Man that really sucks and I feel for you. I want to say “hang in there it will all work out” but I remember wanting to punch everybody in the face that was saying that to me when I was unemployed for 2.5 years at the tail end of the Great Recession. We spent through 90 percent of our retirement savings and were preparing to sell our house when I finally found work. I actually broke down and started balling when I got a job offer I could accept. (Not in front of the new employer, thank god.)

We’ve moved a significant portion of our cash into I-bonds (it takes time because we can only move $20k per year due to purchasing limits) and our fixed assets into TIPS funds to protect ourselves at least a little bit. Also decided not to pay off our mortgage because it might get inflated away.

(I know nobody is really worried about inflation which is why I expect massive inflation.)

This is a good week! Not only is Biden winning, but I got a job!!

After being laid off on 4/15, my old employer is now hiring me back in my old boss’ job starting Monday!

It’s a 10% pay decrease but it’s a job and it’s a bigger role there so maybe I can parlay it into more after the pandemic.

I was running out of unemployment any week now (maybe this week?) and was about to be so fucked.

Congrats man. Happy to hear it!

Congrats

Thanks.

Just talked to HR and they actually got it raised up so only 5k under what I was (and 5% less bonus) so a 7% decrease which is better.

Now I just gotta figure out best path to dig out of financial hole from the last 6 months.

Refinancing the home to lower rates is first up. May take out of 401k to pay down debts and remove interest and then pay the 401k back so I don’t pay taxes.

Great news, well done, happy for you. What happened to your old boss?

I believe the Heros Act has them extended thru Sept 2021. So I’d imagine if there’s no new stimulus Biden will use an EO to extend it to at least that date.

He’s my new boss lol.

He’s in a new position and I’m taking his old position.

He’s the one who petitioned to get me back; was not his choice to lose me when they did the mass layoff so now that there is more investment he was able to get me back.

What’s interesting is every product job I’ve ever had I ended up being rehired by my employer after I left. 4 different companies.

Congrats Nick!!

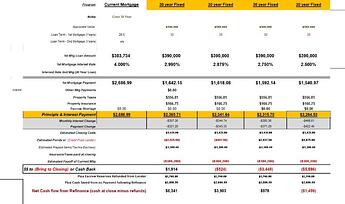

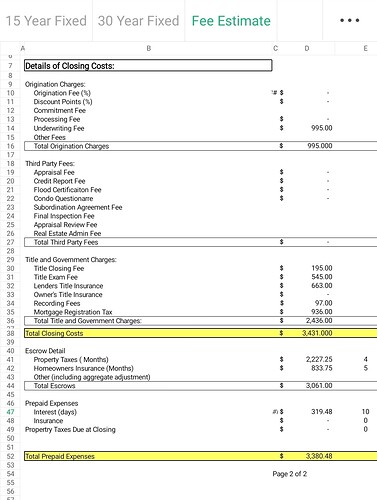

More refinance questions, these are numbers I’m looking at for a 30 year. Closing costs are fixed at $3431 so I will ignore those for the following. If I use 2.99% as the baseline where I’d be getting a $2925 credit it seems like paying a bunch of points (total cost is $4875 plus no credit so $7800) and getting the rate to 2.5% makes my breakeven point 77 months while the other two options have a breakeven rate around 100-110 months, does that make taking 2.5% a no brainer? As of right now we have no plans to move in the near future.

I can’t speak to your questions, but I have others:

First, where do you live where property taxes are only $550 a year? My house is appraises at around $400k and my taxes are like $4500 year!

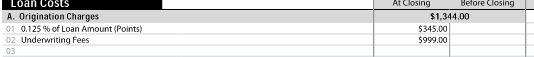

Also, not sure what’s in your fixed costs, but we refi’d $270k a few months ago and our actual lending fees were:

How much different are the origination charges for you? Our fixed closing costs were exactly the same as yours, $3431, but I have a feeling our prepaids were quite a bit more than yours ($2200 in property taxes that were due).

Ah, got it, your fees look reasonable then.

In lieu of refinancing, has anyone just got their lender to just drop their rate? For example, let’s say I call my bank and say I’ve got an offer to refinance at 2.8% and I’m gonna leave, but if you can drop my rate to 3%, I’ll just stick with you to avoid the hassle of refinancing. Anyone know if something like this has ever been pulled off successfully?

Moron and enemy of the people Farhad Manjoo pens a giant article about how risky it is to go home for Thanksgiving, but it concludes with a shrug because fuck it he’s going anyway

It makes sense that people are buying up houses in vacation areas to get out of the city if they’re just gonna WAH anyway but one of these is not like the other…

Well now that I got a job I talked to my broker and am refinancing. It’s dropping rate almost 1% and removing PMI since the market has gone up enough in these 2.5 years that I have 20% equity without even an appraisal (put 10% down).

Closing in less than 30 days and drops mortgage $450/month and really $800/month for first year since I have escrow deficit from this year and that’ll get rolled in. That plus no payment in January means I’ll make up the costs by spring.

Good news, happy for you that bad period is ending so well.

errgggh, just need this interest environment to last beyond Biden cancelling 100k of my wife’s and my student debt.