supply impacted sure, but what about demand?

Will be bad obviously for the foreseeable future. 24$ oil is going to shut off a huge amount of the worlds production though.

Wouldn’t an other way of saying this be that their economic worth is in the ratio of the PV of their future earnings to their future expenses? Or this portion of their net worth is really: X = PV of future earnings - PV of future expenses.

Which is why I’m saying it’s better to freeze loans/mortgages/rent rather than just give UBI or unemployment.

Everyone’s numbers to get plugged in are different, so rather than trying to adjust for needs/means, let’s do our best to pause it all.

Yeah, and you can do this in a semi-free-market way that should be effective. Tell manufacturers that if they shift to ventilators, masks, etc, the US government will buy it all at a 10% (or whatever is a standard in manufacturing, 8%? 5%) profit margin for them, knowing that if we end up with too much, we can then loan it to other countries that can’t afford it or sell it at cost to countries that can, and then put it back in storage after.

Oil almost has to go up long term, but I’m not sure about being in a 3x etf because of the cost of holding it for the amount of time it’ll take to recover. Don’t know a ton about that ratio, but I wouldn’t feel comfortable making a large bet on oil going up in the next couple months. Could easily be 6 months or more imo…

FWIW my Dad retired last year from a company that makes and repairs equipment used in a refinery. He talked to his old boss the other day and asked if business was still coming in. He said not at the moment, but they should get some, because oil companies are buying tons of crude at these prices to refine and store until prices go back up. So the US oil industry is making the same bet you are, FWIW… Long term I like it, short-term the leverage costs would be worth weighing and I don’t know enough to do that myself.

Anyone know how to calculate/predict future inflation based on government spending and the deficit?

Put another way: if we print $2.5 trillion for UBI in the next 18 months, how much are we going to devalue the USD?

Follow up: what’s the best hedge? The stuff I’d normally think of is not responding the way I’d expect and/or risks major issues if there is a liquidity crunch.

Absolutely no one knows. This was the big issue in 2008ish when seriously respected economists were yelling about how government spending/quantitative easing would lead to skyrocketing inflation. And that wasn’t an entirely groundless belief - it’s basically Milton Friedman’s statement that inflation is always, and everywhere, a monetary phenomenon. But, for reasons that Paul Krugman laid out very well, those economists were totally wrong. With hindsight, we should have had substantially more fiscal stimulus and we could have done so without significant inflation pressure.

Now people are singing the same song about “muh inflation”, as if they haven’t learned anything at all.

To be clear, I’m not sure what’s going to happen with inflation as a function of government spending and deficits, but I’m super confident that no one else does either.

On an emotional level, I agree. From a personal decision making process, I think having at least 6 months living expenses is important. I have 12, plus I can liquidate my bankroll into living expenses if it comes down to necessity. Ultimately if the indexes drop like 90%, we’re so fucked that I’m not sure it will matter much the degree to which you’re prepared for a depression, we’re all fucked. I guess it’s better to be prepared than not, but I think there are also risks of keeping everything on the sideline, such as watching inflation ravage your savings.

This is also very different from past economic crises, it’s hard to make comparisons and predict, but I think it’s more like 9/11, our economy should roar back to life quickly afterwards if we manage to keep everyone afloat, because there isn’t an underlying problem.

This is the part where EVERYONE starts to panic and I start thinking about when to re-enter. You gotta zig when the masses zag imo. But don’t zig too soon before they zag.

Read the document I posted. At least there’s a baseline of a MFing plan. That makes me a feel a little better. Very likely this lock down will work enough that we can re-open things in like 3 months. With luck there will also be a summer pause and happy days are here again and there was much rejoicing.

Just be prepared for the lockdown cycle probably combined with colder temps 3 months after that. We could also have new treatments and better suppression methods for the spread by then.

Also if hospitals get overwhelmed, which they almost certainly will in some places, I predict there will be more panic selling in the meantime. Only then will it really hit home for the low-info dipshits who are still holding out hope this is secretly just the flu. Once everyone panics, then it could bottom.

Or that could trigger some other financial catastrophe.

To be clear I’m not advocating against those measures to help people who need it because of what it could do to me, I’m just trying to have a hedge.

We did about $1T in stimulus in 2008-09 right? Plus all the bailouts/loans, but those function a little differently. That corresponds to about $1.2T now.

