Can tell you from experience there probably isn’t a way out from this.

No, I’m just annoyed. Let me vent!

I bet you could get them to spread the payments out of the next 6 months/year. You 100% legally owe them the fees, so don’t see anyway you’re getting out of it. Maybe if you really push you might get them to waive some, but doubtful.

Anyone know if things like the turbotax audit protection stuff is actually useful? I had a crazy amount of medical expenses this year and I’m afraid it will set off some sort of fraud alert. Everything is above board, but I’d like some help if it happened.

Yeah, absolutely this.

I had a paid advisor once. It was as useful experience. I’m not really in much danger of wondering if I should get an advisor.

His advice wasn’t atrocious, but it was definitely suboptimal. I’d call him on it, and he come up with some loltastic reasoning why his advice was the best.

I’m sure he provided value to some of his clients, just not me.

Even accountants have been very disappointing. If I meet a CPA who knows how to properly fill out form 8606 for a backdoor Roth, they will be the first. I’m 0/2 on that. Maybe I just got bad recommendations and hired some schmucks. I’m a total DIYer now.

Starting to pull together 2021 tax documents and came across a new one for me. I received a 2021 W2 from an employer that I left in summer 2020. I am 99% sure I did not receive any $$ in my bank accounts from said employer in 2021, but am double-checking. ADP shows no pay statements for me in 2021 at this employer. I did receive severance at the time, and a commission payment in November 2020 per the separation agreement.

I assume my play here is to try and get the money that ex-employer is claiming they paid to me? I think I’d start with ADP asking if there are 2021 pay statements I’m not seeing that correspond to the W2? And if they can’t be of help, then follow up with former employer to ask the same? It’s possible I was owed another commission or bonus payment per the separation agreement, employer systems show they made that payment, issued a W2, but somehow I never got the $ – although I don’t know how that would happen.

Anything I’m missing?

Just now able to enroll in new employer 401K. Small company. Not the greatest fund lineup, but was encouraged to see some low ER (0.06, 0.02, etc.) Vanguard, Fidelity, BlackRock funds. Oh, but wait…ADP/Voya adds 0.27 to every investment choice for their administrative fees! LOL.

ADP/Voya is the one managing the 401k? lol, that’s highway robbery.

Yes. It is managed by ADP/Voya. Straight 0.27 added to every fund option.

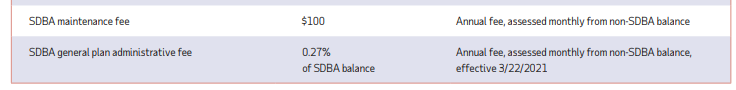

There is an interesting option to do a self-directed brokerage account. I need to look into it more, but it appears that allows you to essentially trade whatever you want via TD Ameritrade, and incur TD’s (minimal or non-existent in some cases) trading fees, and buy whatever low-ER funds you want. It is $100/year (regardless of invested amount), and limited to 50% of your account balance. Not sure if there are other strings attached.

ETA: Wait, no, they hit you with the 0.27% on top of whatever you do in the self-directed account. So basically it’s more expensive (adding the $100 annually) to go self-directed. LOL, geez.

Hopefully you work for a fairly small company (< 1000 employees), otherwise 0.3% is pretty crappy. It won’t end up hurting you much as long as you don’t work there for like 20 years, and you roll it into an IRA once you leave.

You should send an email to the pension committee at your company questioning the amount of the fee and why you have to pay it. Many companies have a deal with record keepers that is a fixed fee per member to administer the plan (why should you be punished with higher record keeping costs just because you save more than Jimmy McSpendy one desk over) and many companies pay the per member fee for the member. Running up big administrator fees on AUM could be considered a violation of the committee’s fiduciary duty if someone brought it to the attention of the Department of Labor. But you sure hope it doesn’t come to that.

It is a small company so I was prepared for it. Could be worse than ~0.3 I suppose. It’s just frustrating because there are likely easy alternatives (easy for me to say - I don’t have to get it set up and manage it) that wouldn’t steal employees’ money like this. But it’s likely the path of least resistance to just roll it up with all the other services ADP provides.

My spouse works for a school district with ~10k employees and her lowest cost choice in her 403(b) is 0.3% for an S&P 500 fund.

Having a hard time filtering out the correct answer on Google so figured I would ask here.

I have a non-qualified deferred bonus that vests over 3 equal installments over 3 years. Am I able to withdraw that money for anything as long as I pay standard income taxes or would I have to pay normal income plus an additional withdrawal fee like I would a 401k or Roth?

I would like to use it as a down payment for a house eventually but I don’t want to pay additional taxes on it. The account is still being set up so my info is limited.

I’ve never participated in a NQDC plan, but some googling indicates that the withdrawal timeline would be laid out within the plan documents.

Figured it out. RSU’s vested.

My bonuses are like this. The deferred portion just gets paid out once a year like normal income, with W2 withholding. No way to get the money early without special circumstances (e.g., getting fired). Your terms could be different.

I’m pretty sure this link covers your situation. For tax purposes they are considered supplemental wages upon distribution, and subject to 25% flat-rate withholding. (Doesn’t mean that’s ultimately what you will pay at the end of the year; it’s just what’s withheld. You will end up paying according to where you end up in the income tax brackets for that year.) You shouldn’t have any penalty to pay if the thing is vested each time you take a distribution.

IMO you should wait to get all your paperwork, and if you are then still not positive of the situation, seek expert guidance. Like 15 minutes with a CPA/tax lawyer should clear things up.

Thank you both. That clears it up.

I may have mentioned this before, but I’d also recommend being aware of exactly what happens to unvested amounts in the event of a termination without cause. There’s already enough emotion in that situation, that you probably don’t want any more surprises.

My experience is with RSU’s, but seems like there’s a pretty wide band of practices, from “you lose everything that hasn’t vested” (somewhat common based on my research) to “you get paid out everything” (probably uncommon), with something like “you keep a prorated amount based on the vesting schedule” in between. My situation was the latter, but it still meant a surprise “loss” of nearly 6 figures.

Still irks me that something provided as a long-term incentive to keep you with the employer can just be taken away like that when holding up your end of the bargain was taken out of your control.