What makes you especially qualified to assess: (a) the likelihood that a Democrat wins the presidency and is able to enact tax legislation, healthcare reform, etc., or (b) the specific dollar impact that such legislation would have? If you see something obvious that suggests stocks should go down, but they go up instead, jumping directly to “I guess everyone is stupid, time to cash in” is wrong. Maybe they’re stupid, but you need to have an answer about why specifically you are so much smarter.

I can relate to all this. It stings but it’s just paper. You’re diversified and prepared for this. Your day-to-day life and lifestyle shouldn’t be impacted by this at all.

And for perspective, the recent market gains have been great. Even with today’s drop, the SP500 is at levels last seen only about 4 months ago. Stay the course.

What should someone in my situation do in a recession? I max my 401k and HSA into vanguard 90% stock funds. I’m 30 years from retirement. I rent and have little debt except for student loans. I assume it’s the obvious answer of just keep maxing everything? Anything else?

My thesis as to why the market is acting irrationally is that that the elite/billionaire class are in denial about Bernie’s chances of winning. Maybe because they don’t understand how much they are despised, how much working class people are struggling or are just Olds brainwashed by the Cold War. I don’t know, but just watch any of them speak (most notably Bloomer in debates) and there is plenty of evidence for my thesis.

This is exactly what I did when I was 30 and it’s worked out so far. Mind you, the markets have been lit over the past decade.

Bloomer’s position is that a) Bernie would be disastrous for the economy b) little chance Bernie could beat Trump.

I think Bloomer is right about a) if you define the “economy” as just the stock market but not b). When pressed on b) with data showing Bernie has a good chance to win, Bloomer just handwaved it away. My respond to that is OKAY BLOOMER

That’s what I’m gonna keep doing.

Max a Roth if your income is low enough to qualify (and high enough to be able to afford it). If you can afford to, start saving in taxable accounts as well. A taxable account gives you some additional peace of mind if you lose your job and have to dip into investments. It would emotionally hurt to have to go into my Roth, but a taxable account would hurt less I think. You should avoid holding bonds and REITs in taxable accounts as they are less tax efficient than equities. US equities funds are slightly more tax efficient than foreign funds but that difference is negligible. You might want to pay off your student loans before starting a taxable account but that’s personal preference.

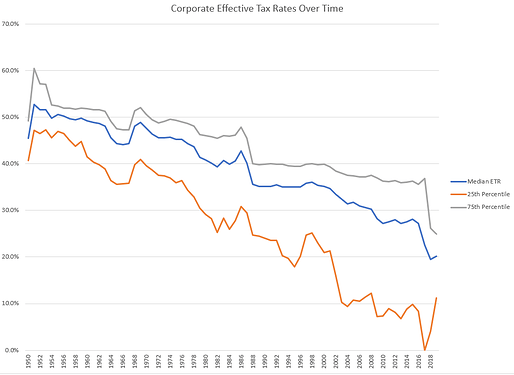

Echoing bobman, this is kind of insane to think you have any particular insight here. Focusing just on the tax issue, here’s how effective taxes have changed over time:

You can see the effect of recent tax cut at the end - the median firm’s effective tax rate (blue line) went from about 27% to about 20%.

With that as background, how would a Democratic president’s views on tax rates affect stock prices? Here are the things you’d have to estimate, even if you thought it was a sure thing that a D would be elected:

-

The likelihood of passing a tax increase. It’s fair to assume that a D president would want to increase taxes, but I think that’s unlikely if the Rs control the Senate. So now you need the probability of a D Senate conditional on a D White House.

-

The new statutory tax rate. It’s currently 21%, down from 35%. (The effective tax rate above is what firms actually pay, including things like state and local taxes and tax credits.) I would expect that even a D tax bill would not increase it beyond 28%. That’s what Obama was proposing.

-

What firms would actually pay under a new statutory rate. Dropping the statutory rate from 35% to 21% decreased effective tax rates from about 27% to about 20%. So a reasonable estimate might be that bumping the statutory rate back up to 28% would increase effective rates to an average of 24%.

-

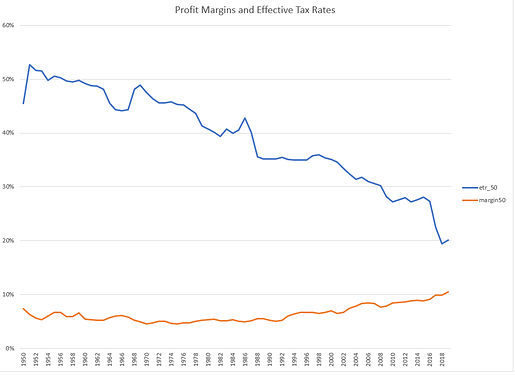

How the increased tax rate would affect corporate profits/cash flows, which are the ultimate driver of stock prices. You can’t just say that an increase in tax rates would mechanically lead to a huge and easily-calculated decrease in corporate profits. That’s because firms will respond to changes in tax rates by changing prices and wages, rather than just passing the effect of the tax rate immediately to owners. You can see this by looking at how net profit margins changed over time and around the recent tax cut:

Even though there’s a huge recent drop in the effective tax rate, you don’t see a corresponding sharp increase in net profit margins (orange line).

