Pretty much this. The “economy” is pretty good but things people actually give a shit about like housing/rent prices, health care/insurance and the like is either still a mess or becoming a mess and Biden hasn’t done fuck all about it besides restart student loans.

And btw, this is difference between Trump and normal loser politicians.

If he wins then suddenly on January 21, 2025 we will have the greatest economy ever! Leave no doubt about that.

Booming stock market, record home prices! Everybody take out a home equity loan and buy a boat …… because we are winning, winning and we are not going to stop!

Oh, well that fucking makes a ton of difference. I thought I must have been way off, but over 1000 properties is ludicrous. A big problem is those investors who are buying 10-20 homes and turning them into rental farms.

Same, im paying roughly 30% less because ive been renting in the same place for 5 years

It’s super important to actually talk about the massive things the Biden administration has done for student loans. Leaving it like this is absurd, and misses the very real wins they got student borrowers even not counting the massive forgiveness SCOTUS screwed them out of.

Do you think the general public’s perception is that Biden has done “massive” things for student loans?

My guess is that even amongst Dems the answer is no.

It’s classic EDem nonsense to tout nibbling around the edges as MASSIVE WINS.

except it’s not.

https://x.com/Redfin/status/1734988876794712111?s=20

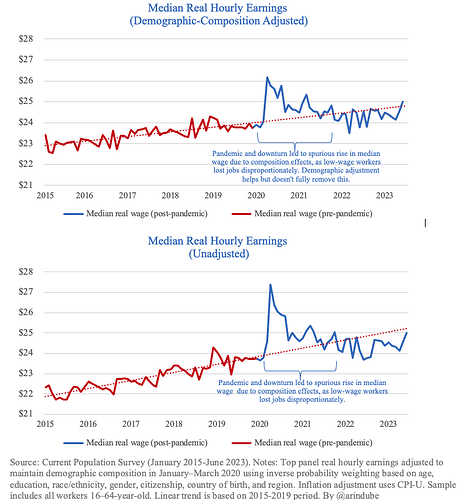

Working class and service industry wages are up. Buying power is up. Gas prices are down, grocery prices are down.

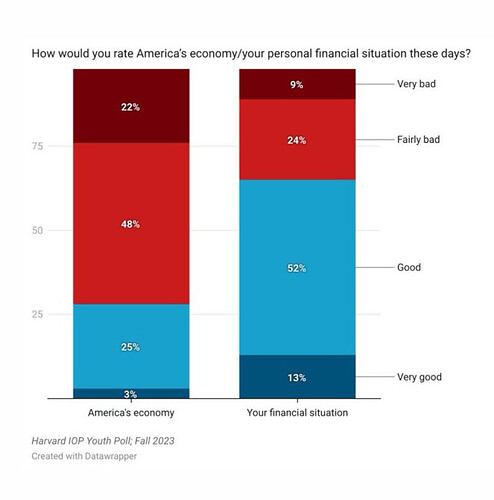

Here’s the graph that tells the real story of the vibecession:

Poll s show big gaps between how people report themselves doing, and how they think “the US economy,” is doing. They believe this due to outside info/the media.

Perhaps people don’t know about it… but the changes aren’t nibbling at the edges.

Changes by the Biden admin in things like the SAVE plan, how interest is forgiven and actually running PSLF as a program to try to get loans forgiven are massive positives. I’m greatly benefitting from these changes personally.

What does “buying power is up” mean, specifically?

And working class wages are up - do they tend to fall year over year?

And gas prices and grocery prices are down - from when? A year ago? Ok I’d buy that. How about from 4 years ago?

I’m not being confrontational. I truly want to understand what’s being said here and how it is relevant

all i’ve learned from this discussion is that everyone needs to move to the flyover middle of the country… i pay less than 800 dollars a month everything included and it hasn’t gone up in three years…

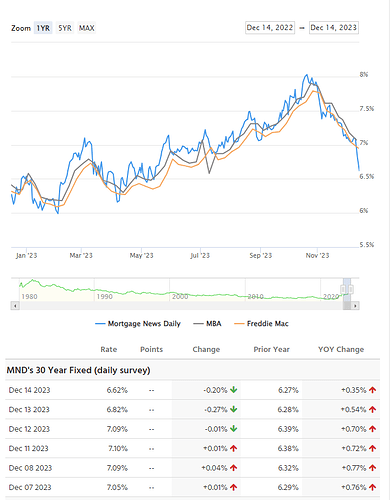

Mortgage rates are going to come down most likely in the next year right?

Admittedly my understanding of mortgage rates is fed goes up fed goes down but still

Yeah, they are coming down as we speak. Yet again, old man Biden is going to peak at just the right time:

But then my Dad’s meager savings account (he’s too scared to buy stonks) will produce less interest. Pretty out of touch of you to not care about my Dad at all.

The same general public that is way better off economically than they think they are.

At the last meeting, Fed indicated ~0.75% rate drop by the end of 2024. Rates were already on the decline from October highs of 8% and combined with that news from the Fed, people are seeing ~6.6%. I use this site for general rate data. Seems pretty good without having to sign up for something 30 Year Fixed Mortgage Rates - National Average

I think one of the things that explains how people feel about this Economic period is that most of the gains have been felt on the lower end of the wealth and income pyramid.

If you take someone who was making $35,000 in 2018 and now are making $10k more in wages even after adjusting for inflation, they might be able to afford a few more things or take on less debt to support their lifestyle, but they still feel in an incredibly fragile economic position. They are still some combination of: Paying off student loans, unable to save for things like a house down payment, retirement, and still feel like one injury or layoff is the difference between them and economic disaster.