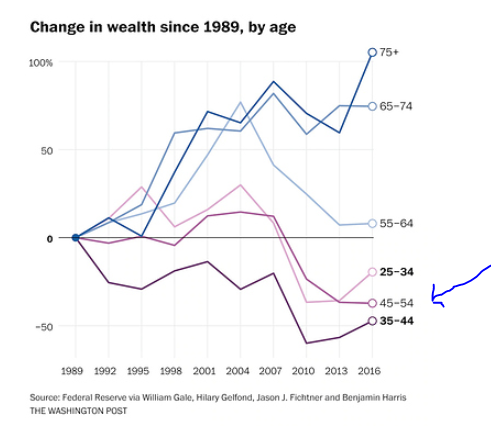

Gen X looks nearly as fucked, and also consider that they are 20 years closer to whatever is going to pass as their “retirement”.

Mid '80s refers to the time of college graduation, not birth.

Mid to late '80s puts you in a pretty bad spot on average. And notice how they’ve also flat-lined while millennials are actually climbing. The Great Recession was pretty tough on younger folks, but also no picnic for Gen X.

Why would they have flatlined when millennials grew? Same time period, they should have had better jobs. Outspending their earnings? I guess they are more likely to have kids and more expensive budgets as a result, but still. Like 55-64 and 65-74 flatlined, too. That’s on them for spending too much.

In a lot of cases, unable to get equal or better jobs in the aftermath of the Great Recession. Sometimes due to age discrimination. I kept myself educated and tech savvy and was still unemployed for almost 3 years. I know many people my age who may never make what they made before the recession. And the timing was right when my generation was supposed to be hitting their stride and making the best bank (and finally having enough to actually save/invest) of their careers. And most of us had just gotten over the shit storm from 2000.

If the chart went out beyond 2016, you would probably see upward trending just because the job market got so hot that nearly everyone could get a decent job. But even in 2016 it still looked bleak for a lot of my generation, including me.

Up 8% today! LOL.

Not that I disagree overall…I’ve been shocked the hospitality stocks have not dropped more than they have, especially since it’s not like the airlines where they get direct bailouts from the government, as it’s a completely franchise-based business.

At the same time, occupancy is coming back faster than I would have thought the last few weeks. But yes, groups and corporate business are going to be needed to get back anywhere near pre-COVID levels.

(Disclosure: Because of reasons, MAR is actually the only individual stock I own).

Yeah, my claim was related to people who were clearly above average with respect to job prospects.

I hope you only bought MAR post March …

Unrelated but is anyone else predicting an article headline ‘stocks rise on protests winding down’ (despite never falling when protests began)?

Dow 26K! STONKS!

Pretty incredible isn’t it? Every city boarded up and full of protesters and a likely new larger wave of Covid-19 on the horizon and we are closing in on all time highs. NASDAQ is up more than 30% in the last 12 months.

No, some old restricted stock that vested a few years ago. Normally my approach is to snap-sell and diversify, but for some reason I held onto it, believing there was upside. I forget at what price it vested - think it was around $85 or so.

Buy and hold baby!

I think the best shot at the market taking a big dump would be a second wave of Covid so unexpectedly bad that states are forced to close up shop again. There will be more pushback against it the second time and it doesn’t look like the market seems to think that it’s an issue. The protesting is a nothingburger, imo.

A few people in BFI was shocked that the market was so late to respond to the severity of Covid. But a lot of the big tanking began when news about the strict closures hit the airwaves.

I’m pretty happy I changed allocation at Dow ~ $29k and went back at ~ $24k. I’m just sad I missed my next target move to a more aggressive allocation at $18k by only a few hundred points.

Maybe you could make your targets more fine-grained or something? Like every 500 DOW points instead of every 5000.

I was in a similar spot - but when I saw the train leaving the station I jumped on it. Market timing + momentum investing = can’t fail. ;)

I would likely never do every 500 points, but I probably should have had a buying step planned between 24k and 18k. In any case, I only do shifts to my allocation and not wholesale moves in and out of the market so that any mistakes are not fatal, and of course this means the upside is also limited.

I don’t think there’s anything this insidious going on. Traders will sell out their positions if they think they will be left holding the bag on overvalued securities. This doesn’t mean that they will sell as soon as they think the shares are overvalued - the polite language they use to say “we are buying on the assumption we can sell it later to an idiot for more money” is “we are deploying a momentum based strategy”.

Institutional investors don’t like it when you describe it that way.

LOL The bottom of that wikipedia article says: “See also: Beanie Babies”