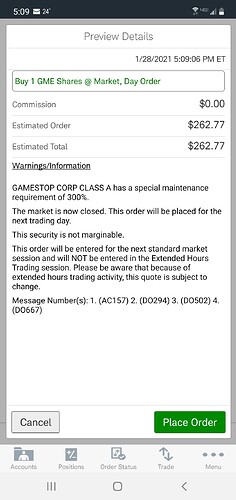

That’s bizarre. I just did the same thing at TD Ameritrade. (Sweating profusely to make sure I didn’t actually execute the purchase.) I just got a message saying it has a 100% margin requirement.

If they are actually requiring 300% margin requirements on long positions, they are effectively banning it or severely limiting it but trying to avoid the heat of outright banning it.

100% makes sense the way it’s trading.

Your margin/buying also increases as the value of your shares go up. So if you bought like $10k shares at $20 a share, as the price increases you can buy more shares. Assuming they kept using all their buying power on the way up, it would have been easy to get $1 million in buying power, even with a small initial deposit.

But then if price drops, or margin requirement increases, you will have to sell a good portion of your holdings.

I thought I read somewhere that they were already out early today.

certainly some did but they couldn’t have all gotten out

Oh, I wonder if it’s because you’re placing a market order, where they can’t guarantee that it’s going to execute at a price for which you have sufficient equity.

FD GME calls/puts here I come!

I believe it was @anon3530961 upthread that was devising this MEME index portfolio based on 3rd party sentiment analysis.

Wait, so you’re telling me the amount of credit they extend you is just a function of the value of your portfolio? Holy fuck that is a stupid system.

Wait do I have to like that misogynistic piece of shit Dave Portnoy now?

https://twitter.com/NewYorkStateAG/status/1354917642507866114?s=20

(not sure if this is for allowing selling, or not allowing selling. Assume the latter because I’m still naive)

I bought 2k worth of CCIV shares and then took a nap. I woke up and saw it was down 2% from where I bought and I am so used to buying short dated options I initially thought I lost tons of money. When I realized I was down $40 I was so happy. Shares ftw lol.

47th president of the united state of america misogynistic pierce of shit Dave Portnoy for you sir.

It’s the same warning for limit orders. I’m assuming it’s just an unclear warning message and long positions are 100% and shorts positions are 300%.

It’s the way most secured loans work - the amount of the loan is contingent on the value of the underlying security. Problem is when the underlying security’s value is very volatile or overvalued.

Same thing that happened in housing crash - as home values went up people were able to use the increased value to increase the amount of their loan against the house, so when prices crashed, people that had initially taken out loans they could afford, now had loans they couldn’t afford and were worth more than the house.

Presumably for not allowing buying.