Seems like a topic worth excising, as I’d be interested in continuing this discussion. Particularly interested in condo vs house/townhouse as I’ve only heard bad things about owning a condo

Well if you get the timing wrong every time, yes it’s better to just buy and hold. (1) Investing with better timing >>> (2) investing with a continuous buy and hold strategy > (3) randomly reallocating large chunks of your portfolio >>> (4) buying only at market peaks. The article is saying that 2>3 by using 2>>>4 as an example, which exaggerates the effect of bad timing and ignores the potential for 1.

Not as bad as you would think when you consider that Wall Street brain geniuses aren’t trying to maximize long term returns, they’re trying to maximize the odds of short term returns in order to capture commissions with the risk of catastrophic loss ignored because they’re not personally exposed to the downside risk. I don’t think any WS brain genius would tell you they’re still piling into equities because they believe they’re fairly priced.

That’s not what the article says. “Bob” (from the article, not SUB) finished 50% behind what he would have had by continuously buying. SUB should absolutely not invest if he was sure he would be getting it all in at the peak like Bob. Of course knowing is the hard part, but if he’s as confident as he seems it’s a bad play to get his money in now. It’s worth noting that if he felt like this over a year ago, he wouldn’t have missed anything yet, so missing out on the current market isn’t as bad of a mistake as missing out from 2010-2015. Also worth noting that even if SUB would be better off with a continuous buy and hold strategy, that’s not the same thing as buying in with a large chunk of cash now.

I kid you not I’ve seen people posting this same sentiment since 2011. They have plenty of “dry powder” but already missed out on a double up. (Or whatever the market went up since then.)

Looks like today could be another wild one.

I think the Fedex cutting off Amazon story is super interesting… But I’m in logistics so of course I do lol.

Again, I’m not saying that there aren’t plenty of situations where buying a house is better or even much better than renting. There are. Of course. But if someone is reluctant to buy a house but feels pressure to do so because it’s “that time” in his life, well, that’s when it’s worth bringing up all the drawbacks to homeownership, particularly in terms of an investment. A house’s lack of liquidity, mediocre and uncertain return and very high transaction costs are all well worth considering if you’re reluctant to buy a house but feel like it’s the time in your life to do so. Buying a house is fine but not buying a house is also fine.

I’m in the same boat. Recently came into enough cash for a down payment on a decent condo in So. Cal. and the mortgage would be less than my rent. My strategy–gonna lease a place on the beach for the next year or two, live well, and buy at the better time. It’s a “risk” but one that I think makes sense atm.

I’ll still have the “down payment” to invest, but it will probably be earning 2%. I’m afraid of equities for at least another year (I may get into the market after the great bro-exodus following Warren’s election). What I took from that article, which is solid and I plan to reread, is that I’ll probably put like 10-20k in gold, cause why not. Maybe I can buy gold Trump coins from a 1-800 number of Fox (kidding, I’d buy ity however one buys gold). Really, my income fluctuates the most with how hard I work, and I should work harder than I do to increase my income, which is part of my plan.

I strongly recommend basically everything by Dalio. Guy seems to be going through a major ‘help humanity’ phase probably brought on by feeling a bit guilty for being worth 18B lol. Principles is really good and his book about debt crises is amazing as well. His video about how the economic machine works is probably the best 30 minute econ primer I’ve ever seen as well.

Him and Warren Buffett are definitely major influences for me business wise. There are others, but they are probably the two biggest. It’s ridiculous how much you can learn about how to do capitalism from reading WB’s shareholder letters from start to finish.

I was into reading about investing a lot like 15 years ago and read things like Benjamin Graham, Random Walk Down Wall Street, stuff on Buffett’s philosophies, even a finance textbook. I feel like a guy who’s read like six 2p2 books but rarely sat at a poker table. Everything I read back in the day and after the crash and my general experience with things like real estate in So. Cal. is making me think “cash”. But as that article points out, cash will continue to decline in value. The other option would be to do real research and stuff, but I’d make a far better and more consistent return spending that time just doing my job, which is basically hourly (have own small patent/litigation law firm). Will definitely watch that video and hopefully read Dalio’s book (already had the URL linked in the article open in another window for downloading).

It’s interesting to me how much Dalio’s perspective from that article is consistent on a superficial review with Soros’ theory of reflexivity. I was like two chapters into the Alchemy of Finance like a year ago, but I think it disappeared under my bed. I should find it.

I’ve done a lot more investing than you, but I’m absolutely in the same boat. I make more money when I work harder than I would make investing the money I already have… and it isn’t close.

Dalio’s books are all hilariously free through a smart phone app. The guy really doesn’t need the money. He was offering to give an equivalent amount to charity if you bought the book when Principles first came out. I’m basically 100% certain that Principles will be standard reading for every MBA program in the country within 10 years. It’s that good. Very very helpful for guys like us who own businesses too.

I’m going to be posting a lot on this site until the freight recession ends though lol. A whole lot of trucking companies need to bust before things go back to normal in my office. Still making money, but it’s like 65% of last year on 35% of the work.

Free on iPhone, https://www.principles.com/ says it’s coming soon to Android. I think I’ll just buy it on Kindle.

