Not if you make >$200k

It’s minimal. I get 15 years of tax free growth. Consider 2 scenarios where I have 15 K lying around today.

-

I put 15K into a 529 and then after 15 years start roth converting it. During the years that I make the conversions, I put the money that I would have contributed into a taxable account for investment.

-

I invest 15K into a taxable account and then after 15 years, I just make normal roth contributions.

I think we’re normally a bit better of in scenario 1.

I forgot about that. Without having to back door it, that’s even better. They could close that back door some day.

Maybe I’m a fish but I’ve never gotten into the backdoor Roth and business, just max out my trad 401k. Feel like doing more than that takes away flexibility of my money (still put it in index funds)

One nice thing about a Roth is you can withdraw the contributions at any time with no tax penalty.

And no RMDs, which I doubt is a concern for anyone here right now.

If you’re above the limit, doing a backdoor Roth is just completely free money. Also total flexibility. I’ve never done it, but I hear you can even own real estate within a Roth.

Ok I’ll try to do it this year before I file then, thanks everyone. Didn’t know it was free money. Looks like I have until April 15th to do the $6k

I’m a mega doofus because I spend most of my life thinking about capital markets and investing, and I’ve never looked into backdoor Roth.

I would begin looking into it ASAP.

Prepare to have your brain broken

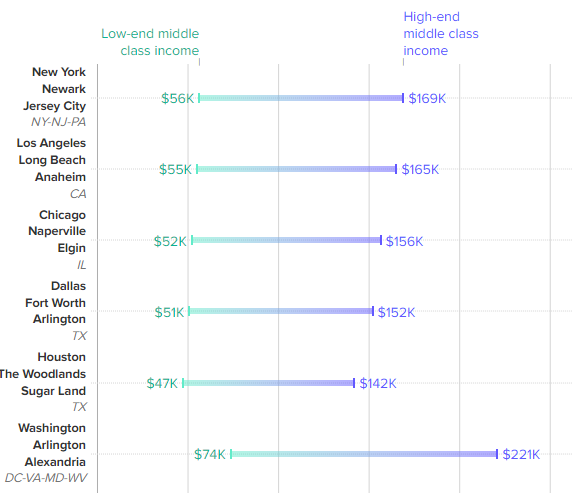

Pew defines “middle class” as those earning between two-thirds and twice the median American household income

yeah that chart was almost exactly what i was expecting. a single person in a LCOL area making 50k can easily save 1-2k every month, a couple with kids in a HCOL area making 150-200k combined might not have any money leftover at the end of the month, its easy to see how they would both think of themselves as belonging in the middle class.

From that same site.

@suzzer99 you need to write one of these.

I’m sure his entire income is from selling get rich quick BS.

Mine’s easy:

- Be a senior dev

- Build something useful

- Don’t have any new work come down the pipeline

Now pay me $29.99 in six easy installments.

What is the best way to set up funds for a child that isn’t the 529 or whatever? Is there something I can set up for kid so when they are certain age it’s theirs?

What you’re looking for is UGMA/UTMA. I think the age at which kid gets ownership varies by state, but in a lot of cases it is 18, which is a bit young for my taste. I have no confidence that they won’t do idiot things with a pile of cash at 18.

That’s the easy way. I assume there are more complicated trusts you could set up, but those would probably cost some money to set up.

I’m with Melk that I’m uncomfortable with the idea of making an irrevocable transfer to an account that a kid will fully control at age 18. Sure, in most cases with healthy individuals and good family dynamics it will work out exactly how you’d want. But the downsides can be bad.

Is there any particular reason that you want to formally “set up funds”, rather than just saving money as best you can and eventually using that money to support your kid when you think it’s appropriate?

Trusts are far superior to UTMA accounts. It can be done pretty cheaply (couple hundred bucks) and ongoing costs are minimal unless you need a corporate trustee.

It doesn’t matter when you in do a Roth conversion. For a backdoor Roth it’s usually cleaner (paperwork wise) to do it the same year as the IRA contribution, but doesn’t need to be.