I really wish my wife gave more of a shit about this stuff. It’s one of the few areas where I can pretty much do what I want. However, if the result of her giving a shit is 40% bonds at age 30 that would definitely lead to some, um, marital discord.

Same deal with my wife. I give her an update every January, which she pays almost zero attention to, and that’s about the extent of her involvement.

I try to update my wife occasionally and she can’t even hang in for the 90 second summary.

tradwives ITT apparently

Heh, I’m in the same boat w.r.t. MrsWookie. She was grumpy with me that I didn’t want to pay off my student loans or our car loan when they were both < 3% interest when I wanted to pay the minimum and invest more, but she backed off when I just took over investing and let her forget it. Her 401k is probably overdue for a rebalancing, but that’s a small mistake with a small portion of our savings. So, I handle the big things, which are mostly set it and forget it, but she doesn’t have to worry about what to set it on, which is complicated.

I would probably approach personal finance a lot differently if I lived in a country with a functioning government. Basically anyone in USA #1 can get wiped out by a health care event at any time, you have to budget insane amounts for college, etc.

Cry me a fucking river. Maple syrup is not cheap, buddy!

Mrs. Tilted would have totally ended up working as a Walmart greeter in her 70s because she spent all her money on clothes if I didn’t handle the finances. I gave her access to our mint account so she can see the number go up but she never looks.

Me to, but somebody has to do it. (Well I disagree about optimizing ROI. My strategy is to take the market average, adjust our AA so that risk is appropriate for our particular situation and tolerance, and hope like hell it all works out.)

At this point I spend 30 minutes a month updating our net worth tracker and paying the bills, and probably a couple of hours in July and January rebalancing and making our annual backdoor Roth and I-bond contributions. (In January I also make an annual report for my wife to ignore.) It did take me a long time to reach this point where I’m not screwing around all the time with investments. But even when I was, it was more about fear and FOMO than it was about enjoying any of it.

And next year I’ll have to read up on any changes to tax law since I haven’t been paying attention and don’t know if the rumored changes to backdoor Roth investments took place or not.

We have the apparently common arrangement of my handling the finances and my wife ignoring all aspects of it, even though she’d be perfectly capable of handling things on her own. At least, paying the bills and keeping track of stuff - she doesn’t really get or believe in the stock market so I’d have to choose our investments.

What’s bizarre to me is that she’s mostly unaware of our net worth and I don’t even think she knows what my salary is. That, on its own isn’t crazy, but she’ll periodically just announce “Oh, no we can’t afford XX”.

I try to show her a summary of balances every few months–mostly because I worry too much about dying and her needing to take over–but she just ignores it. Biggest friction is when I mention Berkshire Hathaway and our concentration in that stock. She is absolutely convinced that we’re going to lose all our money when Buffett goes away. Jokes on me if she’s right, I guess.

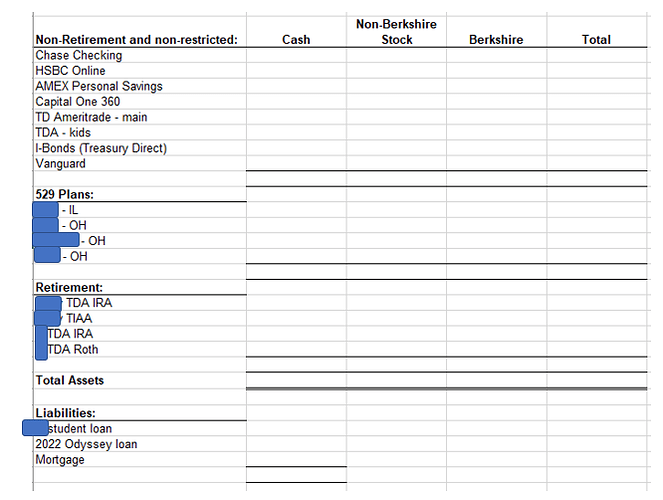

This is the layout of the summary I give her, which tries to break things into restricted items vs. not and cash vs. stocks vs. Berkshire. Is there an obviously better way to summarize things?

She might have a point if you own so much BH that you need a column to distinguish between BH and non-BH in every investment account!

Heh. Actually I put that breakdown in with the idea that she could say, “I’m just going to pretend that column doesn’t exist/goes to zero”. I was quite pleased with myself for thinking of presenting it that way.

She, of course, continued to ignore the whole thing.

Berkshire as a % of Total Assets:

Non-retirement and non-restricted: 37.5%

529 Plans: 0%

Retirement: 13.4%

Total: 19%

Mint pretty much provides this summary without you having to enter it into an Excel/Google sheet.

Your wife actually sounds like she is at least somewhat paying attention. I think my wife probably knows Warren Buffet as “some rich guy” but there is no way in hell she links him to Berkshire Hathaway or knows what exactly BH is, nor would she worry for even a second about concentration of risk. If our report showed 100 percent of everything in GME, I’m pretty sure I would get the usual, “looks great honey” as her eyes gloss over looking at the report.

My wife is practically allergic to dealing with money, it’s a huge trigger for her anxiety. I shudder to think what would happen if I died first.

Strange, it’s the same for my girlfriend. She’ll listen when I talk about savings, retirement, etc, but openly acknowledges that she isn’t retaining any of the information. She didn’t want to set up a savings account without my help (then after realizing how easy it was said that she didn’t need me after all) and freezes up at any talk of setting up an IRA. I’ve tried to get into basic asset allocation ideas but I don’t think they stick.

While I’m sure there are differences between individuals, I’d be very surprised if there’s any difference between male brains and female brains on average when it comes to the ability to work with numbers / understand finances / etc. Idk, maybe there’s something about the hunter brains vs gatherer brains that make men more apt to do math but I highly doubt it. I assume it’s societally conditioned, probably starting in early school when boys are subtly pushed towards hard sciences while girls are pushed subtly pushed towards social sciences.

Same boat as most of you wrt to spouses and money management. The biggest difference is my wife generates the majority of the household income but she doesn’t want to be involved in investing, retirement stuff, taxes etc. If she was alone she’d probably just stick it all in a savings account, or she would pay someone to handle it all for her.

My wife doesn’t care about any of this, she frames everything as “what does this mean for our retirement date?” She has an stressful job so the financial independence date is really important to her.

I also handle all of our money. I don’t think my wife even knows her own salary.

https://gflec.org/research/?item=26365

Abstract: Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. Our survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response option is unavailable, they often choose the correct answer. We estimate a latent class model and predict the probability that respondents truly know the correct answers. We find that about one-third of the financial literacy gender gap can be explained by women’s lower confidence levels. Both financial knowledge and confidence explain stock market participation.