-

The likelihood of a future administration changing those taxes back. If you know with certainty that the R party would immediately bring the statutory rate back down to 21%, then a very temporary change in tax rates during the D administration would have very little impact on stock prices, because the stock price is based on the infinite stream of future cash flows over the corporation’s lifetime. The cash flows in the next few years are only a small portion of that amount.

-

The effect of increased taxes on macro type stuff. I’ll just focus on one - it’s plausible that the increased tax rate would be viewed as a positive for the US fiscal position. As a result, investors would use a lower discount rate to price corporations’ future cash flows. So you’d have an offsetting effect where lower corporate profits are discounted using a smaller discount rate, leading to stock prices that are about the same.

-

Since you’re talking about the market currently being wrong, you’ve also got to think about whether the market is anticipating any or all of these things. There’s no reason to believe that institutional investors are completely blind to the possibility of future changes in tax rates, discount rates, or corporate profits.

If anyone is still alive and reading this, the tl;dr is that timing the market is insanely difficult and I’m super skeptical that you or anyone else on this forum (including me) has any ability to predict future returns. You should absolutely not be making investment decisions based on the assumption that you have an informational advantage about macroeconomic or regulatory factors unless you literally have inside information. And then you shouldn’t act on it either, but for different reasons.

This is good advice. Sometimes it’s okay to hold bonds in a taxable account to allow more space in your IRAs for assets with a higher expected return. It goes against conventional wisdom and it took me a while to come around to it. I read a lot of convincing articles with some actual data on a few blogs and Bogleheads though. I think it’s at least worth considering the other viewpoint if you haven’t.

Anyway, the market tanking doesn’t scare me from a loss standpoint. I’m more scared of the girlfriend and/or myself losing our jobs. She works for an airline and I work for a small financial services company. If this gets really bad and more planes get grounded or boomers withdraw money en masse and decimate the market we could both be fucked.

I’m 100% equities and will keep it like that for the next 10-15 years so I haven’t thought about it too much. Makes sense for some people probably.

Another factor to consider is how people will react to the taxable part of their account decreasing disproportionately compared to their IRA/401k portion. A lot of people will look at the return of each bucket separately. I didn’t bring up tax efficiency with my Dad at all for this reason. I told him to just put everything in the same 60% stock 40% bond fund and stop thinking about it.

I buy and hold 95% of the time. I work in finance and have a relatively high level of relevant education, though I am not claiming to be a savant or anything. What causes a crash in stocks is a large, unexpected shock to the system.

What I see, hear and read everyday is market leaders saying that a) Bernie would be such a shock even if he only gets a fraction of his agenda through but b) he has little chance to win. I agree w/ a., the President can do a lot w/o Congress, for example trade, where Bernie is as anti-trade as Trump. Take Trump on trade w/o doing everything he could to prop up the market and we would be a lot lower right now… and Bernie is very credibly promising to the exact opposite of Trump, do everything he can to take down the large corporations, I.e. stock market.

In fact the country club Republicans that make up half of finance (other half being Bloomer type Ds), are actually rooting/voting for Bernie in primaries (you can also see this in the conservative press) because they think he would be demolished in the general election… because he would be so obviously bad for the “economy.”

This is just such obviously wishful thinking, I mean Bloomberg himself is on the record as saying Bernie would have obviously won the general election in 2016… and now he has deluded himself into thinking Bernie has little shot in 2020.

I dunno, I could obviously be wrong and the “market” does actually have all this sorted out despite all the billionaires who control it sounding delusional. In which case I’ll take my lower return in bonds for one year.

Thisisfinedog.jpg

Upped my 401k contribution. Let’s go.

For me it helps that the fall is due to a very visible and comprehensible problem. It makes perfect sense why a deadly pandemic would cause a global recession and stocks to tumble. Everyone can understand that and can kind of game out different scenarios in their head. In 2008-2009 I didn’t know what the hell was going on and that substantially added to the stress and panic.

I went through 2000 and 2008 without a problem. Didn’t touch anything and barely even thought about it. Maybe because I was younger and had more years until retirement.

There are advantages to having equities in taxable accounts too though. In particular if you give a lot to charity, you can disappear a lot of gain over time by donating appreciated positions. You can also harvest losses to get a $3k/year ordinary deduction. Then, after retirement, you may be able to harvest some gains at a zero rate too.

Why would a person tie any of their portfolio to Dow index funds instead of S&P index funds?

Not saying I’m right but I can’t think why that is a good strategy.

I’m no investment expert.

It isn’t a good strategy. But the DJIA is going to be .99 correlated with the broad US equities and .85 correlated with foreign. So when people talk about the DJIA falling however many points it is not at all irrelevant. It’s only slightly less relevant than the s&p 500 or vti.

This is a good insight. A way to think of this is that a fair amount of your economic power is your own human capital. The younger you are the greater the percentage of your overall economic “worth” is tied up in your human capital (PV of future earnings). I’ve never seen anyone deploy this insight in a useful way but theoretically you could do something like short the travel industry stocks to hedge the loss of human capital that would arise from a downsizing in those companies. That’s tough to do in the real world though (it’s more of a fun intellectual exercise than actionable advice).