Want to do the Introduction to Computer Science class on EdX? Even better price than your local community college. I’ll do it if you do, we can start a thread. Course starts August 28th.

Yeah I’m in. I’m starting to suspect that not being able to code in 2019 is like not being able to type in 1990. It’s still a thing that applies to some people, but those people’s shelf life is significantly more limited than others.

I’d probably need to research it a little to be sure, but my theory is in the edit above.

Basically Vanguard mostly sells only good investment products.

Fidelity and the others sell the same good products as Vanguard but also a ton of bad products. They make a lot of money off of the bad products. It is also my understanding that they push these more.

But if you use Fidelity in a “Boglehead” way then it really is going to be virtually the same cost as Vanguard.

Similarly you can get a brokerage account at Vanguard and buy a bunch of shitty loaded funds actively managed by another company. Then being at Vanguard doesn’t help you at all.

The bottom line is that whether your account is held at Fidelity or Vanguard is actually of little practical significance. Especially compared to what you invest in. For the stuff you should be investing in, the difference is inconsequential.

That’s a fair point and I will concede that if you just buy Fidelity’s loss leader products you can get fees as low or lower than Vanguard. So my support for Vanguard is more philosophical than anything else. I know enough not to get screwed. But since Vanguard is a more ethical enterprise than Fidelity – it’s almost not possible to get screwed by Vanguard – I choose to do business with them and only them. (except for when I want to fool around with single stocks, they’re terrible at that on purpose).

Maybe, but I’ve not personally seen any evidence of that, or of them pushing anything at all. I suppose they could do this with 401k plan administrators as getting some high cost funds into a 401k plan probably pays off well.

Yeah this is a big one. I’m sure everyone else has found themselves in a situation where none of the 401k options are good but you max it out anyway because of the match.

Not just to the match, either. Even if your options are quite bad (like 1% fees) it’s still better to max out your tax advantaged 401k over saving in a taxable account. Then you can roll it over when you retire or switch jobs.

Yeah especially if you will be in a position to make no tax rollovers from your former 401k into a Roth.

Posting here because of all of the talk in the Trump thread about the markets.

Would love to know more about this sort of stuff. I do have some money that I could be investing, but don’t really feel like getting it into the market right now (see Trump killing 2% off of the DJIA with a single tweetstorm earlier today).

This series of blog posts is a pretty good introduction to investing and the stock market. Very buy and hold index funds standard advice, and very against the sort of market timing you’re doing now.

I have some disagreements with his advice, but it’s minor. He recommends against buying foreign stocks, I have foreign stock as like 30% of my holdings. And I have REITs as 10%. He would just buy VTI and be done with it. Which is fine (and I’m sure he’d say my allocation is also fine).

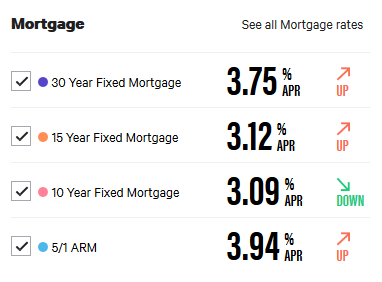

I don’t know about the rest, but trying to sell you on a ARM in the current interest rate environment screams walk out the door to me.

Untrue. It depends on a number of factors. It’s not difficult at all to construct scenarios where an ARM may be a superior choice among the available options. Given what goofy has already told us, it seems unlikely that an ARM would be his best option, but we would need to know much more to dismiss the option entirely.

Questions, as I try to understand the wild world of home financing:

- Does refinancing essentially mean taking out a 2nd mortgage to immediately pay off the balance of your 1st, at improved terms?

Effectively yes, except I wouldn’t use the term 2nd mortgage. 2nd mortgage implies that you’ve got 2 separate mortgages on your property, with the 2nd one being junior to the 1st. (You’ll see people do this when they have relatively little cash available for a down payment - they’ll take out a 1st mortgage for 80% of the property value and a 2nd mortgage for 15%, so that they only have to put down 5% cash.) But yes, you’re paying off your existing loan with the proceeds of a new loan.

Talking to a lender, he explained the advantage of an ARM largely in the framing of, if you’re buying your first house and you might only be there for 10 years, you get the advantage of a lower rate in a 10/1. Should we also be considering that, even if we stay longer than 10 years (which I’d guess is likely, though I obviously can’t see the future), refinancing can keep our rate down relative to wherever rates jump to in the adjustable period?

There are a couple of things going on here:

-

The general idea is that the fixed portion of ARM contracts are typically much lower than the rate on a 30-year conventional mortgage. If you are going to move (and therefore exit the loan) within the fixed portion of the ARM contract, then it’s a no-brainer to take the lower rate ARM. If you do take out an ARM and end up staying well beyond the fixed horizon, at some point you might look back and say “I really wish we had taken out a fixed mortgage.” I like to think of that as insurance, though, because the bad states of the world are usually the ones where you have to move quickly. In my particular case, for example, I was moving here as an untenured professor. If I ended up regretting an ARM after the fact, it would be because I stayed longer than I expected, which means I would have gotten tenure. So my mortgage regret state would be in an otherwise happy state, which seems like pretty good hedging.

