I got hit down 200 points a while ago because one of my student loans stopped contacting me and I assumed it was on hiatus because of covid since it was through the university. Lol nope get fucked for 7 years. Paid it off immediately once I knew ofc.

For some reason CNBC is now publishing these types of articles on the reg

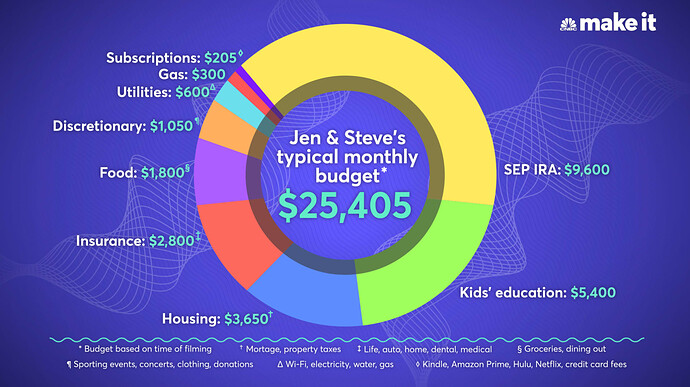

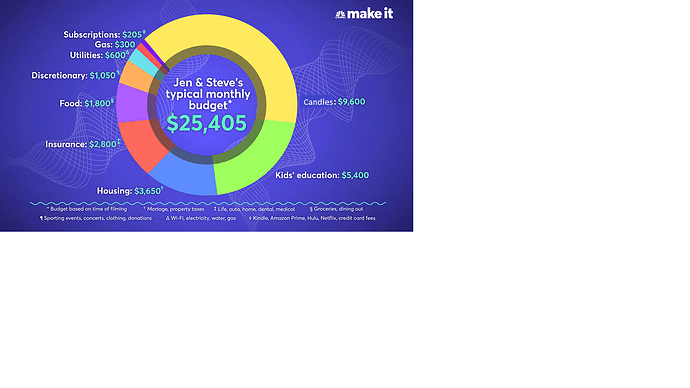

totally normal monthly expenses incoming

With the exception of what I assume is private school tuition, all of the expenses in the chart seem pretty normal.

Very few people save $9,600 per month in retirement accounts.

Edit: which brings up another pet peeve of mine, which is rich people counting their own monthly accumulation of capital as an “expense”. Ok buddy.

Take out the education item, and that is still $20,000 per month. $240,000 per year.

That may be normal for people in like the 98th percentile of income, but is not normal for pretty much anyone else.

That whole “Millennial Money” series is almost all people who make several fold more than the average 25-40 year old. I could tolerate it if it was mostly stories about people with shit jobs, high rents and student loans.

The whole genre is terrible for a number of reasons.

First, obviously, it isn’t actionable for anyone. Like what is a well-meaning millennial supposed to do with this information? Start a travel the world or I quit my job or personal finance blog and rake in the cash? Get the fuck out. The thing millennials actually need is higher wages, I’ll leave it as an exercise for the reader why (checks notes) CNBC doesn’t provide much in the way of helping people achieve that.

But even worse, it has the instagram effect of making people feel terrible about themselves for circumstances that are primarily institutionally driven. Like if you’re a normal decent person and you are 35-45 in America you have been getting shit on by the system for your entire adult life. Your early career got ruined by a housing bubble you had nothing to do with (and whose perpetrators got away with zero punishment of any kind), you probably have massive student debt, you can’t afford a house, the whole god damn game is rigged against you yet every mainstream media outlet basically tells you to bootstrap it. Fuck that.

I mean one of their “expenses” is saving $9,000 a month. That’s not an expense!

Wait till the credit agencies start determine your score based on your Facebook network, Google searches and typing speed.

Yeah, we’ve been mocking these stories for almost as long as 22 had a politics forum. It’s always rich people feeling like they don’t have that much disposable income after having otherwise allocated their considerable wealth. I mean, look at that piddly $1050 of discretionary money that’s left over after spending a ton on everything else! If they were really rich, they’d have so much more left over (meanwhile, a richer family has about the same amount of discretionary income due to having higher housing, car, nanny, and education expenses, so they’re basically broke, too).

What’s their monthly Olive oil budget though

Could cut those expenses in half if they stop buying milk.

As you said in your edit, that’s not an “expense”. I only looked at the actual expenses.

Are we even sure that the couple called it an “expense”? Maybe it’s just the writer who decided to describe it that way.

See above. The IRA contribution is not an expense by any reasonable definition.

Yes they have a high income. However, setting aside the private education, the expenses themselves weren’t that crazy.

Looks like Keeed beat me to it. But it’s this.

Take out the IRA and the education and they are still at $120k a year. It’s a lot of money relative to the median millennial income.

I don’t have a problem with those people or anything; my issue is with publishing the article as if it has any value whatsoever for all the reasons Riverman already said.

A while back I found myself hate-reading those articles like “We’re a married couple in our 30s making average salaries; here’s how we paid off $180K in debt in four years” and I’d just scroll down looking for the part (usually like #4 on a list of 7 “tips”) were it was something like “4. Do a an asset inventory: Around this time Bri was able to find a buyer for a lakefront property his uncle had left him years ago when he passed. We were able to put almost all of this $280K towards savings, home improvements, and yes our debt goals” and you just throw your hands up

I agree with all that. I was just responding to this comment:

And I still think that they’re pretty normal except for the private school.

I agree that their income is very high and that it is not anything most can relate to. That wasn’t in the very specific comment I was responding to.

$3,600 a month for housing in Silicon Valley for a family of 4 seems crazy low. The article says that includes $2,100 for mortgage and then I guess that means $1,500 for taxes. It doesn’t seem right that mortgage is just slightly more than property taxes.

Quick research shows that Silicon Valley property taxes are about 0.8%, so that means their home is worth a bit over $2 million. Even if you assume they only borrowed say $1.5 million, that is still about $7k a month.

So either they are lying or have paid off a ton of their home (or I guess they bought it years ago when prices were 1/3rd what they are now). Either way, the chart is meaningless showing a crazy low housing cost for Silicon Valley.