My dad was a severe alcoholic. If he had money he would easily drink 40 drinks a day. He’d open a 40 ounce bottle in the morning and finish it that day. Often he’d send us on our bikes to get him more because he was too drunk to drive. He’d call ahead to the liquor store to tell them I was coming and they’d accept his instruction to give it to us. I was like 8 years old.

man I drink too much 0_o

Up until a couple years ago I was a drink every night and binge 2-3 times a week guy. I wanted to lose weight and started working out regularly and it’s pretty damn hard to lose weight consuming that much alcohol unless you never eat so I cut way back. Now I average less than 10 drinks a week. Also helps that most of my friends I partied with have babies so they’re a lot lamer now

I stopped almost all drinking start of this year, feel good about it so far, lost quite a bit of weight.

I think our attitude to alcohol may be one of the things far future generations look back and are like what the hell were they thinking?

Well yea, because they’re all gonna have legal weed

Looks like I spent ~$2197 on beer last year and $1013 on weed. The beer number definitely misses some spending though, as I don’t separate the 6 pack I picked up with groceries or drinks at a restaurant (which obviously wasn’t a big expense in the last 9 months of 2020…)

Quit all drinking about three years ago, not that I was that much of a drinker before that. I’m convinced alcohol toxic poison that no human who cares about their health should be partaking in.

Working on sugar right now. This one’s harder, but I’ve cut out enough of it to realize that the difference in how I feel when eating it vs. not is night and day.

I don’t have a sweet tooth, and find most all desserts, sweets, and especially ice cream and milkshakes unappetizing. Minimizing or eliminating sugar feels like a cheat code for maintaining stable body weight and energy/mood levels.

I feel like this estimate is really low for my habits. Was consistently drinking a 6 pack of craft ipas most nights + going out multiple times a week.

definitely too low. 6pack of craft ipa is 10 per 6pack at least.

Not when you buy it by the case at Costco.

I checked our spending for 2020 vs. 2019, and found our groceries went up by 50%, from 9k to 13k. I knew that food prices had gone up, but damn. We did a lot of Instacart and Peapod early on, before switching to curbside pickup. Our restaurant spend went down by 50% (4k to 2k), which means we were tipping very well for our rare takeout/delivery meals. Booze spending only went down by 20%, from 2500 to 2000. I now drink craft NA beer at a rate of a six pack a week, compared to a case plus of Harpoon or similar in 2019. The rest is wine and spirits for my wife, and – NEW! – guests.

Is this supposed “labor shortage” limited to just certain sectors?

Anecdotal evidence, but holy crap is this the furthest thing from my reality. I’m not super actively looking for a new job, but have put in a few applications to jobs that I am easily qualified for and haven’t gotten anywhere. And the lower level jobs similar to where I started have pay rates that are abysmal and haven’t moved at all in the last few years.

Can’t imagine it applies to $75k+ white collar jobs. I’m guessing it’s mostly blue collar and the service industry. I work in manufacturing and we have raised the base pay quite a bit to attract workers.

I’m white collar, but under that pay level.

But even pay grades significantly lower than me haven’t budged in the university job listings for science positions.

My guess is people in good jobs aren’t really looking as tons and tons of people are thrilled with work from home and have the opportunity to continue doing that, limiting mobility.

Also, lol bosses. Worker productivity is at an all time high with widespread work from home but bosses are still demanding people come into an office so they can try to justify their useless role of “managing people” errrrrr wasting everyone’s time and taking credit for any success.

I think it’s in the white collar world as well, at least a little bit. My firm (“professional services”) has expedited the year-end performance evaluation and raise/bonus process (and is promising good numbers; we’ll know the truth in two weeks) I believe in response to very high turnover over the past year. Even after announcing the earlier and bigger raises we’ve still seen quite a few folks leave.

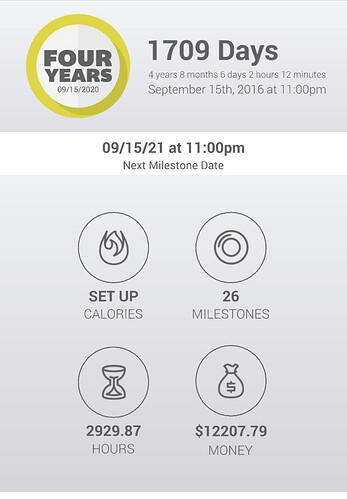

Today is the two year anniversary of when I became worth nothing! i.e. assets == liabilities. Have added quite bit to the assets column in those two years since, but it’s nice having some milestones like that tracked so I can reflect upon them. I will be drinking an extra fancy beer tonight in celebration.

Doing well at personal finance is incredibly hard!

It is not rewarding at all to max out a 401k when you’re under 40. You can’t even touch the money for at least 20 years, and the balance never seems to grow meaningfully, even when markets are good. It takes a couple decades for the magic of compounding to really kick in.

We all know the math, that $x00 per month invested at 7% return for 30+ years becomes a fuckton of money, but it is so unsatisfying at the beginning. Not to mention, you might die and never spend it, or markets could go full Japan for 20 years.

Oh yeah, you’re also supposed to just somehow deal with not affording a house in a nice neighborhood or having a hard time paying for a family.

Related to this point, I set up a spreadsheet for college savings when we had our first kid 15 years ago. I knew that it was going to be massively expensive to pay for college, with huge error bars around any estimate. But I wanted to have some general sense for roughly how much I should at least try to save.

I made estimates about:

- the type of school (basically, the current tuition level)

- the rate of tuition inflation

- return on any investments I set aside

And I found that process to be incredibly helpful in saying “I need to try to set aside this amount each month in a fund that is earmarked for college”. As @Riverman alluded to, it can be very intimidating to save for a tidal wave of tuition costs with small monthly drips of savings. Why even bother? But seeing how those small monthly amounts would grow over the decades really helped me believe that I could save a material amount.