Looks like inflation peaked around 5-6% back then, so even if we spend twice as much we’re looking at maybe 10-12%. But I guess there’s a chance there’s just a tipping point where it goes off a cliff and we get hyperinflation?

Wut

There’s a chance Italy has flattened its curve, China is starting to get back to normal to the best of our knowledge - by which I mean their economy seems functional.

Tons of uncertainty but there is enough info out there to argue WAAF or WAAGTBF (going to be fine), economically speaking.

The more sure someone is about what’s going to happen the less you should listen to them. We’re in uncharted waters.

Looking at historical inflation charts, our inflation rate peaked at like 5.5-6% in 2008. We saw deflation in 2009, then went positive again and we’ve been at 0-4% since.

So I’m saying if we deficit spend twice as much this time as we did then, isn’t twice the rate of inflation a reasonable guess? Maybe not, because that impacts the numerator and we don’t know the denominator. Realistically the denominator should be like total US Dollars in the economy, right?

So if we spend $2.5 trillion and the GDP is 20 trillion, that’s 12.5%.

This seems as reasonable of a ballpark worst case estimate as any, right?

The reason I’m trying to figure this out, roughly, is so that I can evaluate how much risk I’m taking with my savings and how much I should try to hedge.

Banks getting absolutely slaughtered

The more sure someone is about what’s going to happen the less you should listen to them. We’re in uncharted waters.

This is actually pretty accurate in the best of times. Bombastic self assurance is persuasive because of the emotional appeal, but the track record of bombastic self assured predictions is abysmal. The smartest people with the best insights are always questioning, questioning, questioning.

True. But we know China is back to work in some places. Key will be watching Italy and see how that goes for them. Rome didn’t get hit very hard. So they could try some things there with basically limiting travel from Lombardy or who knows.

Also if we aren’t planning to implement S. Korea plan once we lift this stuff and studying the shit out of Japan right now I’ll be super disappointed. At least Donnie Dipshit seems to understand he needs to defer to the experts - for now. One fear is the summer pause sends him back into magical thinking mode.

Another fear is our lock down isn’t strict enough and we can’t get to the re-open point for a lot longer than 3 months.

All the spending was after the fall of 2008, which was when inflation cratered.

Looking at historical inflation charts, our inflation rate peaked at like 5.5-6% in 2008. We saw deflation in 2009, then went positive again and we’ve been at 0-4% since.

So I’m saying if we deficit spend twice as much this time as we did then, isn’t twice the rate of inflation a reasonable guess? Maybe not, because that impacts the numerator and we don’t know the denominator. Realistically the denominator should be like total US Dollars in the economy, right?

So if we spend $2.5 trillion and the GDP is 20 trillion, that’s 12.5%.

This seems as reasonable of a ballpark worst case estimate as any, right?

The reason I’m trying to figure this out, roughly, is so that I can evaluate how much risk I’m taking with my savings and how much I should try to hedge.

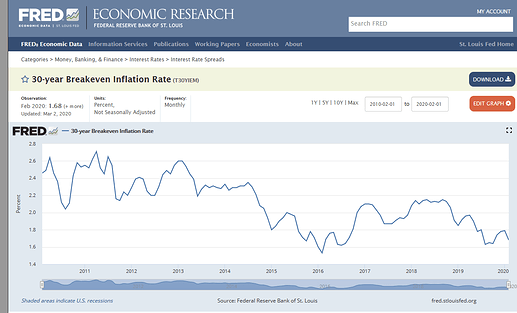

It’s totally understandable that you’d want to know what future inflation will be. But there’s no linear rule that you can use to say that deficits*beta = expected inflation. As you implied, we’ve been running huge deficits for the last 10 years with virtually no inflation. And if you look at inflation-protected treasuries (TIPS), even the 30 years have absolutely no expectation of serious inflation built in:

No one knows anything.

There’s a chance Italy has flattened its curve, China is starting to get back to normal to the best of our knowledge - by which I mean their economy seems functional.

Tons of uncertainty but there is enough info out there to argue WAAF or WAAGTBF (going to be fine), economically speaking.

Even if they haven’t flattened yet, their lockdown is so restrictive it has to come soon. That report says to expect 2 weeks I believe.