We are getting close. 1B market cap.

Fidelity all kinds of fucked up this morning.

CLVS below 9 again and falling off a cliff, lol

We tried. I’m gonna keep holding for the memes

VIX -20% LOLLLLLLLLLLLLLLLLLLLLLLLLL

Have zero skin in the game but this is crazy

Living history again.

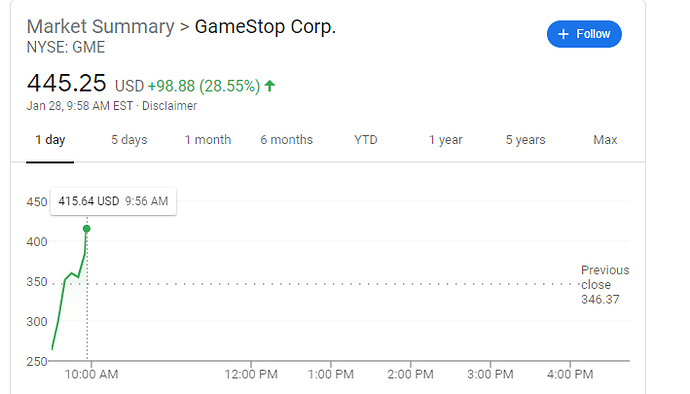

Already up another 10% since you posted this lol

Edit: not anymore

GME wow. Nice try rh.

WE

LIKE

THE

STOCK

Dumped my BB now I’m ALL IN on the CLVS dream

It takes a long time to unwind a business that large. I have worked on some much smaller businesses that went away and it can take years to wrap things up.

Plus Blockbuster still has manageable assets.

Not sure how it remains listed unless delisting is only for egregious situations, that I don’t know.

So this is true and it’s hilarious. A big PE fund entered into a complicated deal in 2018 with AMC that created these bonds, which originally had a conversion price of $18.95. But there was some complicated reset mechanic whereby the price got lowered down to $14.50, and the shadowy Chinese entity that controls AMC got diluted because of COVID. So at the end of that, Silver Lake is carrying a huge loss on this investment because AMC is teetering on the edge of bankruptcy.

Then the WSB fools bid up the price of AMC to a price where the conversion right is in the money. Now, @spidercrab will tell you how you should almost never exercise an option prior to maturity, because it’s always better to wait til expiry and sell the option if you need the cash. That’s even more true in this case. This is the rare exception where no one with $600 million would be willing to pay anything for the option, and the only suckers are at retail. But exercising the option is extremely dangerous, because 44 million shares of AMC are only worth $200 million, and you’re trading a $600 million note to get them. So (I am speculating here, but with high confidence), Silver Lake has been spending the last couple days shorting AMC as hard as it can into the teeth of all the WSB fools. Now it’s short 44 million shares, and it’s theoretically vulnerable to a short squeeze. But… when the brokers call inquiring about how they are going to cover their short position, they can just magic the 44 million shares they need into existence by handing the bonds over to the Company and close out their position.

It looks like Silver Lake actually was not greedy at all here and basically sold at around the amount they needed to make back their original investment. So the end result is that RHers eat $400 million that Silver Lake lost on their AMC investment. Marvelous. The Money Stuff on this is going to be outstanding if it hasn’t already been covered.

I think I have ~10k of BB/AMC/NOK that I’m just going to hold, I think. This feels like it’s more about defending the little guy than it is making a profit at this point. I don’t want to play a role in tanking things for everyone else.

ETA: All three of these at least have plausible recovery/growth scenarios so maybe holding is the right call anyway.

lololololol they probably caused game stop to go even higher with the halt

The trading system is currently unavailable. Please try again later. If you require immediate assistance, please call Schwab at 877-368-8288. (OE9060)

KOOL

CNBC crying for the hedge funds, “they employ lots of people” lololol fuck off buddy

I mean, yeah, every bubble works on the principle that each fool thinks there’s an even greater fool out there he can offload his bad investment to at a profit. So I can see why those people are pissed that the dumb money spigot got turned off while they’re still holding the bag, but…

It’s been 40 min. Why am I not rich (and more centrist)? I’ve been had.

Sold BB - I hate Best Buy anyway! Let’s go CLVS.

Edit- it’s a joke.

You needed to buy 900 worth of options instead of 900 worth of stonk to have any chance lol.