Yeah I’m just sitting on cash and if/when this crap stabilizes I will pay down 50% of my ~4% mortgage I think.

Same here.

One thing that makes it easy is I now realize I’d get hit with short term capital gains tax in my brokerage account. So I’m stuck with those. No way I’m sure enough about what to do more than the rake on that.

But the IRA I really want to start unloading. I’m watching the states that opened up early like Georgia. If they clearly start to spike again - which I expect at some point - I may pull the trigger and put a bunch of the IRA in cash.

I re-fied mine at something super low like 2.5%. Still probably a better deal to pay it off.

The problem is I plan to sell it soon. So putting more money in home equity really doesn’t help me any. My payments stay the same they just end in 2036 instead of 2046. Do I have that right?

Anyone have an idea of a good category of index fund that would be most likely to benefit from the govt buying up all the bonds? Large-cap value? Dividend growth?

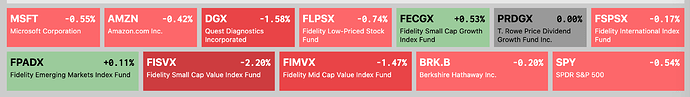

These are some of the funds I’ve held in the past:

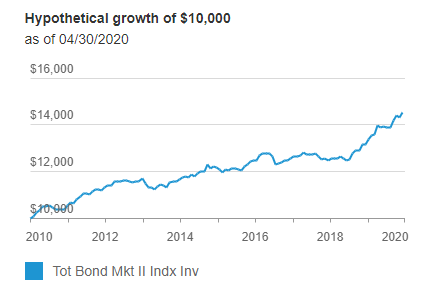

VTBIX?

I’m selling a bunch of stock funds in my IRAs today. I already moved a chunk into bond funds in late March, and I have enough cash to survive for a couple of years at least (assuming money can help with survival, that is.) So I guess this is more market timing, but I’m (was, anyway) so close to retirement that I don’t want to lose another 30-40% of N.W.

Just to make sure I’m reading this right that VTBIX has returned roughly 20% over a decade and tested its 2010 low in 2019? There’s no dividend or anything similar right? So this is just very low risk and similar to a CD or buying treasuries or something right?

I’m sort of in the same boat with not needing a ton more money. But my plan is to semi-retire and be a nomad for as long as I feel like it and am able. So more money never hurts as it just means more things I can do.

Yeah, that’s the one. It should be throwing off dividends, though, from the bond interest.

And you wouldn’t see those in this return chart? What are they?

I’m not sure why they wouldn’t show. If you look here, you see the regular dividends: Vanguard Total Bond Market II Idx Inv (VTBIX) Stock Historical Prices & Data - Yahoo Finance

Anybody know why the market fell off a cliff in the last 20 minutes today?

here’s the total return for last ten years

https://investor.vanguard.com/mutual-funds/profile/overview/vtbix

The chart you had is just the price of the fund.

I assume combo of Fauci saying we have a long way to go and LA locking down through August. The market has been under the erroneous assumption that this thing is almost over. Anything that pushes back against that is going to move the market lower.

Had not seen this. Last I heard, Newsom was prepping how to get restaurants back open in the state. Looking into this now.

I think it is only rumor for now but LA county has been ramping up the last few weeks so not surprising.

Yeah I see it now. Hopefully they stick with it. I understand lesser impacted counties wanting to open, but LA should 100% not be one of them.

Cali public unis announcing the fall semester is canceled has to be having an impact also.

If Cali and NE economies don’t return to “normal” this year that is a huge blow to the valuation of both the US economy as a whole and stocks. That doesn’t even include possible flareups in all the dumbass red states. I continue to think all the risk is to the downside. NASDAQ up for 2020 and S&P 500 up from this same point in 2019 is completely insane.

So about 3.5% annual return?

Just saw this as well. With the CSU system making this decision, its only a matter of time before the UC system does the same and other college systems around the country follow suit. Its quite true that “As goes California, so goes the nation.”

Im curious how tuition will change for a fully online semester compared to on campus tuition.

Futures continuing to drill. Down almost another 1% from close. The current stock market reminds me so much of late 2017 bitcoin. Completely untethered from reality and driven almost entirely by FOMO. At some point all of the dumb wallstreetbets bro money is in and there is nowhere to go but down for a while.

Yeah, looks like a good chance we will dip below 23K again tomorrow. The market is hideously bloated and I can’t imagine it remaining that way for long, especially with the decision that places like LA and NY have to make.

I mean, all the rural communities in the world can choose to ignore lockdowns, but if urban centers remain mostly locked down/out of business, then this market is grossly overpriced.