“And, while most historians are focused on DeepFuckingValue as an important thought leader, Thicc_Dads_Club’s contributions are often overlooked, leading to…”

I’m a little confused about the “they” and “them” here. Here’s my brief understanding:

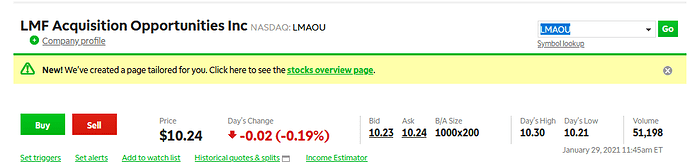

LMF Acquisition Opportunties is the company that just raised $100 million in an offering.

That offering distributed units of LMAOU, which is a bundle of one share of common stock and one warrant (with an exercise price of $11.50).

The common shares will trade as LMAO and the warrants will trade as LMAOW. Neither of those are trading individually yet, so the only thing you can trade is the combined bundle.

LMFAO Sponsor, an LLC, owns 20% of Class B common shares of LMF Acquisition Opportunities, which will convert to Class A common shares. So it seems reasonable that LMFAO Sponsor would be worth at least 20% of the value of the LMF common shares they hold, less any debt they hold.

One big issue is that LMFAO Sponsor is not wholly-owned by LM Funding America (publicly traded LMFA stock). When you look at the ownership interests in LMFAO Sponsor, you’re just told that LMFA is the sole manager, not the sole owner. And that the LMFA CEO and CFO both have “membership” interests in LMFAO Sponsor (the entity that owns 20% of the LMFAO entity). Digging deeper, a recent filing shows that the CEO and CFO each own 12.5% of LMFAO Sponsor personally. So now, even if you think that LMFA should be valued based on their proportionate ownership share of LMFAO, you’ve got to make sure that you’re looking at LMFA’s ownership (75% of 20%), and not include the CEO and CFO’s shares.

The second big issue is that LMFA appears to be a terrible, money-losing firm, having lost $2.75 million in the 3 months ending 9/30/20, and losing $3.74 million in the 9 months ending 9/30/20. So even if you think there’s value in LMFA’s 15% ownership in LMFAO, that value is still attached to a turd of a company.

This all seems like an enormous and obvious scam, filled with opaque related party transactions and obvious conflicts of interest. Obviously it’s going to moon.

Scam+Terrible underlying company?

BULLISH

So can we actually buy LMAO? And if so, how?

I read that whole damn Michael Lewis book and I still don’t understand HFT.

There is a difference between:

- Citadel buys, from Robinhood, the right to fill StonkNazi420’s market order for 100 shares. It then buys 100 shares for $99 each and sells them to StonkNazi420 for $100 each.

and

- Citadel sees the order first because their computers are the fastest, then buys the shares at market and sells them to StonkNazi for slightly more.

Are they doing 1, 2 or both? Is either illegal?

Such a good rule for living: before you’re a prick about something, be really really sure you’re not wrong.

Not yet I don’t think. It goes public soon from what I understand.

OK, I signed up for Ameritrade so I can be a cool guy like you all. I bought some NOK, some AMC, and some CLVS. Let’s goooo!

Right now, you can buy units of LMAOU, which is a unit of LMAO stock AND a warrant to buy a share of LMAO stock. If you were excited about being able to buy LMAO on its own, how can you pass up the bundle?

“Is a  Just a

Just a  ? Perspectives on phallocentrism in the early GME tout period”

? Perspectives on phallocentrism in the early GME tout period”

Talk to me like I’m 5. I currently have $500 worth of LMFA (more like $400 now). I click sell on that, and then what do I type into the search box on robinhood and click buy on to do what you are saying?

I’ve been working in trading for 9 years and I honestly don’t really know what they actually do, if they do one or the other or both, or the legality of each of these distinctions.

Maybe this is right also but there is basically zero volume on this ticker and doesn’t appear on the two brokers I have access to.

it’s meme STONKS world and we are just living in it.

Currently own shares in AMC, EXPR, NOK, and SNDL. Have been making money on these shares selling covered calls against them too.Not sure I’m getting to the moon but it’s been a pretty profitable week of trading.

I am completely out of NAKD now.

Yes, obviously.

I don’t know about Robinhood, but in TD Ameritrade I type in the ticker LMAOU and it pops up like any other stock. (Please don’t buy this.)

Not huge volume, but it shows up on TDA for me with a reasonable spread and about $500k of volume.

a headphones company that is heavily shorted so it’s

like most of them except clovis.

like most of them except clovis.

Etrade has it.

They’re not doing either. They have an inventory of XYZ, which is on the exchange for 101/99. When some mope shows up wanting to buy XYZ, they sell it to him for 100.5. When a mope wants to sell XYZ, they give him 99.5. They make a dollar for each share they turn around that way.

All the HFT stuff has to do with the fact that sometimes people who aren’t mopes want want to sell XYZ, because they know that XYZ is actually only worth 90. If you pay them 99.5, or even 99, then you get killed. But the whole point of Robinhood is that no one who knows anything would ever trade from there, so it’s pure mopery, which makes it valuable.