Correct. Depending on your personal utility function for additional wealth. Also depends on how you have valued the present value of your earning capacity.

But it is not even remotely surprising that for many, many people taking the 950K is the way to go.

What’s shocking is how many people on this site, with a gambling heritage, still say they choose the 950k knowing how large the expected value difference is.

You’re calculating EV incorrectly.

DUCY?

It asks for your bankroll. The way I interpret that is that we take out what we need to live on* and the rest is bankroll. That should account for most of the wealth, debt service and expense categories.

it’s curious that the question does not mention the respondents’ bankroll, and perfect math calculation should sort out the respondents. but in reality, we know there will be very high number of people choosing incorrectly, whether they are high risk or financially secure. I can’t figure out what to put into kelly calculator, but gut feel breakpoint is somewhere around $950k

TITCR

I realized it was Travolta. I think that’s a sufficient sample to say yes

What’s shocking is how many people on this site, with a gambling heritage, still say they choose the 950k knowing how large the expected value difference is.

Yes, we are all extremely aware of simple EV calculations. So what is it that other people are considering, that you fail to consider?

There is no long run here. This is one instance that the hypothetical person finds themself in, unlikely to ever be repeated. And people below a certain level of career and/or wealth are, for the purposes of this hypothetical, essentially with their whole bankroll on the table with no means outside this instance to ever replenish it.

It’s a massively more conservative situation than a fish at a huge final table considering the pay jumps, because losing here is $0 instead of 5th place or whatever

This hypothetical is illustrative of the advantages of prior wealth, but it’s like people have this mental block to not want to accept that, and instead just go “nah look at the EV, don’t be stupid, a poor person is the same as rich”

we know there will be very high number of people choosing incorrectly,

I guess it depends on what you mean by “very high number”. I think a lot of people are sort of intuitively doing the math without realizing they are doing it.

For example if you’re playing NLHE, if you’re facing a relatively small river bet relative to a huge pot, even someone who does understand basic concepts like probability and odds will have an an intuitive sense that they are risking a small amount for a big payoff and they will correctly call even though they couldn’t justify their decision with actual calculation. Even someone who could do it probably wouldn’t actually do the math because they have done the math enough to know which side of the inequality will be larger without calculating the exact numbers.

However, in closer calls, a lot of people will make the wrong call because their “intuitive math” is incorrect. So to circle back to your original point, I do think that the majority of people who responded in this thread have responded correctly given their bankrolls and other factors. But certainly some have not. Is that a very high number of people? That’s a completely subjective determination.

A true to God Not The Onion

https://twitter.com/oneunderscore__/status/1736806037771235726?t=gwIpzOu_LtajfFqu1GXDWw

This hypothetical is illustrative of the advantages of prior wealth, but it’s like people have this mental block to not want to accept that, and instead just go “nah look at the EV, don’t be stupid, a poor person is the same as rich”

I think it’s illustrative that people don’t understand bankroll management and the underlying math very well. That’s a problem that afflicts most Americans rich and poor. What’s crazy is the number of people her that don’t get it despite us being a community of people who have a lot of experience and skill when it comes to making wagers.

Am I the only one who didn’t realize this was John Travolta?

This is at least one order of magnitude worse than not realizing that Christian was Ed McCaffrey’s son.

This hypothetical is illustrative of the advantages of prior wealth, but it’s like people have this mental block to not want to accept that, and instead just go “nah look at the EV, don’t be stupid, a poor person is the same as rich”

It’s extremely easy to explain it to a rich person. Just say "Look I will flip you for everything you own. Heads you give me everything (house, car, stonks, bonds, cash, your business, your trust fund, all of your possessions…absolutely everything). Tails I give you 5x that amount. "

Do you take the flip? Obviously even the rich person (barring some angleshots) is not going to take that deal even though it is massively +EV.

The original question is almost the same as far as the mathematical considerations.

I’ve been saying exactly this since the hypothetical was first posted.

You can just pop this into a Kelly calculator (and full Kelly betting is a very aggressive strategy) and it will just tell you whether the amount you should risk is more or less than 950K. If your personal utility function for additional wealth is very different from the default Kelly assumption, then you can adjust accordingly (either by estimating or if you’re really motivated doing the actual math).

You can educate me where I am wrong here or maybe you’ll just keep poking fun. You seem so certain of your position that this is a Kelly criteria problem but my understanding of Kelly criteria was always that risk of ruin = not being able to play anymore, because it is a tool for understanding bet sizing in repeating games. This scenario isn’t the type gambling where you can keep playing if you have buy in but can’t play once your bankroll is busted, it’s a one and done.

So what is risk of ruin in this scenario? If you’re a paycheck to paycheck person and the bankroll is basically 950k, you’re not ruined if you don’t get it, you’re just in the same position you were in before the scenario happened. If you equate bankroll to assets (home equity, retirement fund, etc.) you’re ignoring future earning potential which is the biggest asset for most people. Like going back to my early 20’s, I’m making maybe one and a half times the minimum wage living with 5 roommates, I have no assets of that sort. But I still don’t think the 950k is the right choice for me. I’m not somehow homeless if I don’t get it and I’m not set for life if I do get it.

Part of the psychology of taking it over the chance at a ton more is the mental anguish that would come from losing the flip.

I can’t remember if I mentioned on here that this happened to probably my best friend a few months ago. I was best man at his wedding.

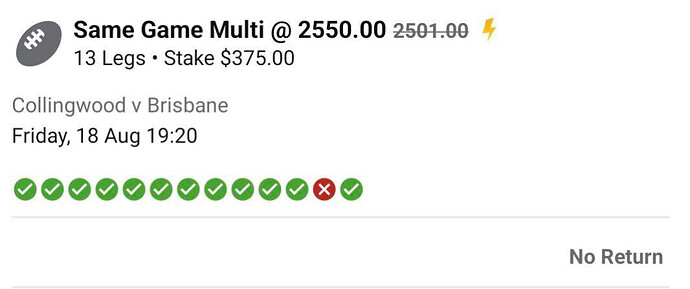

That is $A 375 ($US 252) staked at odds of +255000. All of the 13 legs came in except one, which was a particular guy to score a goal in this game. Towards the end of the last quarter he got the ball in front of goal but passed it off to someone else. Then right at the end of the game, he took a mark (made a catch) in front of goal, which would have given him a free kick at goal. Unfortunately the full-time siren went while the ball was in the air, so this didn’t count. Payout would have been $A 965,250 ($US $650,347).

Does anyone’s answer change if you consider a physical model?

Assume a casino has a roulette wheel with quad 0’s. You have knowledge that it’s a trick wheel that lands on the same color every time, but you don’t know which color. You’re also certain that the casino will allow you to place 5 bets before shutting the game down. You have to place a bet to see the first spin and you can’t add money to the table for subsequent bets. How much are you putting down on the first spin?