~30k but always felt like it was too much too

30k emergency fund in what used to be a “high yield” online savings account but now is pretty much doing nothing.

And we’ll ignore the embarrassing savings account we have with way too much cash in it doing literal nothing that should all be pumped into VTSAX but arrgh it just sits.

I think the traditional guidance of keeping a multiple of monthly expenses in cash is a good one. It’s probably too expensive to keep enough money back to cover a ton of contingencies, but if you think through how much you would need to just sustain for 3-6 months that’s an awful lot of peace of mind. Knowing you’d have several months to address any emergency that pops up relieves a lot of worry.

Updates on my rent negotiation.

They were really unresponsive for a while. Not answering emails.

Eventually I went with a tip from “never split the difference” which was recommended here on UP.

“Should I assume that the landlord is not interested in the lease extension”

First time I’ve tried it and I got an instant reply. So that’s a big endorsement for the strategy.

After a couple more days, they’ve come back with 675.

Great result, is it worth trying to get a little more? Ask again for 650? 660?

I wouldn’t. Take the win and move on. $15 seems irrelevant in the grand scheme.

That’s my thought as well, unless actually moving is an extremely cheap and frictionless transaction it seems like it’s not worth negotiating further. Good job getting your rent down and not overpaying.

Nice lil victory. Agree with taking the W.

This was also my initial instinct. But I’m conscious that under negotiating is probably a serious life leak, so I thought I would ask.

Yeah, your instincts are right. But I think in this case you’ve seized the value by assertively asking for what you want and successful negotiation means that you do sometimes give the other side something back. Good job!

Upthread I mentioned that I keep 2 yrs. It’s suboptimal, but it makes me feel basically invincible against economic catastrophe short of complete societal breakdown. I’m actually thinking about maybe putting some in another currency for diversification purposes. But I haven’t really done any more than just think to myself, “I should really look into that”.

If you have a mortgage then an offset account at least will be worth more than 0.5%. I never used to have a buffer but I live with a lot less stress now that we also build up a little more than a years worth in that account.

We’re 40, make a quarter mil a year and have 4 million is assets. Are we doing ok???

Fun fact: The chart that I have of our net worth looks eerily similar to Micrsoft’s market capitalization chart for the last 20 years.

Logan Roy fuck off dot gif

We definitely have a lot of Boglehead hate-readers up in here.

There are a lot of humble brags on the internet. This is one of them.

I find Bogleheads incredibly helpful when I have questions on specific investment related issues. As for the “I’m in the top 0.1% of all human beings in terms of wealth - is there more I can be doing?” posts, I chuckle more than anything else.

Yeah, me too.

I’d argue that even that thread gave the OP some useful food for thought. No one really went full Riverman on them, but there were plenty that voiced similar sentiments.

I personally cut them a bit of slack. Worrying about money is hard not to do. Even if you have a lot. It’s a hard habit to break.

I make $1.5 million a year, what should I do?

https://www.bogleheads.org/forum/viewtopic.php?f=1&t=363390&newpost=6353126

In his spot, asking about asset allocations probably could have been a reasonable question, but the questions this guy comes up with are kind of dumb:

-

Should I put more money in this hedge fund that already has 25% of my NW or should I just invest in VTI

-

Should I take out a margin loan to invest even more in this hedge fund that has 25% of my NW.

-

Should I sell VTI from my taxable account, take the tax hit, and then put that in to this hedge fund that already has 25% of my NW.

To help readers make a decision about this he gives no details about the fund other than the fact that it is “well-regarded”. I suppose, there are no realistic attributes of this fund that he could describe that would change the answers to the 3 above questions.

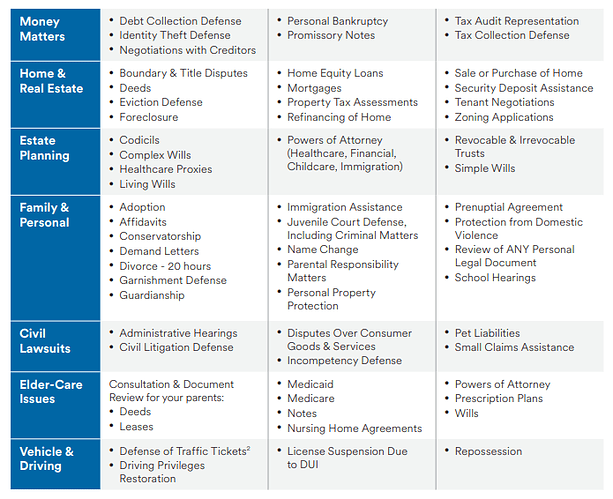

Anybody pay for Metlife Legal Plans (formerly Hyatt Legal Plans) as a work benefit? I think I’ve had access before and never really paid attention to it, but going through enrollment now, <$20/month for access to attorneys for various things seems like a good deal. I wonder if anybody has actually used it before.

I looked into it at one point and I determined that these services were not great for anything that you would really want good legal advice for.