I can’t speak to the real estate situation of your cousin, but if this is the 600-room hotel I think it is based on your comments, yeah, there’s no way the hotel isn’t reopening at some point. The question is how long it takes to recover and whether he’d have to take pay cuts at any point.

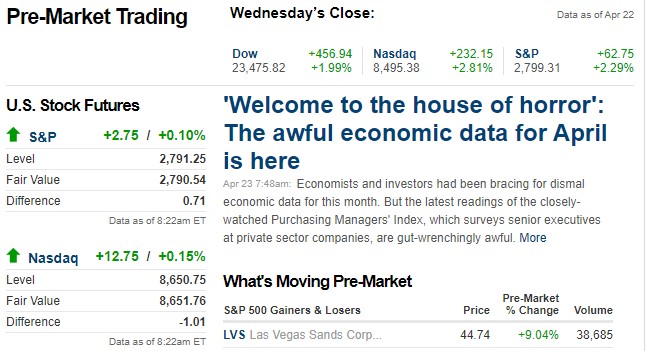

All jobs created since the gfc are gone so we better believe the DOW is paring back this week’s losses!

Margin Call is easily the best movie about Wall Street and/or finance ever made. A masterpiece of a movie.

Margin Call is great but I think I like Big Short better just because of the mortgage douches.

The fact that the djia can be up, at all, the day after mcconnell says “fuck the states, go bankrupt” shows that none of us know anything at all.

And 5.5 million new jobless claims

obviously that was priced in and they were expecting 6.5 million new jobless claims, so up up up!

a more cynical person would think this was manufactured to give time and cover to dump the hell out of everything now so they can buy twice as much when it tanks to 12k.

The Big Short was way better IMO.

Margin Call was just:

- Some kid, working for some unnamed firm that does unnamed stuff, says whoa look at this math on my screen!

- Guy looks at his screen, says whoa, brings it to the attention of another guy.

- That other guy, a lady and some comedian guy say whoa and call up another guy, the endboss.

- The endboss helicopters in and says it’s time to sell.

- #2 boss says, “But what about the poor buyers?” Endboss says fuck’em

- The next day, they sell. The End

Colleague sent me this explanation of the oil situation from the internet:

Imagine the following…you pay $500 today and commit to receiving an escort at your house in 15 days. Cos your wife is traveling. This is called a futures contract.

Unfortunately, lockdown came and your wife will now be home for the next 60 days.

You do not want this woman to show up at your house at all and try to pass this futures contract to someone else.

Only you cannot sell this commitment because nobody can receive the escort at home anymore. Everyone is in full storage with wife.

To make matters worse, not even the pimp (Chicago Mercantile Exchange) has more room to receive the girls because his house is crowded with girls.

So you will pay anyone just to take the girl off your hands.

I mean, the market is opaque to the point where no one can explain how stuff actually works, and when pressed those in the industry just relay it supposedly works in micro or macro econ 101 examples that clearly don’t apply in real life or things wouldnt be so opaque in the first place.

Surely such a system is surely on the up and up

Can someone explain to me why stock buybacks are being vilified while no one ever mentions dividends in the same way? They seem the same to me.

I’m pretty sure Chamath is often critical of dividends, too. I think the argument is often that executives do buybacks regardless of how expensive the stock is, often to increase the value of their options (which decreases when dividends are paid).

I’m already pencilling in 4-6 hours of time for arguing this point when someone disagrees with you. This gets me so heated.

Buybacks are obviously better than dividends because they are more tax efficient.

I think there’s a good argument to be made for keeping cash in order to capitalize in volatile times, but that’s obviously a completely different topic.

I mean if you’re using buybacks as a mechanism to return value to shareholders, you should be doing it at regular intervals regardless of stock price, right? Like you should have regular dividend payments and regular stock buy backs.

Nah. Berkshire sometimes buys its stock back, but only when it trades below what they believe intrinsic value is.

I understand tax efficiency for investors is why companies do stock buybacks instead of paying dividends. But I get the distinct impression that that’s not what the “companies spent X% of their profits on stock buy backs!” crowd is saying. They seem to be arguing that a company buying back its stock is somehow intrinsically wrong and immoral in and of itself, and they never make the same argument about dividends.

But by all means we should change tax law so that buybacks and dividends are effectively taxed the same. I think Marco Rubio had a proposal along those lines.

I think the argument isn’t so much that buybacks are wrong, its that keeping little to no cash is stupid.