Well I do try but sometimes the dealer is like, “Oh you have 90% equity for a $10K pot lol backdoor flush, fuck you. Pay the guy who 5bet your AA with 42 suited.”

I think it’s because they are mostly about rich people’s kids, who live in an alternative reality. But I don’t actually know what this person’s situation is, maybe she is truly a grinder who started with nothing and went way into debt on a 1-in-a-million shot at being rich, and because she succeeded that makes her a role model.

Just going to leave this here:

https://www.bogleheads.org/forum/viewtopic.php?f=2&t=373463&newpost=6582795

Can we afford 5M house with ocean view?

We have been looking for a new house for over a year and inventory is very low in our HCOL area (SoCal). We finally found a house that has everything we’re looking for - larger sq ft for growing family, larger primary bedroom, higher ceilings, bigger kitchen and updated. We also really want a house with a nice view, and the views for this house are incredible 180 degree ocean view.

Our plan is to sell bonds in taxable, liquidate our cash savings, and tap equity from our current home.

Details:Current home:

Value 2.4M

Mortgage loan 800k @ 2.875% 30 yr fixed

HOA $65 per year

Property taxes 20k per yearTaxable account:

2.4M total

Muni bonds 500k

International stock 400k

Rest is VG TSM indexOther investments:

800k (600k his/her 401ks and 200k his/her Roth IRAs)Savings:

440k in online savings accountMonthly income:

60-80k pre-tax

30-40k post-tax

healthcare and disability insurance includedOther expenses:

Private school 2k per month

Monthly costs (travel, cars, restaurants, hobbies): 10kExpected costs of new house:

~20k per month 10 year 6 month ARM @ 3.625

Includes – Property taxes 5k per month, HOA 850 per month (gated community, tennis courts etc), Homeowner’s insurance=============================

QUESTIONS:

- Can we afford this house or is the budget too tight?

- What is the best way to tap equity from our current house – cashout refi or HELOC?

- Any other thoughts?

As an aside, the market is really tough right now. We are waiving appraisal contingency, renting the house back at no cost to owner’s for 29 days after the close of escrow, and waiving contingency for the sale of our current house. Apparently, there are 4-6 other offers coming in today.

Thank you in advance!!

Alright which one of you is this:

Could change username from financial.freedom to house.poor

Seems like an awful purchase to me, wouldn’t even consider it.

$26k per month on housing with a take home of $35k per month? lol no thanks

What a miserable experience - allocate all of your income and assets to an ocean view house, while working a combined 140 hours/week to make sure you enjoy zero of it.

That being said, kind of a refreshing change from the obnoxious “I have a $12 million net worth, can I afford to retire?” posts.

fyp

They almost have enough money to buy that house in cash right now lol

800k mortgage for house worth 2.4 mil…. must be nice!!

Why do they have $440,000 in a savings account?

They really wanted the free checks

At first I thought the income was way out of line with their assets, and then I realized those were monthly numbers. Who the fuck talks about monthly income?

People who spend all their money!

I do? I get paid on a monthly basis. All of my bills are monthly. I evaluate how much I spend on a monthly basis? Am I crazy?

Yeah I guess for budgeting purposes it makes sense. But in most contexts people talk about their annual income, and the numbers they put up were in the 100k range.

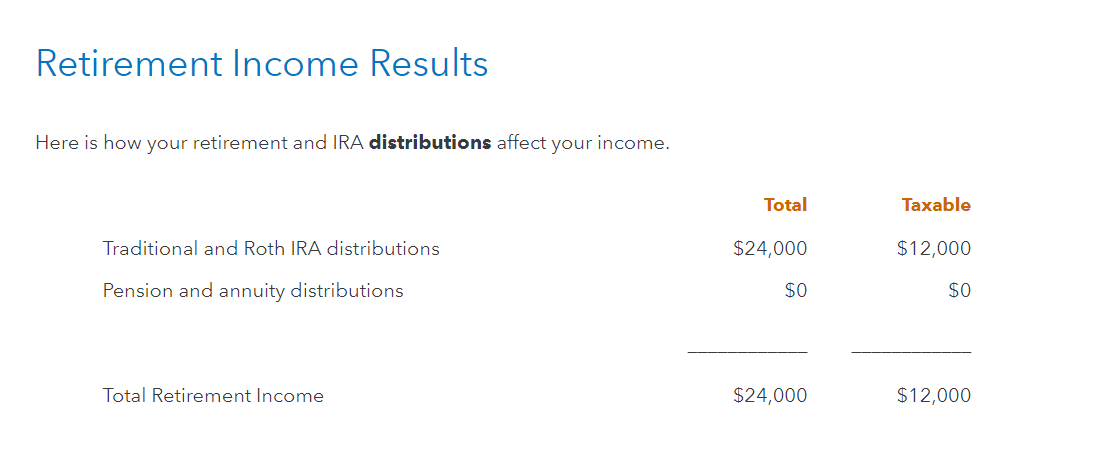

i’ve had an accountant do my taxes the past few years but i decided to do them myself this year because they were pretty simple and i didn’t get all my info together in time. I’m trying to put our backdoor roth IRA stuff in, when i’m done i get to this summary screen does it look right? This is for my wife and myself.

Looks like it’s being double counted. Did you click the box to say that the Roth IRA was a conversion from the traditional contribution?

yeah i followed that post actually, the only thing that threw me off was that step 8 wasn’t an option for me

Answer the questions on the following screens, until you reach Choose Not to Deduct IRA Contributions . Select Yes, make part of my IRA contribution nondeductible , enter the amount you contributed, and Continue

it gave me the warning about income being too high to deduct the contributions which i’m guessing is correct

What if I offered you a job with a free oceanfront mansion, and your take home pay would be $108K a year?

$108k household take home would be a big pay cut so I’d pass, if I was single sure sounds great.

I guess my point is just there’s a big difference in spending 26K/35K a month on housing and spending 2.6K/3.5K a month on housing.