60 more days, retail investors would have experienced that loss. So this is a good thing! This is the markets working. Whereas Uber, the consensual hallucination continues. They have to maintain the illusion of growth. They have to maintain the growth story. Without the growth story, they’re worth 20 percent of what they’re worth now. I think that chops off 50 to 80 percent in the next 25 months. WeWork can start from zero. If they act crisply enough, it can still be a nice, cute office-sharing company. Uber has to maintain the hallucination. Uber has to keep chasing that eight ball.

Two problems here:

-

No one lost $47 billion. Retail investors would not have lost $47 billion if the IPO closed and the company went bankrupt the next day. It was only a $1 billion offering! Can’t brag about your “incredibly prescient competence called math” and then go on to make ridiculous calculation mistakes like that in the immediately succeeding sentences.

-

The consensual hallucination theory is a serious epicycle. If WeWork and Uber are both basically the same fraud, why did the market correctly refuse to buy one while continuing to give the other a significant value. “Sometimes the markets hallucinate and sometimes they don’t” is pretty unsatisfying.

Because Uber is clearly presented better. Wework was ran by a serial con artist with gobs of conflicts of interest just sprayed all over the IPO. I’m amazed he isnt in jail.

There are a lot of fair comparisons to make about the two companies’ business models.

If we ever get really good batteries the whole concept of a power grid might barely even make sense anymore. Solar creates a shitload of power, the trouble is what you do when the sun isn’t out. If you introduced cheap long lived batteries you could save a lot of money on maintaining the grid.

Initially read “flashlight” as “fleshlight”, which really should have been somewhere on that list.

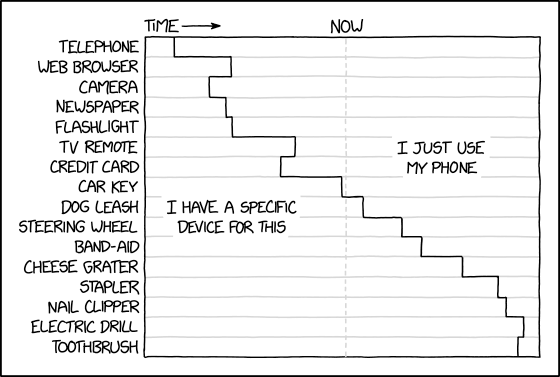

Revenue from dedicated cameras is probably at a high point because they’re all very high-end now. The actual trends are that high-end cameras have grown at a slow and steady pace. In the meantime, the product of “cheap electronic device that can take acceptable selfies” was created and then universally adopted. The action in the chart is that that category was formerly a “camera” and then became a “phone,” but that’s just categorization. The business isn’t different.

This article is a basic introductory to how Private Equity firms pillage and often destroy healthy companies. If you don’t know much about how they work it does a good job covering the basics.

PEs are a blight as they epitomize the money sucking middle man who creates nothing of value. There are exceptions but not many. My biggest peeve is their ability to buy companies with a tiny amount of their own capital and loading down the purchased company with massive debt. That should not be a thing.

Article is terrible.

- Somebody made a profitable trade.

- ?

- Conspiracy!

That reporting is exactly the kind of thing that makes me mistrust the media.

Lone Bitcoin Whale Likely Fueled 2017 Price Surge, Study Says

I gotta say, wash trading being easy in a ‘digital currency’ that was worth roughly a penny just a few years before is a pretty big bug in the system. I’ve felt for a while that given the power consumption requirements of crypto the juice (practical applications) wasn’t worth the squeeze at a fundamental level… and this article isn’t even alleging that it was primarily wash trading.

I’m not saying that if you’re a huge crypto believer and you own a bunch of it that you should sell it… but I’d definitely make sure you aren’t holding so much of it that it going to zero would really hurt you.

To be clear I’ve felt the technology was probably pretty useful since I first heard about it, but I’m nowhere near as certain that currency (although I’d argue that crypto is more like digital gold/diamonds in practice than a currency) is the best application of the technology. I think it’s best applications are things like identity verification, and owning your own personal credit/data, where the transactions are by definition pretty large and validation is mega important (and where the current methods leave a lot to be desired).