-

Can you “fix” an ARM situation by refinancing after the expiration of the fixed period? Maybe? It depends? Probably not? The problem here is that those situations where your ARM has reset to a much higher rate will be the environments where interest rates are generally higher, so it isn’t like you’re going to have a wealth of low-interest refinancing options to escape your high ARM. (I say this, although somehow my ARM adjusted to a 5.1% rate in a world of very low rates. So I’m basically doing now what I said just a few sentences ago you couldn’t do. I think this is an unusual period, though.)

To make sure I’m not misinterpreting, you do still get to deduct your mortgage interest, right?

I haven’t paid a lot of attention to this because under the new tax law I didn’t itemize last year, and I don’t know if I will this year. (My mortgage is less than half yours.) But yes, with caveats. Some googling around indicates that if you refinance, you can continue to deduct your mortgage interest on the new loan, but maybe not completely if you increase the mortgage. For example, I’m refinancing a roughly $310k mortgage with a $370k loan. I can deduct interest on the new loan, but only based on the original $310k amount at the new rate, not on the full $370k loan. [A clarification: this depends on what you use the cash out money for. If you use it to improve the value of the home, which we plan on doing, the full amount is deductible.]

does the deduction limit apply to the original size of the loan, or the remaining balance? (i.e. once I pay off enough of the mortgage to be under $750k of principal, do I get the full deduction at that point?)

You can deduct interest on the first $750k of debt. So if the loan is bigger than that, you’ll only get deduction for the first $750k worth. As time goes by and the balance drops below $750k, you’ll get the full deduction.

As far as NhlNut’s comment, I don’t know how accurate these are, but here’s current bankrate info:

If you’re choosing between a 30-year fixed and the 5/1 ARM, it’s pretty hard to justify the ARM.

The best numbers I’ve been quoted are 3.25% for 30 year fixed (or a little lower w/ points), 2.625% for 10/1 ARM

Jesus, these are both really sexy numbers. I thought my 3.625% was sweet action, but I guess absolutely nailing the bottom is too much to hope for.

My new Apple Card arrived. It was pitched as being financed by Apple, not the banks. Great! Wait what’s that logo in the top left???

I’m currently working on refinancing my 2.875% 15 year fixed into a 2.75% 15-year fixed! (This is not dumb because I’m rolling a 4.5% HELOC we used to renovate into the loan as well.)

You should look at credit unions too. Not as customer-friendly, but you can get some amazing deals.

I help this guy at work with retirement advice stuff. He’s like 65 and basically clueless about retirement/financial stuff. This all started a couple of years ago when he asked me to look over his investments in his his 401k that he has at my company (he works for a vendor now and hasn’t worked for my company in like 10 years but worked for us for the 25 years before that). Dude had 300k in there with his allocation at 100% stock at 63 years old. It gets worse. He had most of that in the small cap fund because he thought that mean smaller risk. It does not! Anyway, I got him set up with a 60/40 stock bond split and told him not to look at it any more.

So now he’s looking to retire in December or so. He wants to move to Florida and owns his regular nice house, which he won’t have any trouble selling and a rental house in a shady part of town that he bought for like 35k. But now he says he’s going to spend the first part of retirement personally fixing this house up nice so he can sell it. It’s going to take him months to fix it. He has a company pension worth like $2000/month, a union pension that will get him maybe $600/month, social security, his $300k 401k and another 401k with I’m guessing like another 100k. In terrific shape. Go to Florida and live on the beach. But he’s going to work his ass off to make his rental house in nice shape to sell. He can work all he wants but it won’t make the house in a non-drug-infested neighborhood. I tried to convince him to either lower the price to whatever it takes to sell as is or buy his house in Florida and then just stop paying the mortgage on the rental and mail the bank the keys. Once he has his house he won’t need his credit.

Anyway he’s not the kind of guy to do that (not honest he would say) but I just hate that he’s going to basically delay what he’s been talking about doing for years for a very dumb and very pointless task that won’t remotely be worth his time and money.

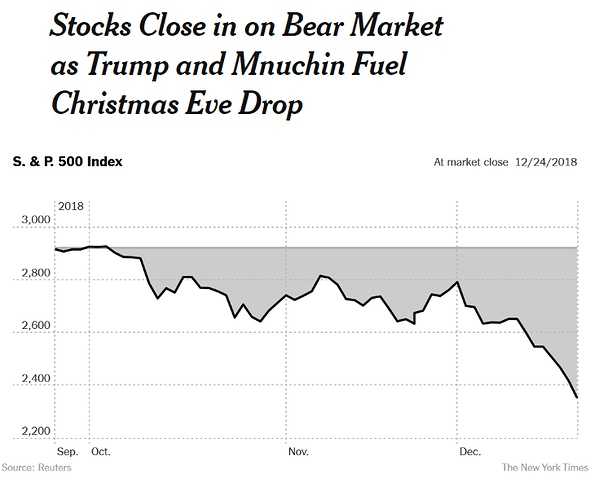

Periodic reminder to ignore basically all media analysis when it comes to investing. S&P 500 is up 38% since this article one year ago.

Let’s all laugh at grue who only this year realized that 401k 19k cap does not include employer contributions btw.