I don’t understand the logistics things. I know tons of stuff is shipping, but it seems like Amazon has been using some fly by night delivery services who have too-low wage workers, which seems shady. Don’t know anything about shipping in general, though know Buffett thought it was a good idea to buy railroads and was almost certainly correct. I told my mom to buy Berkshire in like 2002, but I don’t think she ever did.

I just buy the market with low cost index finds and accept whatever it gives. Most people who try to do better don’t. And I barely have to exert any effort at all to follow my plan. No research, no advisers, and you can read everything you need to know in an afternoon.

AFAIK they’re running their own delivery service using the Uber/Lyft type model where anyone can sign up to be a delivery driver.

BTW, Charlie Munger has an interesting 27 page article on the Psychology of Human Misjudgement that I’ve been meaning to read. (Link looks dicey but it’s legit.)

And here’s a link to a free pdf of Dalio’s Debt Crisis book (480 pages).

But really, I just want to short Herbalife.

And then once you just accept this philosophy it’s actually fairly liberating. I stress way less now about market fluctuations now that I’ve committed to this strategy than when I was actively thinking OK when should I get out of stocks? Should I go 100% bonds? 100% cash? 50% bonds 50% stock? blah blah blah.

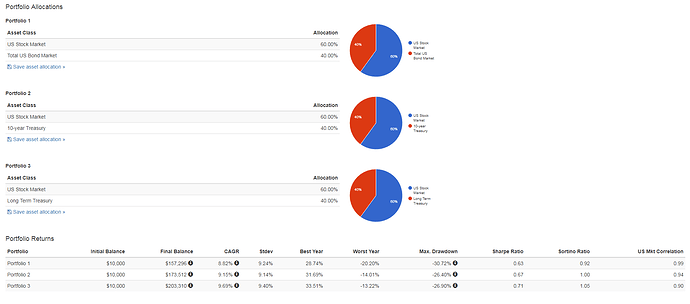

Once I retire or semi-retire I’ll probably move to like 40% US equities 10% REITs 20% foreign equities and 30% long US treasuries. Long bonds are obviously more volatile than shorter term bonds, but in this case that’s actually a benefit. Holding all government bonds is way better than a total bond market fund, because only government bonds tend to be anti-correlated to equities. That is, when a stock tanks its corporate bonds will also tend to tank, while government bonds tend to go up when the stock market tanks. And that’s where the increased volatility of long bonds comes in – the longer the duration the bond, the more it will tend to go up when the stock market crashes. And then long bonds tend to have higher yields than shorter duration bonds, so you get a double benefit.

Here’s a quick backtest demonstrating the benefits of long government bonds. It’s a little biased because it involves a long-term interest rate decrease from 1987-now.

I read a book, Stocks for the Long Run, that had the buy and hold philosophy and demonstrated, if I remember correctly, that it was the best long term strategy. Thing is, I’m not gonna jump into the market now with real cash when I’m still awaiting the Trumpocalypse. If I invest in anything in the next 6 months it will probably be ammo, freeze dried food, and like aluminium ingots.

Yeah there’s nothing wrong with dollar cost averaging for the typical worker saving for retirement. It’s a bit different for people in my situation who don’t have a consistent income.

With regard to trucking there was a new regulation mandating electronic logging devices in trucks that went into effect in mid december 2017. The result was a supply crunch going into what turned out to be very high demand in 2018. Trucking rates went BONKERS. If you owned a truck from January 2018-August 2018 you averaged 6k a week in NET profit for that entire period or you did something very wrong.

Obviously those conditions made it make a lot of sense for trucking companies to be in pedal to the metal expansion mode (which hilariously they were already in because 2017 had been a pretty good year) which drove up the price of equipment and drivers, which everyone happily paid because the money was great.

Eventually the expansion of trucking capacity finally brought the market back into something like balance in September-October 2018 and prices have basically been falling ever since… but things didn’t get really bad until the start of 2Q 2019.

Normally the 2-3rd quarter of the year are the busy season in trucking. This year rates were 40-60% lower than last year depending on region and equipment type. Granted last years rates were crazy, but not crazy enough to make 40-60% lower work. Demand was only off a little from last year, but supply was way up… and that coupled with demand being off (my guess is tariffs played a major role with demand being juiced by people importing stuff to get ahead of the tariffs in 2018 and slowing WAY down in 2019) resulted in the absolutely collapse in spot market prices. When you combined this collapse in rates with the increased costs paid to drivers and equipment last year you have the perfect conditions for a huge die off. So far there have been a few major trucking companies that closed and thousands of smaller spot market carriers.

I’ve had a rough 2019… mostly because while I expected it to not be as good as 2018 (which would have been pretty hard tbh… 2018 was crazy) I didn’t expect the glut to be so dramatic.

I’m a freight broker, so I experienced the recession mainly as having a lot less volume and much better margins on a per load basis. Definitely a weird year. Still fine, still easily paying bills, but I did have to cut my assistant and my wife is going out and getting a job as a nurse again (although this is mainly for health insurance). I also had to completely rethink what type of customers I oriented my business around. Overall it’s been pretty crazy.

I am in the same situation and just plopped my money into some 50/50 solid stock/bonds low risk fund.

This one:

All my money is in Vanguard Life Strategy funds. I sleep well.