I think there will be general euphoria until the open-ups start failing.

And if they don’t? Trump has luckboxed his whole life what stops it now.

Then I won’t pull out of the stock market again.

The odds of this thing not forcing the current level of lockdown again at some point have to be sub 1%. It’s way too contagious. It may get a summer pause but I just can’t see a realistic scenario where it’s going to disappear like SARS did.

The scenario is moonshotting prophylactics, treatments, and/or vaccines to the point that people are willing to live with it.

Back to normal, everyone! Take your Max Strength Pepcid AC twice a day, use your nicotine patch, and rub some Lysol on it!

I’m partially joking, but if Pepcid AC as a prophylactic reduces the mortality rate by 50% (and the hospitalization rate by a similar amount), and if intravenous Pepcid at 9x strength reduces it farther among people who have a severe case, and if nicotine helps too… Stacking those things up may actually turn it into ~the flu.

So the parlay is something like: flatten the curve, move things outdoors as possible, summer slowdown, some combo of medical research coming through or an early vaccine…

I’m starting to think there’s a shot we’ve seen the bottom. Not likely, but possible.

Oil down a mere 27% today.

stonks up bigly though, looks like we’ll be OPEN FOR BUSINESS soon

Exxon flat, finance bros must have been expecting oil to drop by 30%

@Suzzer99, paging you to the stimulus thread, we have a pension argument. I REPEAT, WE HAVE AN ACTIVE PENSION ARGUMENT IN PROGRESS, SUPPORT IS NEEDED IMMEDIATELY.

Anyone want to take some guesses as to what would actually make this market go down?

-20% unemployment

-Oil basically being worthless

-Minus 30% GDP growth projected for 2nd quarter

-Coronavirus “only” killing 15,000 Americans last week

None of that did it. The S&P 500 is down 2% on the year. If it is really as simple as cranking on the money printers full blower and trotting out IraqGeneral.meme then lol the last 100 years of monetary policy.

Once we start “reopening” and then get slammed by a second wave 3-4 weeks later, I think the markets will finally accept this isn’t going to be a quick thing that finishes up before summer.

What would constitute a second “wave”? We hit the record high number of confirmed cases last Thursday and the record high number of confirmed deaths a few days before that and we had multiple states open already and a lot more following over the next week. It isn’t clear to me at all how bad it would have to get to actually go back into restrictions in USA #1.

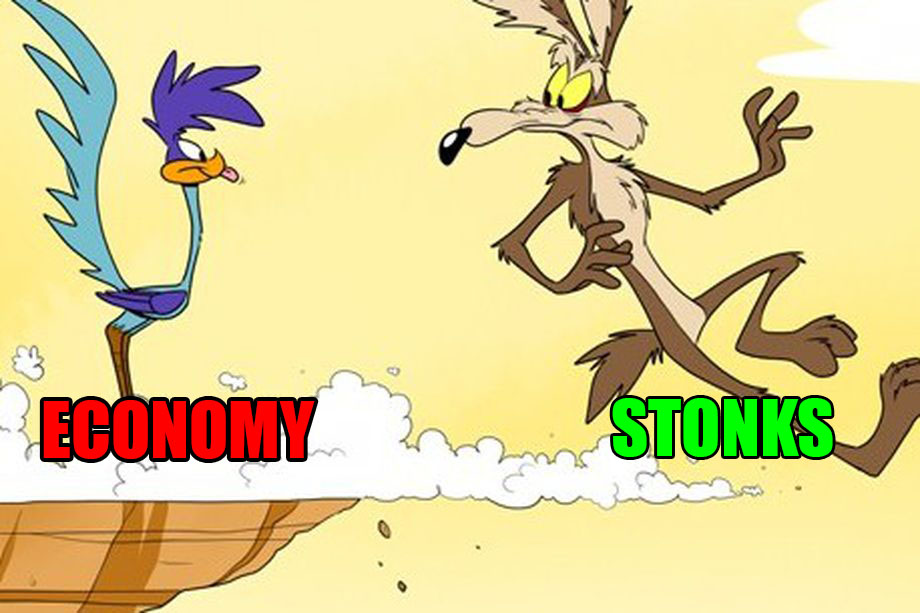

Seems to me like we’re at the point where the coyote has already run off the cliff but hasn’t looked down yet.

It seems pretty inconsistent that we are simultaneously believing that everything is fine and this Coronavirus thing is about over and Congress is simultaneously working on a 4th or 5th stimulus bill(I can’t keep track anymore) within basically a month.

Yep - that’s what I’ll be looking for. But I think it could be a bit more of a slow burn second wave - due to summer, masks, other behavior changes, not opening the riskiest stuff, and some herd immunity.

But then that goes right back to Wichita’s point. If everything is going to be OK then the economic theory we’ve been running the world on is completely wrong.

I thought that even before covid. But again it’s one of those who the hell knows how long until the music stops things.

Anyone have a clue why Quest Diagnostics is up 9% today? Google just yields the usual bot-generated pablum.

I think one possibility is that we’re just seeing the naked break between the large cap stock market and the general privatd sector economy. This is not a well thought out theory or idea so you guys will pick it apart no doubt. But what if it’s simply that the largest companies driving stock market performance are basically so heavily backed by the government that the stock speculators are pricing them like what we in the British Empire call crown corporations? The kind of decimation you guys are expecting seems to be happening to small businesses, AKA the actual private sector. But small businesses don’t issue securities.