This is the truest thing ever written, lol.

No doubt. I normally am betting a ton on sports and dfs this time of year with MM/DFS/Masters/NBA playoffs so at least I get to scratch the itch. It’s just pure gambling and I know it. Me and the Mrs have been long in our retirement accounts the whole time.

Their long-term future cash flows? Well,

- Aggregate consumer spending is likely to go down in the near term, but

- Amazon’s competitive position is likely to improve because their competition with physical retail space (Target, Wal-Mart, Best Buy, Costco, etc.) are likely to be hurt more by this pandemic, so

- I could imagine that Amazon’s pricing power goes up, offsetting the decline in sales volume

and it’s not clear at all to me that Amazon’s equity is less valuable now than it on Earth 2 without this pandemic.

I’d say a better question is do Amazon’s competitors’ (of all sizes) profits get hurt? I’d suggest they do.

That’s a valid point but if the entire retail pie gets smaller shouldn’t that be reflected in the total S&P 500 valuation? Or is the S&P 500 index so out of whack that it doesn’t matter?

To ask it another way if the entire economy contracts 10% in 2020-2021 that has to impact stock valuations right? If Amazon only benefits in a relative sense that shouldn’t matter right?

Editing because I may have misinterpreted your post. If you’re talking about the aggregate market, I’d point you to the spreadsheet I created earlier and ask you for some assumptions, and how they translate to industry losses in value, and how those industry losses aggregate to the market level. Let’s say that the aggregate economy shrinks by 10% in 2020-2021, and the effect was that every single firm’s profits were zeroed out for the year. Even that scenario would not really be a huge deal on its own in terms of valuation, and I definitely don’t think it translates to the PV of future cash flows falling by more than 10%. You can make matters more severe and see how those will translate to valuations, but ultimately most of these corporations will continue to exist and consumer spending will continue to flow. So the question is, what will the aggregate effect on the NPV of future corporate profits be? I definitely don’t know, but we’re already down more than 10% YTD, which is kind of a big deal.

If you’re talking about Amazon.com individually:

I’d say here’s where it’s important to distinguish between “the economy” and “the stock market”. Let’s say that as of year-end 2019, we were in a cut-throat world of competition. The fact that Amazon and Wal-Mart and Costco and Target et al. are competing with each other is great for consumers but bad for their profits. Ultimately, the benefits of competition accrue to consumers, not investors. So it’s kind of like the grocery industry - high, relatively stable sales at terrible margins. The grocery industry is a bad industry to invest in.

But now, a bunch of those competitors get wiped out and some of those aggregate sales (consumer consumption) decrease - maybe forever! But if that means that Amazon can extract greater profit margins from the remaining sales, then of course they can become more valuable. It’s much better to be a quasi-monopolist in a small market than a big player in a huge market that effectively earns its cost of capital because competition is severe.

One last edit: I am also surprised by the market level right now. My gut feels like it should be lower. But I also know that, despite LOL STONKS, the aggregate market is generally better than I am at pricing things, and I know that I’m likely to have a bunch of biases that I’m unaware of. Which is why I’m simultaneously preaching the buy-and-hold mantra and constantly tempted to sell a bunch of stock at these levels.

All of this sounds like kicking an awfully big can not very far down the road.

- Turn money printer up to 11

- Wait for vaccine

- ???

- Everything hunky dory by 2021

All the risk is to the downside. There is no way that is priced in. We are relatively near ATH when the January 2020 economy is basically best case scenerio for Jan 2021 and that is mostly a pipe dream. That is my entire point and it sounds like you are one of the only ones who agrees at this point. The downsides to me that are not priced in are:

-Wave 2

-Some type of financial contagion/collapse from all this

-No vaccine ever

-Repeated shutdowns

-Complete collapse of faith in the markets/government over 1-4 above

-Companies we currently think this is somehow positive for experiencing pain from this.

So ya. Things might be fine. But I see no upside surprises that get us much of anywhere. If Covid-19 ends today we should be at what? February-5%. That’s pretty close to where we are.

I guess I basically think the same. I am buy and hold in my tax advantaged accounts and buying puts for short term gambling. I do agree the makeup of the indexes is bullish as currently constructed. I just think there is no way a company like Amazon permanently avoids pain from a global recession/depression.

I also agree with this but Riverman is correct in saying nobody knows anything, it’s guesswork etc. You really can throw logic out the window. I bought bear funds on advice from my idiot merchant banker brother who is makes shit tonnes somehow and he said it was a certainty … nek minnit he sells for massive loss and is now fully on the other side.

That reminds me, wonder how that d 10 dude is doing, hey did he ever post his reentry point to the market? Huh, weird, he didn’t?

Hydroxychloroquine proven to have worse outcomes than no drug

Remdesivir trial failed efficacy

Hospitals now testing Pepcid AC, based on data that was observed in Wuhan.

Like every time I hear about a new possible treatment it is uplifting but the heartburn thing was known since Wuhan and hasn’t made a difference yet. I think overall the news over the last week regarding treatments has been bad, not good.

Fairly sure it was March 23. When word spread of his buys people knew the market had bottomed.

Oh ya i forgot the biggest downside risk of all. We have a literal moron handling the recovery.

The other 80% of the country is spending significantly less than they used to. The 20% who are currently unemployed will be desperate to go back to work.

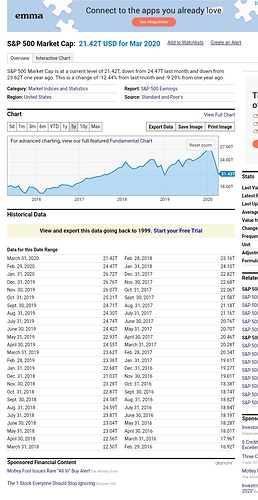

I’m not saying that it will be completely seamless, or even that it won’t all come undone, but the SP500 did shed something like $5 trillion of value, so it’s not obvious that the damage to the 500 biggest companies is going to be significantly more than that.

$5T of value from the absolute bottom. Something like $2T at this point in total. I think we just fundamentally disagree about what our future looks like. Because the future I see is basically nothing resembling January 2020 until at at a minimum late 2021. That will absolutely crush the current valuations of corporations. And well of course that may mean more free money to the rich but at some point the political appetite runs out for that. Probably a lot sooner than late 2021.

The simple answer is because everyone is unemployed because their employers shuttered their operations by government order. If/when those employers reopen, they will hire back all the people they just laid off to do the work. In 2008, most of the firing was businesses permanently closing down (in whole or in part) or cutting costs by letting go their most marginal employees, permanently. Those jobs are gone and never coming back. When gyms and barbershops reopen in this country, the gym attendant and barber jobs are going to come back.

Where are you getting these numbers from??

-

Well capitalized companies are going to gobble up market share in the aftermath.

-

The government is going to prop up large public firms and let actual small businesses go busto.

-

Mass Unemployment = lower wages for the firms mentioned in #1 and #2 above.

-

In a zero interest rate world each dollar of earnings is more valuable.